Hedge Funds Profit Off Subprime Collapse

Location: New York

Author:

Hennessee Group LLC

Date: Wednesday, August 22, 2007

In an October 2006 press release, Hennessee Group reported that hedge funds have been using credit default swaps (CDS) in several ways, including purchasing CDS on sub-prime mortgage backed fixed income securities and indices intended to profit from deterioration in credit quality among mortgage borrowers.

|

Sub-Prime Mortgage

Lenders |

||

|

Price Decline from 1/1/07 to 8/1/07 |

Short % of Float (7/10/07) |

|

| Accredited Lenders |

-70% |

47% |

| Corus Bankshares |

-31% |

56% |

| FirstFed Financial |

-36% |

47% |

| Fremont General |

-65% |

45% |

| IndyMac Bancorp |

-55% |

52% |

| New Century Financial |

-96% |

36% |

| NovaStar Financial |

-93% |

67% |

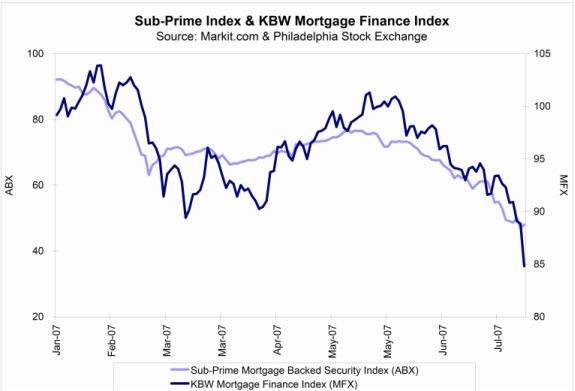

In what has been the best short sale theme since 2002, many hedge funds have greatly benefited from the collapse in sub-prime mortgages via their short exposure to mortgage lenders and sub-prime mortgage backed securities and indices. While some have focused on shorting mortgage lenders and buying credit default swaps (CDS) on specific mortgage backed bonds, others have elected to purchase CDS on indices of these securities (the ABX series), with most focused on those securities issued in 2006 under more relaxed lending standards. The ABX-HE-BBB- 06-2 Index (ABX Index of BBB- traunches issued in 2006) is now down –60 percent for the year (through the end of July). Several managers think there is still more downside for the lowest level traunches, as they believe cumulative losses for sub-prime mortgage securities could potentially cause the value of the BBB- traunches to be worthless.

However, as has been widely publicized, several hedge funds with leveraged long bets on bonds backed by sub-prime mortgages experienced significant losses in the first half of this year. According to reports, these funds leveraged investor capital between 10 and 20 times, and held a collection of collateralized debt obligations and mortgage-backed securities, some of which were illiquid and “marked to model”. As the value of the underlying bonds fell, funds faced margin calls from lenders, which forced selling of assets and further exacerbated losses. While BBB traunches have garnered the most coverage, even more senior traunches have been affected by the collapse, as the AAA traunche has declined -1 percent, the AA traunche fell -5 percent, and the A traunche decreased -20 percent, as of the end of June.

While many recent news stories have publicized hedge fund failures related to the sub-prime collapse, the reality of the situation is that many hedge funds were expecting such an event and were able to profit from the decline.

To subscribe or visit go to: http://www.riskcenter.com