Renewable Energy Portfolios Standards and Transmission Reliability, Part V

Location: New York

Author:

George Campbell

Date: Tuesday, February 26, 2008

If gasoline pump prices varied between $0 and $21,000 per gallon depending on a particular time of year that a driver was filling up, do you think that consumer consumption patterns would change? Retail electric prices should have exhibited this same range of volatility over the last decade and probably significantly higher if the additional cost of rotating blackouts was included. To create this comparison, I used actual wholesale electric market transactions that I have managed over the last ten years and applied it to the current price of gasoline. The highest priced transaction was $6,500/ MWh (I actually heard of prices as high as $10,000/ MWh during the summer of 1998 & 1999). The lowest priced transaction was $0/ MWh. Wholesale electric markets are extremely volatile as my example shows and marginal costs change within every hour. But almost all US retail electric consumers are protected from this volatility because they have levelized rate options. It is my belief that exposing all large commercial and industrial (C&I) customers to this volatility risk, for at least their marginal load, will greatly expand demand response (DR) capability and help solve Renewable Portfolio Standards' (RPS) reliability problems.

In Parts III and IV of this series, I outlined the three broad categories of incentives that can be used to solve the demand response (DR) problem: Financial Incentives, Moral Incentives and Mandatory Incentives. In Part II of this series, I identified a particular Mandatory DR Distribution Utility Requirement that would require retail electric distribution utilities to require all large C&I customers to take service under two part RTP. This is also referred to as Block and Swing Rates (I will henceforth refer to these as Dynamic Pricing). Dynamic Pricing exposes customers to the volatile wholesale pricing I previously described. So why is this so critical to expanding the role of DR? I believe that it will accomplish the following:

- Provide for a national pricing infrastructure that will allow transmission operators to immediately conjoin the marginal system costs, including reliability's costs to all large C&I consumers rates.

- Expand DR Service Provider's (companies such as EnerNOC, Comverge and Energy Curtailment Specialists, Inc.) market size so that they can economically expand throughout the United States.

Dynamic Pricing can be implemented voluntarily as part of a Financial Incentive or forced onto all customers as part of a Mandatory Incentive requirement of regulators. The retail distribution utility could voluntarily do this but in Part III of this series I explained how certain retail customers in any rate design are negatively impacted (even though it would be revenue neutral) and could cause a significant decline in a utility's favorability rating. Most vertically integrated electric utilities (VIEUs) will not voluntarily expose their customers to a rate design structure that will significantly decrease their favorability ratings. In the Northeast competitive retail markets that are trying to solve a wholesale market power problem, over fourteen distribution utilities require all large C&I customers to take default service under a rate that represents the wholesale electric spot price. The customer then has to take their whole load at the Swing price or they can contract for service from a competitive retail supplier and lock in Blocks at a fixed price or take a combination of a Block and Swing pricing structure. The Block and Swing pricing structure is one of the most common retail rate structures for large C&I customers in those markets.

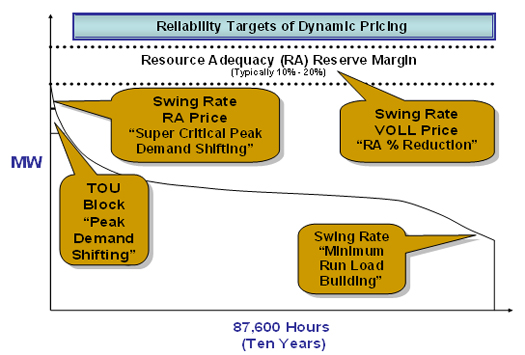

In this series of articles I am not trying to gradually improve the efficiency of the existing electric industry. I am trying to identify the lowest cost solution to a reliability problem that large scale RPS requirements will create. To help understand where those areas are and how Dynamic Pricing can be a large part of the solution, I have produced a ten year (87,600 hours) load duration curve (Figure 1). Transmission operators have a long term reliability planning process (I am going to use ten years, even though some use longer horizons). I have also identified in Figure 1 how components to a Dynamic Pricing rate can provide solutions to transmission operator's reliability requirements during certain load conditions. The features of the Dynamic Rate are:

- Swing Rate VOLL Price

- Swing Rate Resource Adequacy Super Critical Peak Price

- TOU Block

- Swing Rate Minimum Run Load Building

Figure 1

Transmission operators require Resource Adequacy (RA) reserves to reduce the likelihood of a generation-based transmission outage. If RA reserves are not sufficient, rotating blackouts are the last line of emergency measures to prevent a total collapse of the system. These RA reserves are usually between 10 percent -20 percent, depending on the infrastructure of the transmission control area. Also, the higher the RA reserve level, the less likely it is to have a generation-based blackout. When setting RA levels, transmission operators usually consider demand to be inelastic other than for interruptible contracted demand. However, if they could trigger a price response that could make demand more elastic, the RA level could be reduced. A 2006 White Paper for the California ISO (CAISO) on Resource Adequacy estimated the value of lost load (VOLL) from an outage to be between $2,000/MWh and $250,000/MWh. If a transmission operator had the ability to trigger price signals ranging from $2/ kWh to $250/ kWh and all of the large C&I customers in their control areas were exposed to them for their marginal consumption the next hour, demand would be considered a significantly more controllable variable than it is now. RA levels would then be reduced, potentially significantly.

The Midwest ISO (MISO), in their 2006 Resource Adequacy White Paper, identifies just such a VOLL pricing structure. The goal was to have the market participants choose the proper level of RA reserve levels by making demand more elastic. Redundant peaking turbine capacity can also be avoided for RPS reliability requirements, because RA levels can be reduced with VOLL pricing.

Dynamic Pricing can solve another type of RPS reliability problem: minimum generator run problems. I have readers of my articles write in (and send me spreadsheets) to express their concern of the minimum run problems that will be created by RPS. This problem is created because steam plants need a day to bring on line. During off-peak hours of peak days, there is sometimes not adequate load to keep these plants at their minimum operating limits. RPS, especially wind, will be placing additional off peak power on the system, making the problem worse. If a steam plant is shut down, it will then not be available for the next days' peak hours. Dynamic Pricing can solve this problem by sending very low prices during off peak hours to all the large C&I customers.

If all large C&I customers have Dynamic Pricing Blocks structured as TOU rates, the annual peak demand will be reduced. This TOU rate structure can be both daily, weekdays/weekends and seasonal. The price signals are not nearly as severe as either VOLL or supercritical RA prices. TOU rates should be based on the time differentiated prices of the wholesale electric market, as these will be the best societal estimates of regional economy dispatch costs. Transmission planners can take these long-term gradual changes in demand and incorporate them into their load forecasting process.

Resource Adequacy Super Critical Peak Prices should be based on the value of a peaking turbine. This is added onto the wholesale market peak hour energy cost which is the basis of a TOU peak hour block. The cost of a peaking turbine ranges from $65,000 - $80,000 MW-year. The kWh price will be based on the number of hours that the block will need to be triggered per year to adequately cover the system peak. RA Super Critical Peak Prices can be triggered the day-ahead or intra day like VOLL pricing. This pricing part of the structure should be considered as part of annual demand reductions like TOU rates, whereas VOLL should be treated as a reduction in RA levels (for example having a RA level go from 12 percent to 7 percent).

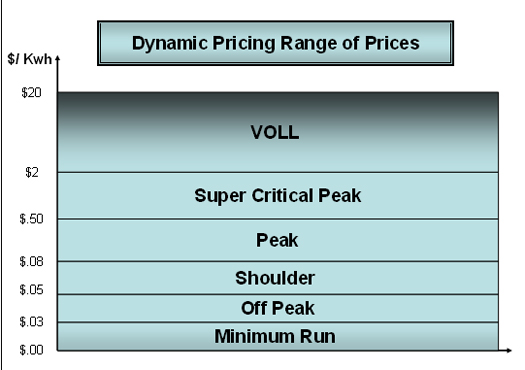

Actual Dynamic Pricing components will be dependent on the transmission area and the electric distribution utility specific cost structure. To help understand their spectrum I have produced Figure 2 as estimated ranges.

Figure 2

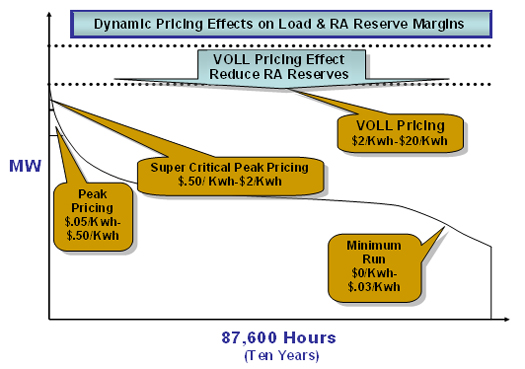

The setting and administration of these rate components should be done to find a lower cost solution to a generation-based supply option. While the range of VOLL could be as high as $250/kWh, the goal is to set the rate as low as possible. In transmission control areas that have large surpluses of RA reserves, the VOLL should be zero. Figure 3 is an overlay of these prices with Figure 1 to help understand the prices and the transmission reliability problems they are trying to solve.

Figure 3

I believe that the other part of a large scale expansion of DR is to foster a market that is both large and relatively homogeneous so that DR Service Providers, such as EnerNOC, Comverge and Energy Curtailment Specialists, Inc. can economically expand to all areas of the United States with efficient market approaches and solutions. Large C&I customer DR capability is highly diverse, and target segmentation and market approaches can improve efficiency. I will review in a future article how DR Service Providers can bring these economic efficiencies to the customer's facilities in this process. Residential and small commercial customers also have the ability to solve the RPS reliability problem. I believe that those incentive programs will look entirely different than the Large C&I segment and I will identify successful drivers for that customer segment in future articles.

UtiliPoint's IssueAlert(SM) articles are compiled based on the independent analysis of UtiliPoint consultants. The opinions expressed in UtiliPoint's IssueAlert articles are not intended to predict financial performance of companies discussed, or to be the basis for investment decisions of any kind. UtiliPoint's sole purpose in publishing its IssueAlert articles is to offer an independent perspective regarding the key events occurring in the energy industry, based on its long-standing reputation as an expert on energy issues. © 2004, UtiliPoint International, Inc. All rights reserved.

To subscribe or visit go to: http://www.riskcenter.com