By Bill Trapp, Nate Moock, and

David Denton, Eastman Gasification Services Co.

Gasifying coal to facilitate burning it has long been the Holy Grail of

power production. Now that grail is within reach. The ownership cost of an

integrated gasification combined-cycle plant (IGCC) has become competitive

with that of conventional, natural gas–fired combined-cycle plants when

gas prices rise into the $4 to $6/mmBtu range. IGCC plants have a number

of very appealing qualities:

- Exceptional environmental performance, including cost-effective removal of mercury and the potential for low-cost CO2 capture and sequestration.

- Their potential to be retrofit to and supply natural gas–fired plants, potentially putting some of that idle generation back on-line.

- Production of hydrogen—one objective of the DOE’s Clean Coal Power and FutureGen initiatives to fuel the next energy economy.

- Decreasing costs. The capital cost of an IGCC plant is now estimated to be between $1,200 and $1,400/kW, and it is trending downward. This range is competitive with that of the newest generation of supercritical pulverized-coal power plants.

IGCC progress has been slow in the 20 years since the pioneering 120-MW

Coolwater plant began operation in the California desert. You could count

on one hand the number of new IGCC plants commissioned over the past

decade. There are two IGCC plants operating in the U.S. today, and both

were initially subsidized by the DOE’s Clean Coal Technology

demonstration program. One is the 262-MW Wabash River repowering project

in Indiana; it started up in October 1995 and uses E-GAS gasification

technology from ConocoPhillips (formerly Destec). The other is a 250-MW

Tampa Electric Co. project in Florida that started up in September 1996;

its gasification technology is from Texaco. Both projects have

demonstrated that they can produce enough synthetic gas to fully fuel a

General Electric 7F turbine.

Europe has also served as an IGCC test track. There are two significant

projects on the Continent. One is the SEP/Demkolec project at Buggenum in

the Netherlands; it uses Shell gasification technology and commenced

operation in early 1994. The other is the ELCOGAS project in Puertollano,

Spain; its Prenflo gasification technology was first applied to coal in

December 1997. Both projects use Siemens V94.3 engines with silo

combustors. NOx emissions are controlled by saturating the fuel gas with

hot water and by adding to it nitrogen extracted from the air by a

separation unit. However, the turbines at both plants have experienced

combustion-induced vibration and overheating of their combustors.

|

|

1. First in the U.S. In 1983, Eastman Chemical Co. put the first commercial coal gasification facility in the U.S. into service in Kingsport, Tenn. The open structure in the middle houses the gasifier block, and the white building to the right contains the rod mills that grind its coal input. On the left and in the background are the plant’s acid gas–removal columns. Courtesy: Eastman Chemical Co. |

Last July, Japan also tossed its hat into the ring with the commercial startup of ChevronTexaco Worldwide Power and Gasification’s 342-MW IGCC plant at Nippon Petroleum Refining Co.’s 340,000–barrels per day Negishi Refinery in Yokohama. The feedstock for the IGCC facility is asphalt from the refinery.

Adapting on the fly

For any IGCC plant, the road to success—as measured by its

availability—is a steep O&M learning curve. At both U.S. projects,

many fixes had to be implemented after startup to address the

unanticipated. The gasification industry in general has had difficulty in

bringing new plants on-line quickly, sometimes taking as long as three to

four years to reach mature reliability. Even after reaching steady state,

reliability (<85%) has been below expectation.

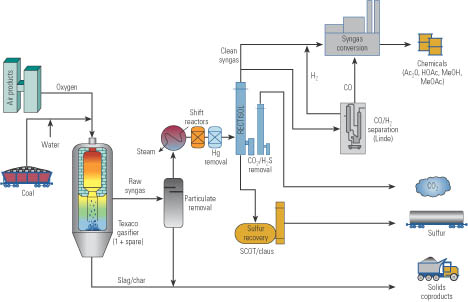

| The

coal gasification process at Eastman

Conceptually, coal gasification is a relatively simple process. A carbonaceous fuel—usually coal, petroleum coke, or heavy oil—is co-fed with water and oxygen in a reducing atmosphere at high pressure (up to 1,000 psig) to produce the desired products of carbon monoxide (CO) and hydrogen (H2). Sulfur in the form of H2S and some amount of CO2 is also produced and removed in the process. This gaseous mixture is commonly referred to as synthesis gas or syngas. At Kingsport, Eastman’s gasification process (Figure 2) uses two high-pressure (1,000 psig) Texaco quench gasifiers to convert about 1,250 tons/day of bituminous coal into acetyl chemicals. The Rectisol process removes 99.5+% of sulfur and CO from the syngas. The sulfur is recovered in elemental form using a combination of Claus SRUs (sulfur recovery units) and SCOT (Shell Claus off-gas treating) processes. A Linde AG-designed cold box is used to cryogenically separate CO from a portion of the syngas.

The downstream chemical plants use technology purchased from Lurgi AG and Air Products & Chemicals Inc. (Lehigh Valley, Pa.) for methanol production. Eastman developed the technology for making methyl acetate, acetic acid, and acetic anhydride from syngas. Only one of the gasifiers is required for normal production, and one is a spare. There are several key pieces of equipment that are also spared, and in places two processing units are required for full rates, but there are no complete spare trains for any other section of the plant. Mercury removal is key Because Eastman manufactures chemicals from the syngas produced

by the gasifier block, the downstream catalysts and end products

must be protected from volatile contaminants in the syngas vapor.

In particular, some of the acetyl-based products have end-use

requirements that impose extremely low limits on mercury

contamination. |

Experience: The best teacher

Eastman Chemical Co., originally a subsidiary of Eastman Kodak and spun off as a separate company in 1994, was founded in 1920 to supply methanol from wood distillation as an alternative to foreign supplies that were interrupted during World War I. Over the ensuing decades, Eastman Chemical’s interests expanded to include coal gasification. Its Chemicals from Coal facility located in Kingsport, Tenn. (Figure 1) was the first commercial-scale coal gasification plant in the U.S., and it has now been operating continuously for over 20 years. To put that into perspective, Kingsport has literally an order of magnitude more operating experience with coal gasification than all other U.S. IGCC plants combined. What makes the gap even more remarkable is that Kingsport isn’t a demonstration facility; it’s an industrial plant that has to turn a profit.

At Kingsport, the syngas (synthetic gas) produced by a licensed Chevron/Texaco process (see box, page 43) is used to produce chemicals rather than to fuel power generation. About 1,250 tons/day of high-sulfur Appalachian bituminous coal are converted to acetyl chemicals. CO and H2 are first combined to produce methanol. The methanol is then reacted with CO to produce acetic acid and other derivatives used in the manufacture of a variety of consumer products.

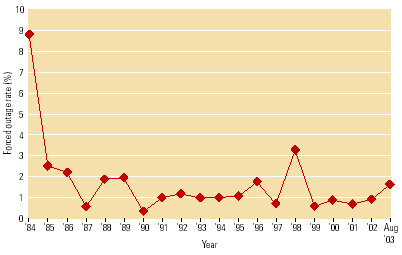

O&M stats: Industry-leadingand improving

A key operating metric of a gasification plant is its availability. One measure to express this is the on-stream time, the number of hours it actually operates during a specified time frame (usually a year), expressed as a percentage. Kingsport’s availability during its most recent two-year maintenance cycle (the operating period chosen) was very impressive. As Figure 4 shows, from September 2000 through September 2003 the gasification block—from air separation and coal handling through syngas cleanup, including one gasifier plus a spare—was on-stream 98.1%. Of the 2.0% downtime, 0.8% was planned (the plant’s biannual maintenance shutdown in May 2001), now extended to every three years, making the plant’s forced outage rate 1.1%.

Eastman estimates that if no spare were available, the gasifier’s reliability would be between 88% and 90%. Over the two-year period, the gasifier’s average annual loading capacity (or capacity factor) was 132% of its original design rate: 125% during the year with the planned shutdown and 139% during the other year. The typical daily syngas production rate is about 145% of the original design rate.

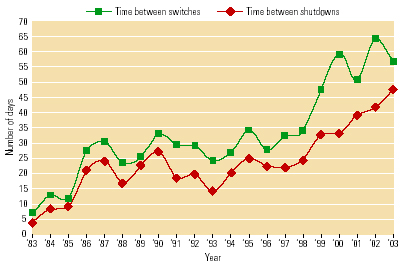

Another measure of the process’s availability—and reliability—is

the average time between gasifier switches. As a result of continuous

process improvements, that number has increased steadily and now is about

60 days (Figure 5). In addition, the average gasifier run time (the period

between a gasifier’s startup and shutdown, regardless of whether it is

switched or restarted) has also been climbing and is now more than 47

days.

|

| 4. Forced outage rate. Kingsport’s forced outage rate was less than 9% during its first full year of operation but has averaged less than 2% over the past 19 years. Source: Eastman Chemical Co. |

|

| 5. Gasifier run data. The average time between gasifier switches is currently around 60 days. The record run, in 2002, was 122 days. The longest run last year was 95 days. Source: Eastman Chemical Co. |

|

|

6. Acid gas removal area. A night shot of activity in the acid gas–removal area of Kingsport during the last triennial maintenance / inspection blitz. Courtesy: Eastman Chemical Co. |

Although the gasifier has had to shut down for a number of reasons over the past 20 years, the most significant one has been the longevity of its feed injector. After plant staff redesigned that piece of equipment in 1998, reliability and availability of the entire process improved, leading to a record

run of 122 days in 2002. The longest run last year was 95 days. To

further improve Kingsport’s reliability, availability, and performance,

Eastman relies heavily on preventive maintenance. During the planned

shutdowns mentioned earlier, the plant is shut down for an 8.5-day

maintenance blitz/vessel inspection every three years (Figure 6). During

the last outage, 520 work orders were completed, expending 22,000 work

hours. Maintenance of the acid gas removal columns (which use the Rectisol

process jointly developed by Germany’s Linde AG and Lurgi AG) is

typically the critical path due to warm-up/cooldown and deinventory

issues.

|

|

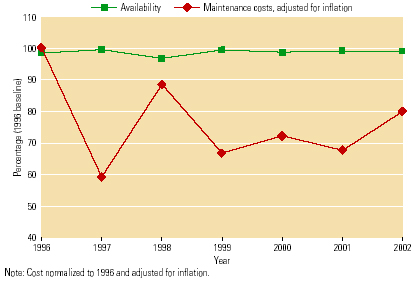

7. Reliability determines maintenance. The maintenance program used at Kingsport allows equipment reliability to dictate maintenance schedules. Between 1996 and 2002, this program reduced the plant’s maintenance costs 20% while the availability and production of the gasification process remained essentially constant. Source: Eastman |

At Kingsport, Eastman uses a reliability-based maintenance system whose elements include expertise, work practices, training, and technology. Between 1996 and 2002, it lowered the plant’s maintenance costs by 20% while the availability and production of the gasification process remained essentially constant (Figure 7). A key aspect of the system is that it allows equipment reliability to dictate maintenance work schedules. That has enabled Eastman to transition from almost entirely shift maintenance in the early years to much more planned maintenance on the day shift. Maintenance data is collected on most individual pieces of equipment and then analyzed against a criticality ranking to develop a preventive maintenance schedule. Critical equipment is routinely refurbished before failure, while some pieces of nonessential equipment are run until they fail.

|

|

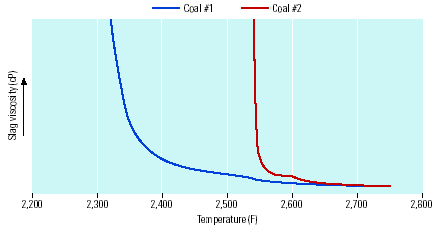

8. Slag viscosity vs. temperature. Coals with the same ash fusion temperature behave very differently in a slagging gasifier. Coal #1 could run at much lower temperatures, while coal #2 would be difficult to run without high refractory wear. Source: Eastman Chemical Co. |

Lessons learned

Now let’s look at some of the design and operating issues that prospective developers and owners of coal gasification processes must consider when evaluating available technology options. The stellar performance of the Kingsport plant has not been due to any one design or operating method or change to them, but rather to a long history of incremental improvements. As with most successful power projects, the devil is in the details.

The first and perhaps most important thing a gasification process developer must consider is which coal or other carbonaceous feed to use. The obvious considerations such as price, Btu value, sulfur content, ash content, and availability readily come to mind. But of these, a coal’s ash content has the most impact on the performance of a slagging gasifier.

Figure 8 plots the slag viscosity vs. temperature for two different coals with exactly the same ash fusion point, as reported by the standard laboratory procedure. However, these two coals would behave very differently in a gasifier. The ash from coal #2 would be very difficult to gasify without high refractory wear because its slag would be very viscous, even at 2,550F. By comparison, the ash from coal #1 (the curve with the more gradual slope) would be much more forgiving and could be gasified at much lower temperatures with fewer slag removal problems. In many cases, coals can be modified to make their slag behave as desired. For example, a fluxant can be added to low-ash pet coke to remove heavy metals from it and encapsulate or vitrify them in the slag.

Another consideration in choosing a feed source is the impact of trace minerals. All coals contain most of the members of the periodic table of elements at some level of concentration. But for most elements, their concentration is low, and the gasifier vitrifies the impurities in the nonhazardous slag it produces. However, chlorides, arsenic, nickel, mercury, and vanadium need special consideration. The concentration of these chemicals will determine the plant’s metallurgy, equipment fouling factors, catalyst life, solids handling and disposal practices, water discharge rate, and personal protective equipment needs.

For example, if a coal has a high level of chlorides, those chlorides will build up in the gasifier and lead to two problems: limits on the use of stainless steel piping (which is prone to stress corrosion cracking) and an increased need for water blowdown. Vanadium also is troublesome, for two reasons: its concentration is usually high (particularly in pet coke), and it has a very different melting point at normal reducing gasifier operating conditions than it does in the oxidizing environment present during preheat, startups, and shutdowns.

The consistency of a coal’s physical properties also is important. Wide variations in the feed require a gasifier to operate over a wider range of temperatures, O/C ratios, and slurry concentrations, and may result in less-efficient operation (lower conversion, more CO2) and increased refractory wear. Other considerations for a coal are its compatibility with slurry additives, the slurry solids concentration achievable vs. desired concentration, the choice of fluxants and the resulting impact on water chemistry, and its grind distribution and the effect that has on slurry properties and carbon conversion. All coals are not created equal, but gasifiers are very flexible and can accept a wide range of coals as long as the important characteristics of the coal or other feed stream are understood and accounted for.

Solving permit problems

Developers of IGCC plants also must address their environmental impact. Recently, regulators have expressed concerns about the flaring of raw syngas containing sulfur during plant startups. The crux of the problem is this: Because syngas is difficult to store, and all of the plant’s units are started in sequence, there is a time window when the gasifier is producing raw gas but the sulfur recovery unit is not yet running. This aspect of operations should be considered when permitting the plant.

Flaring gas is particularly troublesome during the early years of a plant when startups are more frequent. But there are alternatives. Eastman developed a patented technique to start the gasifier and sulfur recovery units up on a sulfur-free, liquid fuel and then transition to the normal slurry feed without interruption. This avoids the flaring of raw syngas during startup and reduces the plant’s total SO2 emissions.

As for another pollutant, Eastman has always been sensitive to levels of mercury in Kingsport’s output of syngas because some of the end product is used by the photographic industry whose processes are very sensitive to mercury contamination. Mercury is removed from the syngas using relatively small absorbent beds that trap the mercury at a 90+% removal rate. The bed operates at normal process pressure of ~1,000 psig and 80 to 90F. The adsorbent bed material is changed out every 12 to 18 months on the basis of its fouling and pressure drop, not its mercury loading capacity, which is estimated at up to a 10-year life.

Stops acid gas

After the choice of a feed for his IGCC plant, the next decision a developer must make—the earlier the better—is which acid gas–removal technology to use. That decision should take into account both the plant’s permit requirements and the expected end use of the syngas. For example, Eastman chose the Rectisol process because it excels at removing sulfur and CO2 and because Kingsport’s output is used in chemical production processes involving downstream cryogenic separation and sensitive catalysts.

The sulfur level in the syngas produced at Kingsport is less than 1 ppm, meaning that total sulfur removal and capture efficiency is 99.5+%. For power production applications (where permitting allows), a less-intensive removal process such as methyldiethanolamine (MDEA) adsorption or Selexol may suffice. As you might expect, the capital cost of an acid gas–removal system reflects its effectiveness at removing sulfur, but the added cost for significantly higher sulfur removal levels is much lower than for other coal technologies. For a 500-MW IGCC, a Selexol system capable of removing 99% of the sulfur from the syngas might add $20 million to $30 million to the capital cost over the standard MDEA option. Getting to the 99.5+% level would require a Rectisol system priced at an additional $40 million to $50 million over MDEA.

So, pick your sulfur emissions target and read the price, right? Well, it’s not quite that simple. The sulfur loading capacity of a given system depends on the sulfur and CO2 content of the gas as well as the system pressure. Generally speaking, chemical solvent processes such as those in MDEA systems (which typically can remove around 98% of sulfur) are more efficient at lower pressures, but the physical solvents like methanol in a Rectisol process are more efficient at higher pressures.

|

|

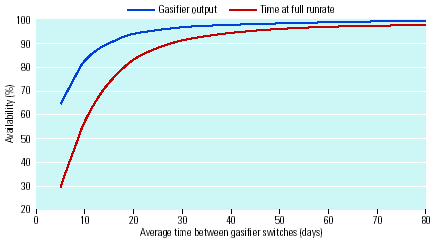

9. Availability vs. run time. At low gasifier run times, plots

of the system’s overall output and percentage time at maximum

rate show the expected steep curves. However, the gasifier’s

overall reliability flattens out at around 40 to 50 days,

indicating that no significant increase would come from adding

redundant equipment beyond that point. Source: Eastman Chemical

Co. |

Two are better than one

It’s as true in coal gasification as it is other engineering

endeavors: Redundancy can be an asset when individual pieces of equipment

or systems are unreliable, but redundancy also can be a liability if it

obscures poor performance. The only question is how much redundancy to

design in, because big pieces of hardware have big price tags. The

intelligent approach to answering that question is to base redundancy

decisions on the hard operating data, criticality rankings, and

performance history of equipment, and make them targeted to specific

areas. For example, at Kingsport a spare quench water pump has been deemed

appropriate because these kinds of pumps are both known to have a short

mean time to failure and are absolutely essential to plant operation.

Another example might be a set of exchangers that are known to foul

frequently, must be cleaned after every run (and sometimes during a run),

and cannot be bypassed.

The authors’ most frequently asked question about redundancy is, “How

many gasifiers should I have to give me X% availability?” For the

7/24/365 Eastman operation, there is one gasifier and one spare. The

cooling train and water system are single-train, but with carefully

selected equipment spared.

Eastman feels so strongly about intelligent redundancy that it has

created statistical models, based on Kingsport historical records, to

refine its decision-making process. For example, in analyzing the effect

of gasifier average run time on overall system reliability, plots of the

system’s overall output and percent time at maximum rate show the

expected steep curves at low run times (Figure 9). However, the curves

start flattening out at around 40 to 50 days, indicating that no

significant increase in reliability would result from adding more

redundancy beyond that point. So in the design and operation of the plant,

the redundancy target clearly should be around 40 to 50 days; any extra

redundancy or expense to get more than 50 days probably would not be

economic.

Safety first

At Kingsport, Eastman pays more than lip service to both process safety and personal safety. The plan’s long-term OSHA recordable rate is between 1.0 and 2.0, which is in the upper quartile of the chemical industry and means that an Eastman chemical plant operator is much safer at work than at home. The last injury that required a day away from work (a turned ankle) was more than 11 years ago and was not related to the process.

Eastman uses a behavior-based system as the primary means of ensuring safe plant work practices. Naturally, it includes provision and mandatory use of personal protective clothing and equipment. For example, mechanics must use fire protection suits when changing out the feed injector while the unit is still hot. Syngas containing CO and H2S are highly toxic, and when H2S has been taken out, the syngas is also odorless. The gas is processed at very high pressures, increasing the potential for leaks. Because of the potential dangers, all Eastman operators wear personal CO and H2S monitors that alert them to potentially hazardous concentrations of those gases. Area monitors are also strategically located throughout the buildings.

Training is another vital element of process and personal safety. At Kingsport, there are two basic types of training for operations personnel. New operators must take and pass three years of courses to be certified by the U.S. Bureau of Apprenticeship Training. The curriculum includes general education on pumps, valves, instruments, and processing equipment, as well as job-specific training on all of the individual tasks a fully competent gasifier operator is likely to be given.

But an operator’s initial training is not the end of his learning, which will continue for his entire career. There are also mandatory safety training sessions such as fire extinguisher use, emergency evacuations, and environmental inspection and response. But just as important, process refresher training is also provided on a three-year repeating cycle—over and above what OSHA requires.

IGCC’s promise

Interest in coal gasification is at an all-time high in the U.S. because the process has the potential to provide a big share of America’s future energy needs in an environmentally responsible way. Kingsport is proof that a carefully designed, managed, and operated gasification unit can run very reliably over a long period of time. Getting there hasn’t been easy. But over the past two decades, Eastman has been able to effectively deal with the many complex issues involving coal gasification. The company is proud to offer this article as expert advice to developers in the nascent industry.

In fact, Eastman has such faith in the future of gasification that it has formed a subsidiary—Eastman Gasification Services Co.—to help prospective gasification developers and owners improve the value and performance of their plants. Eastman Gasification Services has also signed a cooperative agreement with ChevronTexaco under which Eastman can readily provide operations, maintenance, management, and technical services to other ChevronTexaco gasification process licensees.