Location: New York

Author: Cheng & Valerie Mercer-Blackman

Date: Wednesday, November 7, 2007

* Average petroleum spot price hit record highs in early November

* Triggered by geopolitical risks, bad weather in Gulf of Mexico, tightening market conditions, and weaker dollar

* Hike may boost headline inflation but impact on growth likely to be marginal

With prices nudging record highs, the recent oil spike has received a lot of media attention.

On November 2, the average petroleum spot price (APSP) set a new high, closing at over $91. The three main benchmark prices for oil also reached record highs during the same week, with West Texas Intermediate closing at almost $96, Brent at more than $92, and Dubai at more than $85. Measured in euro and SDR terms, however, the surge has not been as stark, reflecting the depreciation of the dollar (see Chart 1).

As of early November, futures and options markets indicate that the APSP

will average over $87 per barrel in the fourth quarter of 2007 and over $86

per barrel in 2008, with a more than one in four chance that Brent crude

prices could be above $100 by early 2008.

The recent oil price surge was sparked by heightened geopolitical concerns

about growing tensions along Iraq's border with Turkey, continued concerns

about Iran, and bad weather in the Gulf of Mexico. Increasingly tight oil

market conditions also played a role, as did the weakening dollar, according

to analysts at the IMF.

Oil demand growth is expected to remain robust throughout the rest of 2007,

supported by strong growth in emerging markets, particularly China and the

Middle East (see Chart 2).

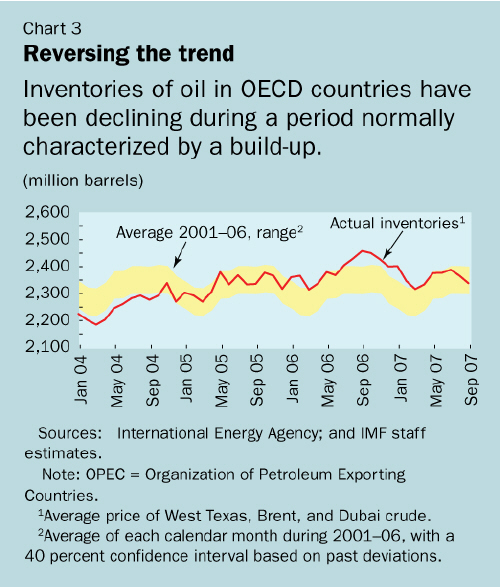

But supply has lagged behind and inventories are falling. During the first

nine months of 2007, world oil supply declined moderately by 0.1 millions of

barrels per day (year on year), reflecting a decline in the output of the

Organization of Petroleum Exporting Countries (OPEC) and limited output

growth in oil-producing countries that are not members of OPEC. As a result,

commercial inventories in OECD countries fell in the third quarter, a period

normally marked by inventory accumulation (see Chart 3).

Supply is unlikely to catch up with demand growth because of the increasing

technological and economic challenges for oil production. As a result, tight

market conditions are expected to persist and possibly intensify, assuming

strong GDP growth continues in emerging markets.

The oil price surge is not an isolated event. Many other

commodities—including precious metals, industrial metals such as lead and

nickel, and foods such as wheat and edible oils—have all set record highs

during 2007. Indeed, the dollar depreciation has amplified the oil price

surge in dollar terms. While the APSP rose by almost 55 percent in dollar

terms during the year ending October 2007, it rose only by about 36 percent

in euro terms.

Apart from this "accounting effect," some market analysts suggest that the

weakening of the dollar, combined with the financial turbulence linked to

the subprime mortgage market in the United States, may have induced

investors to diversify away from dollar-denominated financial assets toward

commodities as "alternative assets."

Rising oil prices will likely boost headline inflation in the months ahead,

but only slightly. The direct effect of the recent oil price rise on

headline consumer price index (CPI) inflation in the United States is

estimated to be about 0.1 percentage points by the end of the year. Overall,

the impact should be manageable, because greater monetary policy credibility

has anchored inflation expectations more securely, particularly in advanced

economies, according to an IMF analysis. The situation may be more

challenging in some emerging market and developing countries where

overheating pressures are of greater concern and rising fuel costs may put

pressure on household budgets and external balances, particularly in

low-income oil-importing countries.

The impact on global economic activity should also be limited. First, the

depreciation of the dollar has softened the impact of the oil price surge on

other major consuming countries. Second, the price rise has been driven by

sustained strong demand growth rather than supply shortfalls. Third,

compared with the oil price surge in the late 1970s, economies today are

much less energy intensive. Fourth, in the case of the United States, the

low season of gasoline consumption during September-October has so far kept

retail gasoline prices comfortably below the highs set in May 2006.

That said, a supply-driven spike to oil prices caused by a serious

deterioration of security conditions in the Middle East could have a

significant impact on global growth. The April 2007 World Economic Report

simulated the impact of a supply-induced oil price hike using the IMF's

"Global Economy Model."

The findings suggested that a sharp supply-induced rise in oil prices could

result in a global slowdown, as income is redistributed to oil-exporting

economies, which have a lower propensity to spend than oil-importing

economies. Higher oil prices would also raise the cost of production and put

upward pressure on the aggregate price level. This would cause central banks

to increase interest rates. Together with the direct impact on production

costs, higher interest rates would then further dent economic activity in

the short run.

To subscribe or visit go to: http://www.riskcenter.com