New Coal Power Plants, A Global View

Location: New York

Author:

George Campbell & Bob Bellemare

Date: Wednesday, August 1, 2007

Unprecedented high natural gas and distillate fuel prices since 2000 have caused increased interest in new coal power plants. Despite global warming concerns, new coal power plants continue to be a heavy favorite for new electric generation facilities, particularly in Asia and the United States. In these regions, coal is plentiful and relatively inexpensive, making coal a favored power plant fuel.

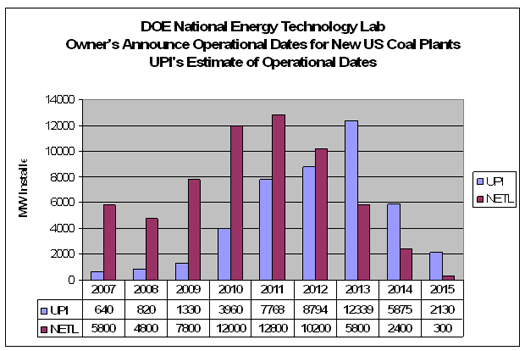

The U.S. Department of Energy's National Energy Technology Laboratory (NETL) lists 155 new coal power plant announcements totaling over 80,000 MW of new capacity. UtiliPoint analyzed this database and is forecasting that 44,000 MW of the 80,000 MW are likely to be installed by 2015. Internationally, the growth in coal is even more bullish with India and China expected to dwarf the United States in building new plants.

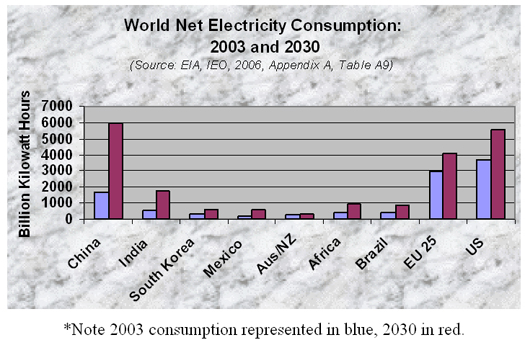

Electric demand is growing throughout the developing world. The U.S. Department of Commerce (DOC) predicts that electricity consumption in China and India will more than triple by 2030. They estimate that South Korea and Mexico's electricity consumption will more than double by 2030. The following DOC table forecasts the growth of electric consumption in the world from 2003 to 2030. China is forecasted to build 500 coal-fired power plants in the next decade, at an average rate of almost one a week, to keep up with its growing demand. In the past year alone, China is reported as having added generating capacity that is equal to the whole of France's electricity grid.

Electric Consumption Forecast

China is also expected to retire a significant portion of their older inefficient power plants. Coal plants currently provide around 80 percent of China's power. China will require firms wanting to build new coal-fired power plants to shut down smaller, older generators at the same time, as part of a drive to boost energy efficiency and cut back pollution.

New coal plants will be built in many states in the United States. However, some states will identify other solutions, both in supply and demand options, and delay building them for the next decade or even longer. In the absence of federal regulation on greenhouse gas emissions, numerous states have developed de facto Federal legislation. Republican governors in Florida and California are leading the way and promoting a carbon emission reduction future. These states tend to be “non-coal” states, but their actions are putting pressure on the federal government to take action.

Although the exact design of federal carbon regulation in the United States remains uncertain, consensus within the power sector and industry at-large suggests that a mandatory reduction in greenhouse gas emissions is impending. During the 109th Congress (2005-2006), 106 bills, resolutions, and amendments specifically addressing global climate change and greenhouse gas emissions were introduced. Under Democratic leadership, the 110th Congress has raised climate change to a top-tier issue. House leaders have pledged to enact aggressive legislation on climate change this year. However, many other states are actively pursuing new coal plant additions. Most of them are located in the Midwest and West Virginia.

UtiliPoint analyzed the NETL database of 80,000 MW of announced projects to create a forecast of the new coal plant construction market between 2007 and 2015. We researched each project to assess how far along it was in the various stages of permitting and development. We also applied an overall probability based on each state's political climate around new coal plant development. Our analysis suggests over 44,000 MW of the 80,000 MW announced projects are likely to be completed by 2015.

U.S. Coal Plant

Announcements (per DOE)

and UtiliPoint (UPI) Forecast of Installation.

Forecasting how many coal plants will actually get built in the United States is a challenge. Unlike the last major build cycle where the United States was undergoing capacity shortages in many areas that is not the case today. Most of the power plants are being built for economy energy to save on expensive natural gas and distillate fuel costs or in anticipation of capacity shortages several years out. If there is a reliability issue, gas turbine peaking units are relatively easy to permit and install to address that issue. Most state regulators are, therefore, under little immediate pressure to permit new coal plants for reliability purposes in regions where natural gas supply is available.

One factor working against new coal plants is rising construction cost. In 2006, the cost of new coal-fired power plants was reported to increase by 40 percent. This is representative of a continuing trend in which capital costs have increased by 90 to 100 percent since 2002. Several recent examples involving Duke Energy, Westar, and American Electric Power have demonstrated how rising costs have forced utilities to postpone or reassess construction plans.

While project delays are likely, the long-term trends in the United States generally point to more coal-fired generation. U.S. policymakers are chasing two very difficult and conflicting goals: substantial cuts in greenhouse gas emissions and meeting anticipated increase in electric demand. Electricity demand is expected to conservatively grow about 40 percent in the United States. by 2030, representing a need for over 400,000 MW of new generating plants which does not even account for retirements of existing plants. Coal, the United States most plentiful fossil fuel, is expected to play a major role in meeting this future demand.

In the long term if carbon dioxide regulations come into existence there will likely be increased financial pressures to replace old generating units with cleaner and more efficient modern plants. According to the Department of Energy (DOE), the United States has about 315,000 megawatts (MW) of coal-fired generation. By 2030 over 150,000 MW of present coal-fired capacity will be more than 50 years old. Replacing these old units with new supercritical coal-fired boilers would reduce greenhouse gases by 25 percent on these units and by 12 percent on the entire coal-fired boiler fleet.

Ethanol production is another factor that may spur growth in coal generation. Ethanol is projected by some to be part of the solution to our solid fuel transportation crisis. Coal-fired power plants could be widely utilized to provide steam at adjacent ethanol plants. This co-generation scenario would reduce the carbon footprint even further for new coal plants.

The undeniable fact is that coal is the United States' most plentiful fossil fuel resource. The United States has two percent of the world's proven oil reserves, three percent of its natural gas reserves and 27 percent of the recoverable coal reserves. While we expect to see carbon dioxide regulations along with increased renewable and nuclear generation, we should not count coal out as a player in our future generation mix. Coal will be the United States' dominant form of electric generation well into the twenty first century.

UtiliPoint's IssueAlert(SM) articles are compiled based on the independent analysis of UtiliPoint consultants. The opinions expressed in UtiliPoint's IssueAlert articles are not intended to predict financial performance of companies discussed, or to be the basis for investment decisions of any kind. UtiliPoint's sole purpose in publishing its IssueAlert articles is to offer an independent perspective regarding the key events occurring in the energy industry, based on its long-standing reputation as an expert on energy issues. © 2004, UtiliPoint International, Inc. All rights reserved. This article is protected by United States copyright and other intellectual property laws and may not be reproduced, rewritten, distributed, redisseminated, transmitted, displayed, published or broadcast, directly or indirectly, in any medium without the prior written permission of UtiliPoint International, Inc.