Global Credit Quality Holds Steady in October

Location: Honolulu

Author:

Donald R. van Deventer

Date: Thursday, November 1, 2007

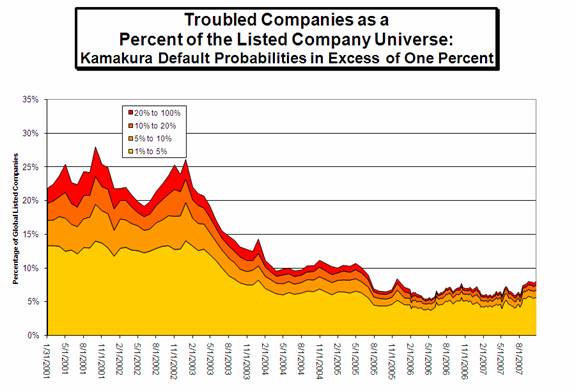

Kamakura Corporation reported yesterday that its monthly index of global credit quality held steady in October, with troubled companies totaling eight percent of the global public company universe. Although credit markets remain tense, Kamakura reported that October global credit quality remained better than 77.8 percent of the monthly periods since January 1990.

This is down sharply from a 95.2 percent rank in July. The average value of the index has been 13.4 percent over the last 17 years. Kamakura defines a troubled company as a company whose defualt probability is in excess of one percent. The index now covers more than 20,000 public companies in 29 countries using the fourth generation version of Kamakura's advanced credit models.

"Market conditions remain nervous but global credit quality managed to hold steady in October at the same levels as September," said Warren Sherman, Kamakura President and Chief Operating Officer. "The 12-month standard deviation of the troubled company index has been 0.8%, up slightly over the last few months but well below the 17 year average standard deviation of 1.8%.

In October, the percentage of the global corporate universe with default probabilities between 1% and 5% actually declined by 0.2% to 5.6% in October. The percentage of companies with default probabilities between 5% and 10% was up by 0.1% to 1.1% of the universe in October.

The percentage of the universe with default probabilities between 10 and 20% was unchanged at 0.8% of the universe. The percentage of companies with default probabilities over 20% was also unchanged at 0.5% of the total universe in October. "

Beginning in January 2006, Kamakura has moved to a global index covering 29 countries using the annualized one month default probability produced by the best performing credit model of the Kamakura Risk Information Services default and correlation service. The model used is the fourth generation Jarrow-Chava reduced form default probability, a formula that bases default predictions on a sophisticated combination of financial ratios, stock price history, and macro-economic factors. The countries currently covered by the index include Australia, Austria, Belgium, Brazil, Canada, Denmark, Finland, France, Germany, Hong Kong, India, Ireland, Israel, Italy, Japan, Luxemburg, Malaysia, the Netherlands, New Zealand, Norway, Singapore, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan, United Kingdom, and the United States.