By Jason Makansi, Pearl Street Inc.

Two years ago, energy storage was not even mentioned in President Bush’s

energy plan. Today, energy storage figures prominently in several sections

of the current comprehensive energy bill making its way through Congress.

Although the bill failed to pass last year, legislators are expected to

begin debating it again soon, and the provisions likely to survive reveal

the progress that the storage community—working through the Energy

Storage Council (see box)—has made in defining its place within the U.S.

energy agenda.

That progress is even more notable because energy storage does not fall within the boundaries of current industry sectors—fuels/energy sources, generation, transmission, distribution, and energy services. It is, in effect, a sixth and completely new dimension of the electricity production and delivery value chain. Energy storage technologies (see “Capacity and discharge parameters to suit any need,” page 26) help bridge the gaps between the five existing dimensions. Just as important, they also optimize the infrastructure into which billions of dollars have already been invested. These are important attributes for an industry still mired in a slump of historic proportions, facing excess capacity in most areas of the country, and experiencing disaggregation of the value chain and divestiture of assets, ostensibly to create competitive markets.

Here’s another take on the last two trends. The U.S. electric power industry is undergoing an upheaval, a transformation to competitive markets (albeit in fits and starts) that has caused tectonic shifts in the traditional land masses. Thanks to the boom in merchant and independent power project development and utility plant sales, more than 30% of America’s generating capacity is now categorized as “non-utility.” Transmission assets are being “reorganized” under regional transmission organizations or independent system operators, and utilities are reluctant to invest in what they may not own or control.

| About the Energy Storage

Council

Several companies actively developing energy storage projects, supplying equipment, or both created the Energy Storage Council (ESC) in late 2001. Its mission is to drive the public policy framework that supports projects and investment. That mission is a critical one today, because justifying storage projects requires cooperation among the industry sectors of fuels/energy sources, transmission, generation, distribution, and energy services. That’s a tall order, given that those sectors, which only recently were managed by vertically integrated utilities, are now being broken apart. Through aggressive lobbying of various government agencies, coordination with relevant industry trade associations, hosting conferences on policy issues, and other initiatives, the ESC has succeeded in crafting and adding language to the comprehensive energy bill now making its way through Congress. Over the past two years, its membership has grown to include project developers and owner/operators, architect/engineering firms, equipment suppliers, and developers of the three principal types of large-scale energy/electricity storage technologies: compressed air storage systems, flywheels, and batteries. The ESC’s next annual meeting will be held

on March 16, 2004, at the Phoenix Park Hotel in Washington, D.C.

For more information or to register, contact kblank@pearlstreetinc.com.

More information about the ESC is available at

www.energystoragecouncil.org. |

Adding to the upheaval, interest in distributed and on-site generation

is rising as distribution-oriented utilities seek new business

opportunities and customers with critical power needs seek to protect

themselves from what they see as deteriorating utility service. Consumers

and their elected officials are demanding renewables, but the true costs

of this highly variable resource are unknown and are therefore not being

factored in. Finally, our national security is jeopardized because the

electric system, fundamental to all other infrastructures, does not have

the equivalent of a Strategic Petroleum Reserve.

A bridge and an optimization tool

Energy storage has the potential to bridge the gap between where the industry has been and where it is going. This is what policymakers are beginning to recognize.

Fundamentally, all storage facilities seek to store electricity produced or purchased at low cost for later release for higher-value purposes. Among those purposes are:

- Sales into high-priced markets.

- Making grids more stable.

- Provision of ancillary services with quick response times.

- Providing backup and bridging power, as does an uninterruptible power system.

- Load leveling between night and day for both transmission and generation purposes.

- Managing voltage and power quality at key distribution points or customer sites

Because it can serve such purposes, energy storage also should be considered a key tool for optimizing America’s existing electricity infrastructure. Storage facilities can help raise the productivity of assets already invested in—including coal-fired plants that may experience deep cycling and low capacity factors and transmission lines that, on average, are only loaded to 50% to 65% of their carrying capacity.

Concurrent with the policy successes, there is renewed interest in energy storage projects as a response to the great blackout of 2003 and recent large-scale system failures as well. For example, one of the largest energy storage projects ever conceived—an underground, 2,700-MW compressed-air energy storage (CAES) reservoir in Norton, Ohio, that has been in development for several years (see below)—aims to connect to a First Energy Corp. transmission line whose failure has been identified as crucial to the chain of events that ultimately led to last August’s cascading blackout in the Northeast and parts of the Midwest. A transmission and storage expert familiar with the project observed that, had it been online at the time, Norton “would have stopped the blackout dead in its tracks.”

| Capacity

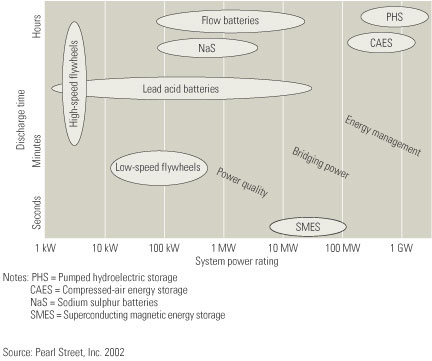

and discharge parameters to suit any need Thumbnail sketches of various energy storage technologies follow. Each of the broad categories fills specific niches, as a function of its system power rating and discharge time (Figure 1). Pumped-storage hydroelectric is the oldest and largest of the commercially available techniques. About 2.5% of U.S. generating capacity is in the form of pumped storage. However, it has become virtually impossible to permit new facilities—America’s last unit came on-line in 1997 after a 20-year development cycle. In pumped-storage hydro, machines that double as pump/turbines and motor/generators are used to pump water into an upper reservoir using low-cost, off-peak power that then is directed through turbine/generators to meet peak demand.

Compressed-air energy storage (CAES) is similar in concept, but air is the working fluid. Compressors driven by low-cost off-peak power charge a storage volume, typically a naturally occurring underground structure. During daily peak periods, the compressed air, along with a small amount of natural gas, is used to drive turbine/generators. Many naturally occurring formations across the country are available for CAES development. One study of the technology indicates that between 12,000 and 40,000 MW of CAES could be justified in the U.S. over the next 5 to 10 years. Battery technologies for large-scale storage range from the conventional lead-acid configurations to emerging reverse-flow, or regenerative, fuel cells. Existing flow batteries have been developed using three electrolytes: zinc bromide, vanadium bromide, and sodium bromide. Energy is exchanged in a closed-loop cycle within an electrochemical cell with separate compartments for each electrolyte that are separated by an ion-exchange membrane. Other advanced batteries for large-scale application use sodium sulfur (NaS) and nickel-cadmium. More exotic configurations, including lithium-ion and nickel-metal hydride, show promise for future utility-scale applications. Flywheels store energy by accelerating a rotor and maintaining the energy as inertial kinetic energy. High-speed flywheels employ advanced composite materials to lower their weight and enable them to withstand high centrifugal forces. One of their principal attributes is that they require less maintenance than battery systems. Superconducting magnetic energy storage (SMES) systems store energy in a magnetic field created by the flow of direct current in a coil of cryogenically cooled superconducting material. Their attractions are extremely high (>95%) round-trip efficiency and the ability to deliver power almost instantaneously. More-thorough descriptions of energy storage technologies,

applications, policy issues, market opportunities, and

stakeholders are available in the Pearl Street Executive Briefing

Report, “Energy Storage: The Sixth Dimension of the Electricity

Value Chain.” Visit www.pearlstreetinc.com to learn how to

obtain this report. |

|

|

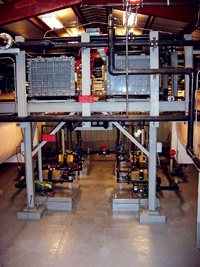

| 2. Vanadium redox battery system. PacifiCorp installed this 250-kW, 8-hour vanadium redox battery system at one of its substations near Moab, Utah. Courtesy: PacifiCorp/VRB Power |

|

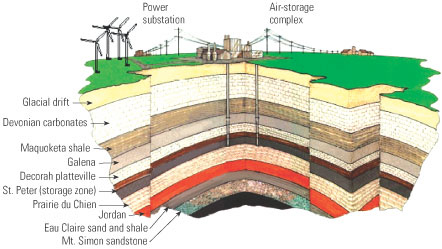

| 3. Artist’s rendering of proposed

2,700-MW Norton Compressed Air Energy Storage Project. The plant, located 35 miles south of Cleveland, will compress air using off-peak electricity and store it in an underground limestone mine. Courtesy: Haddington Ventures LLC |

On the distribution side, storage experts have noted that high-energy flywheels could have responded to distribution-level voltage fluctuations much faster than existing options. The PJM Interconnection, for example, holds 1.1% of its generation in reserve for frequency regulation. But it takes minutes rather than seconds to retrieve the reserve, and that’s typical of response times for many storage systems.

Norton and the other projects profiled below illustrate one or more of the main value propositions that justify energy storage projects:

- Solve transmission problems.

- Raise the value of renewable energy sources.

- Facilitate arbitrage and regional wholesale markets and grid organizations.

- Support distributed generation.

- Enhance national security and infrastructure assurance.

- Optimize the productivity of existing coal, nuclear, and T&D assets.

An advanced battery for T&D

Solving transmission and distribution (T&D) problems with flexibility is the hallmark of the 250-kW, 8-hour vanadium redox battery system (Figure 2) installed by PacifiCorp (Portland, Ore.) at one of its rural substations near Moab, Utah. The facility, now being commissioned, can be relocated to suit future utility requirements. The system enables PacifiCorp to ensure peak power capacity and thereby defer a more expensive substation and transmission line project.

The vanadium redox technology represents one type of flow battery, or reverse-flow, fuel cell. The supplier, Vancouver-based VRB Power Systems Inc., notes that the technology offers the lowest ecological impact of all electrochemical storage options. The system uses conducting plastic electrodes, which do not contain the heavy metals found in most competing systems.

Compressed air in Norton

CAES Development Co. LLC—a wholly owned subsidiary of Houston-based Haddington Ventures LLC—is developing the first, 600-MW phase of a 2,700-MW compressed-air energy storage (CAES) project in Norton, Ohio (Figure 3). Chicago-based Sargent & Lundy is the owner’s engineer, and an inactive 340-million-cubic-foot limestone mine is the storage medium. All major permits are in place for the project, and the terms for multiple tolling arrangements are nearly finalized. Equipment selection will take place early this year, with commercial operation expected for April 2007.

Electricity to be produced by the plant will have multiple paths to market. It will supply American Electric Power Corp.’s 765-kV backbone as well as FirstEnergy’s 345-kV and 138-kV circuits. The first phase will likely access the 138-kV line.

CAES is unique in its ability to function as both a source and a sink for reactive power in managing grid stability. This fact, and Norton’s location—at the heart of the grid whose early failures led to the blackout, straddling the power-hungry markets of the Northeast, and with access to abundant low-cost electricity from the South and Midwest—underscore the potential importance of CAES to grid and market management

|

| 4. The matrix. A matrix of 10 high-speed flywheels is connected to one DC bus on the New York City subway system, forming the first 1-MW “flywheel matrix.” Courtesy: Urenco |

|

| 5. Underground

storage. A cross-sectional view of the 1,200-foot-deep aquifer at the heart of a fully dispatchable, intermediate-load facility proposed for Iowa. It will store 200 MW of energy in the form of compressed air and the natural gas needed to power on-site compressors. The wind turbines will provide another 85 MW. Courtesy: Iowa Stored Energy Project |

Transit energy recovery

|

|

6. Meet BESS.

This battery energy storage system (BESS) in Alaska has a total of 13,760 liquid electrolyte-filled nickel-cadmium cells. Each cell, roughly the size of a large PC, weighs 165 pounds. Total project cost was $35 million. Courtesy: Golden Valley Electric Association |

|

|

7. Frugal BESS.

This battery energy storage system will reduce fuel consumption by the co-op by reducing the level of spinning reserve. BESS has a design life of 20 to 30 years. Courtesy: Golden Valley Electric Association |

Flywheel storage systems seem to have found a niche in mass transit systems worldwide. Such units now serve the metros of Paris, London, Lyon, Hong Kong, and Singapore. Closer to home, 10 100-kW flywheels have been in demonstration for close to two years on 2 miles of test track of the New York City subway system (Figure 4). The UK’s Urenco Power Technologies Ltd., represented in the U.S. by Beacon Power Corp. (Wilmington, Mass.), supplied the flywheels.

The NYC Transit Authority had two problems to solve in modernizing its fleet of cars: how to reduce peak load and how to best recover energy from regenerative braking systems. The latter, consisting of drive motors that are electronically converted into generators during braking, have replaced friction braking systems. Power once lost as heat can now be directed back into the third rail for use by other accelerating trains. Flywheels make this energy recovery more efficient by collecting the excess power and reinjecting it into the third rail when needed, reducing the amount of power lost to resistance.

Flywheels for this project are connected electrically in parallel to deliver up to 1 MW for 30 seconds. The units charge to full potential in 30 seconds. According to NYC Transit officials, these units, if installed throughout the system, could potentially reduce the subway’s annual traction power bill by 10% to 15%, or up to $20 million annually.

Encouraged by favorable test results, Beacon Power is developing a

flywheel capable of discharging 1 MW for 15 minutes for applications

including gas turbine starting, grid stabilization, and frequency

regulation.

Wind + storage

Another CAES project, this one in Iowa, is being supported by 74 municipal utilities in the state (Figure 5). The vision is to build a fully dispatchable, intermediate-load facility by combining a 200-MW CAES plant with an 85-MW wind farm. Worthy of note is that the storage medium is an aquifer—1,200 feet below ground—that can handle 500 psig of pressure. The capacity factor of the facility is expected to be 50%, with wind energy accounting for at least a third of the output. The plant can be converted to baseload operation by adding more wind generation and more compression capability at the CAES plant. The aquifer also can be used to store the natural gas used by the CAES plant.

Rural VAR support

The first phase of the largest battery system in the world is up and running at Golden Valley Electric Association (GVEA), a cooperative located in Fairbanks, Alaska. Some 27 MW of power for up to 15 minutes from a huge nickel-cadmium battery energy storage system (BESS) is now available for VAR support, currently the primary operating mode of the facility (Figures 6 and 7). In effect, the BESS operates as a static VAR compensator. However, the facility also is designed to run as a generator under automatic generator control (AGC) to support the grid when large (6,000- to 8,000-hp) motors are started up. GVEA expects that the BESS will reduce by 65% the number of outages caused by power supply issues that its customers experience. Full output from the facility—40 MW for 7 minutes—will be available when the facility is completed soon.

| Storage

R&D moves forward Although public policy support for it has been lacking, energy storage continues to be the subject of significant research, development, and demonstration programs funded by the DOE. Additional support comes from the California Energy Commission and the New York State Energy Research and Development Authority. Sandia National Laboratory manages the DOE’s storage R&D program. Information about the storage technical community can be found on the Electricity Storage Association’s Web site, www.electricitystorage.org. |