|

"One of the few notable differences between 2002 and 2003 solar collector shipments was in complete shipments."

| Washington D.C. -

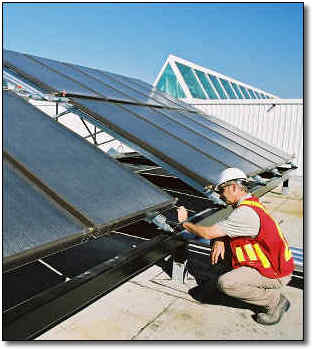

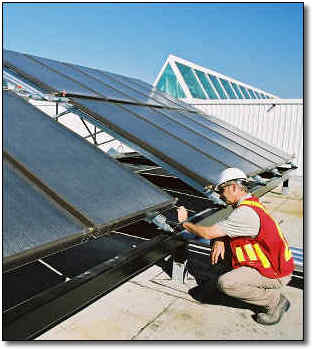

September 17, 2004 [SolarAccess.com] The U.S. Energy Information

Administration (EIA) released a report this month covering U.S. solar

photovoltaic (PV) and solar thermal market activity in 2003. While the

U.S. solar thermal market was ho-hum last year, the PV cell and module

business was anything but dull. The second-largest manufacturer of

photovoltaic (PV) cells and modules, AstroPower, went bankrupt. Other

major manufacturers significantly changed their relative outputs of

cells and modules, as well as entering and leaving major end-use

markets. The result was the first decline in total peak kW production of

PV cells and modules since EIA resumed collecting such data in 1986. In

this, the second of a two-part series of the U.S. solar market,

SolarAccess.com has compiled some key information pertaining to the U.S.

solar thermal market. The first installment, covering the U.S. solar PV

market can be accessed at this link Solar Thermal Collectors The solar collector market was lackluster in 2003. Total and domestic shipments of solar collectors remained close to 2002 and 2001 levels. Total sales were 11.4 million square feet, down 2 percent from 2002. Domestic shipments of 10.9 million square feet declined a similar amount from 2002 levels. The number of companies shipping solar collectors has remained steady since 2000. Low-temperature collectors continued to dominate the market in 2003, with a 95 percent share. Nearly three-fourths of all collectors were produced in five domestic locales: California, New Jersey, Florida, Puerto Rico, and Tennessee, with two-thirds shipped from California and New Jersey alone. As in the past few years, around 80 to 85 percent of solar collectors were sent to the top five destinations. For 2003, these states were: Florida, California, New Jersey, Arizona, and Hawaii. All but New Jersey have relatively high incidences of heated swimming pools. Over two-thirds were shipped to just Florida and California. The small (0.5 million square feet) solar collector export market was dominated by sales to Canada, Mexico, and Austria. Collectors were shipped to various kinds of businesses in similar proportions for both 2002 and 2003. Steady sales produced steady prices for the dominant low temperature collector in 2003. The average price per square foot rose slightly to $2.08 from $1.97 in 2002. Medium and high-temperature collectors went for a somewhat higher average price, resulting in the overall average price per square foot of all solar collectors rising to $3.19 in 2003 from $2.85 in 2002. Shipments by market sector, end use, and type were also similar in 2003 to 2002. The only shift of any size was between the residential and commercial sectors. One of the few notable differences between 2002 and 2003 solar collector shipments was in complete shipments. The number of complete systems rose 15 percent to 7,266 systems in 2003. Moreover the value of complete shipments increased even more to 31 percent. This difference is likely due to the average size of a complete collector decreasing from 143 square feet to 119 square feet, requiring fixed per system costs to be spread over a smaller collector area. Sales concentration remained constant during 2003, with 92 percent of sales made by the 5 largest firms. This concentration has stayed between 90 and 96 percent over the past 5 years. New product introduction continues to be anticipated by only a few companies ; employment is near the 5-year industry average; and except for non-collector system component manufacture, solar collector companies are remaining in the same lines of work as in recent years. Companies which produce solar products continue to do so as the predominant portion of their business. For the first article of this two-part series which summarizes key solar PV activity in the U.S. market click this link For the full EIA report (30 pages, .PDF) covering both technologies click the link below. |

|

|

| For

Further Information: • EIA 2003 Solar PV, Thermal market report (.pdf) |

Please Note: SolarAccess.com and Arizonaenergy.org do not endorse the sites behind these links. We offer them for your additional research. Following these links will open a new browser window.

Copyright © 1999 - 2004 - SolarAccess.com

Please visit www.solaraccess.com for great coverage on energy today!!