At Deer Creek Mine, Clair Christensen inspects the continuous miner, which rips 800 tons of coal from mountain walls in 30 minutes. Jeffrey D. Allred, Deseret Morning News |

"The coal situation in Utah right now is very, very difficult," said Reed Searle, general manager of the Intermountain Power Agency. "Our coal pile surplus is way under what our guidance is. We are eating into that surplus, and thank God we had the surplus or we couldn't have run the plant."

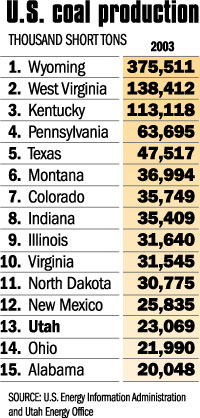

According to a report released this week by the Utah Energy Office, coal production fell in 2003 for the second consecutive year to 23.1 million tons, down from 25.3 million tons a year earlier.

The mine sale price for Utah coal decreased to $16.64 per ton in 2003, compared to $18.47 in 2002. In 2003, total revenues fell below $400 million for the first time in 16 years.

Yet while prices and production levels may be falling, coal distribution to electric utilities is skyrocketing due to Utah's growing demand for power. Roughly 85 percent of Utah's coal in 2003 was delivered to electric utilities at home, across the nation or overseas. Ninety-three percent of all electricity generated in the state can be traced to the burning of coal.

"We own two of our mines, and neither one is producing anywhere near their budgeted production levels," Searle said. "We are not meeting our delivery requirements to others in the state of Utah. We're having trouble getting shipments via the railroad. For the first time in quite a while, we're taking truckloads of coal again."

The falling production levels can be traced to a number of reasons, including lower quality coal, the shutdown of the Skyline Mine in Emery County and dangerous gases that have shut down or delayed production in other mines.

Deseret Morning News graphic |

"I won't comment on the price of coal," Searle said. "If you look at 2004 data you will find an entirely differently story. The price is substantially over $20 (per ton)."

Dave Eskelsen, a spokesman for Utah Power parent company PacifiCorp, said he is unaware of any transportation constraints in coal reaching the company's three coal-fired plants.

"We don't take a whole lot of coal in Utah by rail," Eskelsen said. "It's not a big issue with us."

Jon Allred, a spokesman for the Utah Energy Office, said a bottleneck in the railroad system has created constraints across the West.

"Out-of-state users of Utah coal are having increasing difficulty dealing with coal quality," Allred said. "Power plants in California are reporting they are keeping fairly small amounts of coal on hand, that they're barely meeting reserve requirements."

In fact, Union Pacific can't hire enough people to handle an unprecedented increase in demand for service amid a surge in the economy and glut of Asian imports reaching the United States.

That compounds the problems for power plants like IPP, which rely on the railroad.

"We see a very serious coal shortage problem for a couple of years," Searle said. "We are very worried about our ability to get the quality and quantity of coal that is necessary."

E-mail: danderton@desnews.com