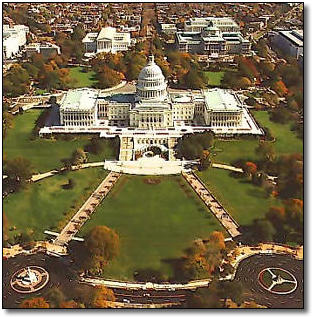

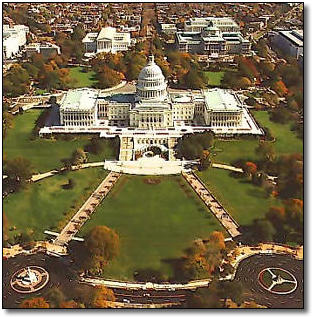

Image: AOC.gov

|

The strained

machinations behind these walls will likely determine whether renewable

energy faces a boom or bust period. Image: AOC.gov |

"Key Senators and congressional staff have told AWEA and other energy lobbyists in Washington, D.C. that the corporate tax bill is the best -- and only -- shot at gaining energy tax credits this year."

| Washington, D.C. -

June 15, 2004 [SolarAccess.com] After a one-week pause to honor the

death of former President Ronald Reagan, the United States Congress is

turning back to creating national policy -- or at least debating it. Among the policy issues likely to be on the floor this week is the U.S. House of Representatives version of the corporate tax bill (H.R. 4520) which contains some key legislation that could substantially boost the country's use of renewable energy. Organizations from across the country are urging supporters of renewable energy to contact their Representatives this week in order to help push through the renewable energy-friendly legislation. The Senate passed their version on the bill, the FSC/ ETI bill, or 'JOBS Act (Jumpstart Our Business Strength) with its attached energy tax sections. Among the sections included in the bill are an extension of the wind energy Production Tax Credit (PTC) to large solar power plants, and a new 15% credit for residential solar equipment. The underlying corporate tax bill is intended to bring about the lifting of European Union trade sanctions on some U.S. products -- which increased to 8% on June 1 -- by repealing a current export tax break that has been ruled a violation of World Trade Organization rules. The tax break, worth $50 billion over 10 years, would be replaced with a variety of corporate tax cuts. The House will likely resume debating whether to include solar tax incentives in companion legislation to the FSC / ETI bill recently passed by the Senate, according to Colin Murchie, Director of Government Affairs for the Solar Energy Industries Association (SEIA). "SEIA and our members have been pushing these incentives for years," said Murchie, whose organization put up a 'Write Your Congressman' web site so as to get the community involved in helping to push the bill -- and its solar-friendly legislation -- through the Congress. SEIA is hardly the first renewable energy, or environmental group to try and rally support for this policy package. The renewable energy industries have stood unanimously behind the Senate passed legislation and hope to see similar measures passed in the House. The wind power industry in particular stands to benefit greatly if a compromise bill emerges from Congress and is signed by the President. The proposed House bill contains a two-year extension (through 12/31/05) of the wind energy Production Tax Credit (PTC). The Senate's version contains a three-year PTC extension (through 12/31/06) - on May 11. The bill also would maintain the inflation adjustment factor provided for under current law, which allows the PTC to keep pace with inflation. Despite broad bi-partisan support, Congress allowed the PTC to expire at the beginning of 2004, brining U.S. wind power development to a grinding halt. Many projects are waiting on reinstatement of the PTC before going ahead with construction plans. "The two-year PTC proposed in the House bill isưan extremely positive development, even though it is for a shorter period than proposed by the Senate," said AWEA legislative director Jaime Steve. "Two years is simply a bargaining position going into an upcoming conference committee negotiation between the House and Senate. As of last week it was even possible that the PTC would not have been included at all in the House corporate tax bill in an effort to keep down the overall cost of the legislation at this stage of the process. What matters most is what comes out of the conference committee a few weeks from now." Key Senators and congressional staff have told AWEA and other energy lobbyists in Washington, D.C. that the corporate tax bill is the best -- and only -- shot at gaining energy tax credits this year. Facing this stark possibility, AWEA also put up their own Web page to encourage supporters of renewable energy to contact their representatives on this bill, which could make the difference between a boom or bust period of wind power development. Some umbrella organizations -- which sometimes struggle for a unified voice on policy -- are clearly in favor of the legislation. In a letter to leadership of the U.S. Senate and House of Representatives, 23 member groups of the Sustainable Energy Coalition called upon Members of Congress to work in a bipartisan fashion to enact "tax provisions promoting renewable energy ... without further delay." The organization -- which includes SEIA, AWEA, the American Bioenergy Association, the Biomass Coordinating Council, the Geothermal Energy Association, the Clean Fuels Development Coalition, the Geothermal Resources Council, the National Hydropower Association and numerous environmental organizations such as the Union of Concerned Scientists, and the Natural Resources Defense Council -- noted "the overarching importance of energy issues today - at gas pumps, pipelines, power lines, power plants, and overseas." The letter's signers stressed that "with every month that passes without adoption of energy tax legislation, the renewables industry faces increasing uncertainty and disincentives to further investment." If the unified chorus is any indication, this may be the most crucial time for action this year. |

|

|

| For

Further Information: • SEIA • AWEA • Sustainable Energy Coalition |

Please Note: SolarAccess.com and Arizonaenergy.org do not endorse the sites behind these links. We offer them for your additional research. Following these links will open a new browser window.

Copyright © 1999 - 2004 - SolarAccess.com

Please visit www.solaraccess.com for great coverage on energy today!!