The bill would also require ethanol use in the U.S. to increase from 4.7

billion gallons in 2007 to 30 billion gallons by 2025, and would establish

a new biodiesel and alternative diesel standard of 250 million gallons in

2008, increasing to two billion gallons in 2015, creating greater demand

for biodiesel as a transportation fuel -- and greater demand for biodiesel

manufacturing plants.

Recognizing the need for conservation, the BOLD Act encourages the

manufacture and purchase of fuel-efficient and flexible-fuel vehicles.

Purchasers of fuel-efficient vehicles would qualify for rebates up to

$2,500. Automakers would be encouraged to install advanced technologies,

including flexible-fuel technology, by 2017. They would be eligible for

either a 35 percent tax credit or retiree health care grants to make this

transition.

The residential credit for solar, however, was not included in the bill,

according to the Solar Energy Industries Association (SEIA). Conrad's bill

would also establish a federal Renewable Portfolio Standard (RPS) with a

goal of 10% renewables by 2020, with a triple-credit multiplier for

distributed generation projects less than one megawatt in size.

Not surprisingly, the SEIA does not anticipate this bill to move forward

in its current form with some of the strong measures such as a national

RPS, which has historically been voted down by lawmakers.

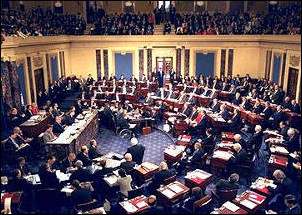

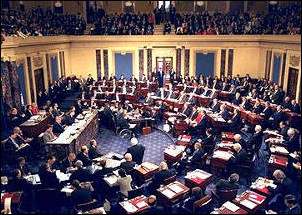

Senator Conrad is now the third member of the Senate Finance Committee in

the last month to introduce legislation to extend the solar investment tax

credit (ITC). As mentioned earlier by Renewable Energy Access, Senators

Charles Grassley and Max Baucus have proposed the Alternative Energy

Extender Act, S. 2401, which would extend both the residential and the

commercial ITCs for solar for an additional three years, creating a total

of five years for both credits (see related story at the link below).

"Although both bills provide a shorter window than the eight-year extender

we are advocating for, it is encouraging that the Senate is willing to

push extenders this year in a bipartisan fashion," said a statement from

SEIA.

There were other nonrenewable energy initiatives in the comprehensive

package including a USD $500 million grant program to fund the development

of coal-to-liquid fuel technology. It would also help increase domestic

oil production by increasing tax credits for oil companies that use carbon

dioxide to extract more oil from aging oil fields.