Location: New York

Author: George Campbell

Date: Tuesday, December 11, 2007

Renewable energy sources presently provide 10.1 percent of the U.S.

installed electric generation capacity. The flexible dispatch of existing

renewable electric sources of hydroelectric (80 percent of renewable total)

and biomass (10 percent) is contributing to the reliability of the U.S.

electric system much like more conventional forms of generation. However,

planning and operational practices may need to significantly change with new

Renewable Portfolio Standards (RPS) that have been implemented in

twenty-five states and is presently being debated in Congress to make it

mandatory in the other states. Much of the new renewable resource is

expected to be wind generation, which has much more variation in its power

production when compared to other forms of electric generation due to the

variability in wind. One potential solution is to marry demand response (DR)

with wind as an alternative to using other resources, such as combustion

turbines, to ensure reliable electric supply during peak times.

Almost half of the states with RPS require greater than 20 percent of the

electric capacity coming from renewable sources. While each state has

different requirements, most states include solar, wind, biomass, small

hydro projects, landfill gas, and some types of municipal solid waste-based

power plants as qualifying resources. Almost all states are excluding

existing large-scale hydro, which makes up the vast majority of the existing

electric renewable fleet. Therefore, most of the RPS sources will be new

builds and they could make up as much as 20 percent of the U.S. total if

present success is implemented in the other states.

The new RPS sources are likely to present planning and operational

challenges for the electric utility industry. Wind and solar are

intermittent resources which can substantively impact the way a transmission

and generation system is planned and operated.

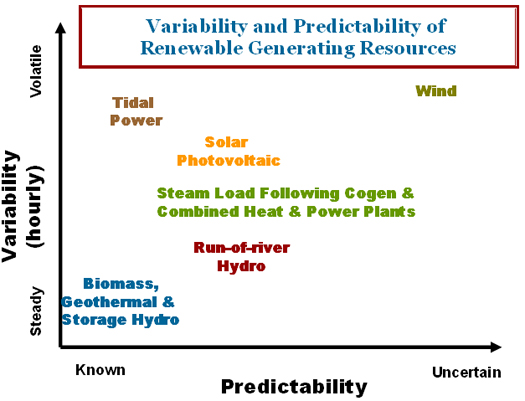

Figure 1 graphs the typical variability and predictability of renewable

generating resources. Biomass, geothermal and hydro with storage have the

capability for a steady and predictable flow of power for reliability

dispatch and are in the lower left portion of the graph. However, wind is

the resource with the most volatility and uncertainty in predictability.

Figure 1

While all of the resources will have increased penetrations because of

the new RPS, wind is presently the one that is being installed to the

greatest degree and its fundamental economics will probably have it be the

dominant RPS in the future. Because wind represents less than one percent of

the installed U.S. electric system capacity it is not an operational problem

today but will be tomorrow if the United States does not properly plan for

this new resource.

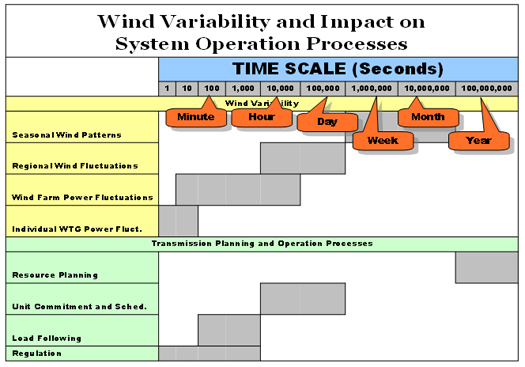

Figure 2 lists the major generation and transmission planning and operations

processes that a wind generator will have to supply for reliability

purposes. Resource planning is a year-ahead process that insures that there

is enough physical generation available for the next year. Most transmission

operators require a 12 percent to 20 percent planning reserve margins to

manage the risk of unplanned generator and transmission outages and

unusually high demands. Because wind typically has a very low correlation

with peak demands in most areas of the United States, only a very small

fraction of its total installed capacity can be included for planning

reserves, if at all. For example, a recent study by the Electric Reliability

Council of Texas (ERCOT), found that 6,300 MW of wind had the same load

carrying capacity as 550 MW of thermal generation for a capacity rating of

only 8.7 percent. In addition power production needs to be ramped up and

down in real-time to manage voltage and frequency. Wind performs these tasks

at a lower level than most other generating resources.

Figure 2

While some reports cite Germany and Spain as having high amounts of wind

generating capacity and no reliability problems, those countries maintain

significantly higher Resource Adequacy Reserves (Planning Reserves) than the

United States. A report that was done for New York State by GE indicated

that their system could take up to 10 percent new wind resources and not

cause reliability problems. However, load growth in their system will reduce

its robustness over time. The solutions to wind's variable production fall

into a combination of the following:

1. Electricity Storage

2. Additional redundant capacity peaking reliability turbines

3. Demand Response

Electricity storage can take place with the following technologies: pumped

hydropower, flywheels, batteries, compressed air, super capacitors and

superconducting magnetic energy. All have significant capital costs and

flywheels are not yet commercial-scale. For wind to be evaluated with the

same capability as hydro with storage capability, the most economical

electric storage technology would have to be included. Because most of these

technologies cost significantly more than wind per installed capacity, the

cost of wind ($/KW) could more than triple. Therefore, there are less

expensive ways of dealing with the variation in wind production—such as the

installation of other, more conventional power plants to produce power when

needed.

For instance, installing combustion turbine (CT) peaking units for Planning

Reserve capacity that wind can't provide would maintain the reliability of

the transmission system. These units cost of approximately $400 - $500/KW

giving them significantly lower capital costs than any of the electric

storage options. However, they will probably require natural gas as a fuel

and additional gas transmission infrastructure will ultimately have to be

built to supply them fuel. Some level of CTs will definitely be part of the

solution.

To solve wind's production variability problem with DR would require more

load shifting on a grand scale. So how much DR capability will be needed? If

the goal is to have 20 percent of the U.S. capacity from new renewable

generation and wind makes up half of that, an additional 90,000 MW of wind

will be needed (as of 2005 there is only 8706 MW of installed capacity).

This assumes that conservation is extremely effective in the United States

and there is no electric load growth over 2006 levels. If DR provides half

of the solution to wind's variable production challenge, we will need an

additional 36,000 MW of load shifting capability, or nearly double today's

37,500 MW of listed capabilities. The actual DR target may be significantly

higher because most DR capability has not been audited in the United States

under the new NERC reliability standards. This reliability audit

verification may be one of the reasons that, in NERC's 2007 Summer

Assessment, only 21,900 MW of DR was reported for interruptible demand and

direct load control.

I believe to increase the DR market size requires the competitive organized

market (COM) practice of requiring default service to be taken by all large

commercial and industrial (C&I) customers under a rate that represents

wholesale electric spot prices (see my article of Sept. 17, 2007).

Residential customers could also have their prices exposed to the spot

market but the infrastructure cost may be too high. If customers are

shielded by rates that do not reflect the volatility in wholesale spot

prices, DR's total potential can't be fully developed. Many COM States now

require large customer default service rates to be based on wholesale

electric market spot energy, capacity and ancillary services prices. This

practice forces all customers to evaluate their DR capability as an

alternative to paying a premium for financially hedging against them. It

makes the DR market potential significantly higher during times that the

transmission and generation system operation is most at risk, at times of

high wholesale spot prices.

I believe the second part of increasing DR capability is to facilitate new

retail services suppliers such as the publicly traded companies EnerNOC,

Comverge and Energy Curtailment Specialists, Inc. They are now providing

comprehensive technology and consulting services along with centralized

customer energy and demand monitoring support to these large customers. As

this COM markets' best practice continues to evolve, vertically integrated

electric utilities (VIEUs) can also implement improved peak-day real time

pricing and encourage these new service providers to bring the same economic

benefits to their customers.

UtiliPoint's IssueAlert(SM) articles are compiled based on

the independent analysis of UtiliPoint consultants. The opinions expressed

in UtiliPoint's IssueAlert articles are not intended to predict financial

performance of companies discussed, or to be the basis for investment

decisions of any kind. UtiliPoint's sole purpose in publishing its

IssueAlert articles is to offer an independent perspective regarding the key

events occurring in the energy industry, based on its long-standing

reputation as an expert on energy issues. © 2004, UtiliPoint International,

Inc. All rights reserved. This article is protected by United States

copyright and other intellectual property laws and may not be reproduced,

rewritten, distributed, redisseminated, transmitted, displayed, published or

broadcast, directly or indirectly, in any medium without the prior written

permission of UtiliPoint International, Inc.