Image: Akeena Solar

|

Image: Akeena Solar |

"It is encouraging to see private companies such as Mount Eden

Vineyards take action to generate their own power and improve our

environment."

- Akeena President Barry Cinnamon

Los Gatos, California - August 18, 2004 [SolarAccess.com]

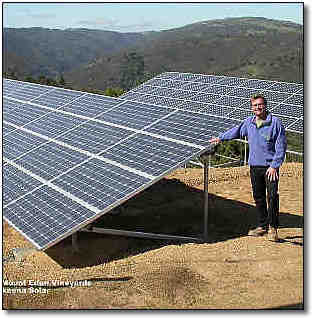

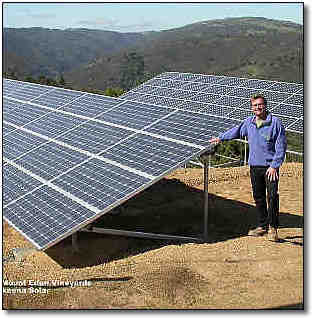

Mount Eden Vineyards made the shift to a 100 percent solar power system for the

winery's electric needs after Akeena Solar sold them on the other benefits of

power from the sun. Mount Eden owner Jeffrey Patterson said he hadn't considered

a solar photovoltaic (PV) array to run the winery's production facilities, main

offices, laboratory and residences until Akeena contacted him.

"The State of California is drastically short of electrical generating

capacity," Akeena President Barry Cinnamon said. "It is encouraging to

see private companies such as Mount Eden Vineyards take action to generate their

own power and improve our environment."

The winery is about 2,000 feet up Mount Eden, and is the oldest winery in the

Santa Cruz Mountains. Every year the vintner produces 5,000 cases of cabernet

sauvignon, pinot noir and chardonnay from the 40 acres of grapes planted on his

200-acre property. Solar PV arrays were placed next to one of the vineyards, and

supply 20 kW of energy that the winery previously bought from Pacific Gas &

Electric (PG&E). The system is wired into Mount Eden's existing electric

service, and allows the vintner to run its electric meter backwards during the

summer months.

"With the amount of area available for the system at Mount Eden Vineyards,

we certainly could have installed a much larger solar power system," said

Cinnamon. "However, our engineering and financial analyses indicated that a

20kW system would be optimal for their historic and planned electrical needs.

Since PG&E will not reimburse their customers for excess power produced on

an annual basis, designing a system with overcapacity is just wasted money for

our customers -- not to mention free power for PG&E."

There are three tax incentives for businesses that install solar electric

systems in California. First is a 15 percent state tax credit against the cost

of the system. Second is a 10 percent Federal tax credit. Third is a five year

accelerated depreciation that applies to the final cost of the system. These

incentives, when combined with the California's rebate program, bring cash

paybacks on these systems down to approximately five years.

"From an environmental point of view, the basic nature of solar power, plus

the combination of incentives we will receive from the State of California and

Federal government , and, from my viewpoint as a businessman, the estimated cost

savings over the life of the system made the decision a 'no brainer,' "

said Patterson.

Akeena Solar designs and installs residential and commercial solar electric

systems in California, New Jersey, New York and Pennsylvania. The company is a

member of the Solar Energy Industry Association, Northern California Solar

Energy Association and California Solar Energy Industry Association (Cal SEIA).

The company also has contracts with vinters Cooper-Garrod and Savannah Chanelle

to install PV systems for their sites

Copyright © 1999 - 2004 - SolarAccess.com

Please visit www.solaraccess.com for great coverage on energy today!!