The Growing Risk of US Ethanol Fuel Program to the Global Economy

Location: New York

Author:

Ed Kim

Date: Wednesday, March 26, 2008

Overview Of The U.S. Ethanol Generation Program

Let’s start off with the USDA’s briefing on Corn, as of February 2008:

”Corn is the most widely produced feed grain in the United States, accounting for more than 90 percent of total value and production of feed grains. Around 80 million acres of land are planted to corn... Most of the crop is used as the main energy ingredient in livestock feed. Corn is also processed into a multitude of food and industrial products including starch, sweeteners, corn oil, beverage and industrial alcohol, and fuel ethanol. The United States is a major player in the world corn trade market, with approximately 20 percent of the corn crop exported to other countries.”

In 2007, the U.S. produced

13,073.89 million bushels of corn. Add in the beginning stock of corn of

1,303.65 million bushels and 2.18 million bushels of imported corn, we had

approximately 14,379.72 million bushels of corn in 2007. Currently, U.S.

makes up 40% of the total global harvest of corn and contributes 70% of the

world’s corn exports, making it a major source of corn to the world food

economy[i].

Therefore, what our E85 generation program will have a substantial global

affect.

Making Ethanol

It takes 1 bushel, or 56 pounds of corn,

to make 2.5 gallons of ethanol, according to Shell. Converting all

available corn as of 2007 into ethanol using the Shell’s data, we arrive at

a theoretic maximum total of 35.95 billion gallons of ethanol that the U.S.

can produce. According to the USDA May 2007 newsletter “Amber Waves”, our annual ethanol production capacity as of February

2007 was 5.6 billion gallons. It further states that current construction

and expansion will add additional 6.2 billion gallons by 2011. If the

projected ethanol production figures from the USDA is correct, we will need

to add an additional 3.2 billion bushels of corn (4.7 billion bushels to

produce 11.8 billion gallons of ethanol less 1.5 billion bushels allocated

to ethanol production in 2007), or 22.4% increase in the current corn

supply, by 2011 to achieve 11 billion gallons of ethanol. Simple economic

tells us that as demand for corn goes up, in this case by expected 3.2

billion bushels by 2011, the prices of corn will go up until supply catches

up. So, until that occurs, we should expect to see the prices of livestock

feed and

all product that uses corn and corn by-products to go up, globally.

Risk of Severely Destabilizing Global Economy[ii]

Since U.S. corn export accounts for approximately 70% of world’s corn

exports, any change in corn exports will reverberate throughout the world.

Therefore, there is a growing risk of destabilizing the global economy, if

we are not careful with the expansion of the current ethanol production. USA

Today states this risk very clearly in its

February 11 article:

”Pakistan is stockpiling wheat and using its military to guard flour mills. Indonesian consumers have taken to the streets to protest rising soy prices. Malaysia no longer lets people take sugar, flour or cooking oil out of the country. North Dakota, the top U.S. wheat-producing state, may import from Canada due to tight supplies.”

As the supply of grain continues to lag the growing demand, Countries will stockpile to ensure they will have sufficient supply to feed their population:

”Grains make up around 60% of the diet in low-income Asian nations, North Africa and the former Soviet republics. Vegetable oil is about 12% of the diet in Sub-Saharan Africa and about 10% in some Asian and Latin American countries, according to the U.S. Agriculture Department. The vegetable oil share of diets is growing as more processed foods are available in low-income countries. People in developing countries are also starting to eat more meat, and that drives up demand for grains. It takes about eight times as much corn to produce the same number of calories from meat as from bread, says Homi Kharas, senior fellow at the Brookings Institution.”

Many revolutions throughout history have their genesis on the shortage of food staples at a reasonable price. Our American Revolution was based on what we saw as unfair taxes being levied on food staples such as tea and sugar. Therefore, the rising grain prices throughout the world will have a destabilizing effect on the global economy[iii].

- Thousands marched in Mexico City in late January to protest the increase in the price of corn tortillas, which had soared 400%.

- Argentina sharply limited beef exports last year to fight food price inflation.

- Police arrested 56 protesters in Malaysia this month during demonstrations against rising food prices.

USDA itself published a study on food supply that

concludes that “The combination of rising energy prices, use of feed crops

for biofuel, greater world food demand, and stagnant food aid may undermine

the food security of low-income countries.” In sum, as with anything so

sacrosanct and basic as food, the higher food costs are manifesting itself

as a major political issue around the globe. This has increased the

potential for severely destabilizing the global economy.

Risk Of Severely Increasing The Cost Of All Basic Goods In the Global

Economy[iv]

The rising grain prices driven by increased global demand combined with

diversion of grain to fuel production is causing tremendous stress on the

global economy:

“Those hit hardest by the soaring price of food are those who were

already struggling to afford it. "You have people who could get along with

bread at 30 cents, but not at 65," says Nancy Roman, the World Food

Programme's communications and policy director. Food prices have risen so

rapidly, Roman says, that the WFP will need $520 million more to provide the

amount of food they had budgeted for this summer. They have saved some costs

by buying food locally rather than importing it from abroad, Roman says.

That saves transportation costs, and helps local farmers, too. Still, she

says, "At some point, you're out of tricks.

In China, inflation may hit a 10-year high, thanks to higher food prices.

Costs in Singapore are rising faster than at any time in the past 30 years,

according to Merrill Lynch. "A lot depends on how countries with large

resources like the U.S. or EU or Brazil, how they invest and how they

proceed with this biofuels initiative and how much extra land they will

bring in," says Shahla Shapouri, a senior economist at the USDA. "Low-income

countries are basically price takers; they are not movers and shakers."

For developing countries, the rising costs of staple grains have had a

tremendous negative effect on their economy as The Food and Agriculture

Organization of the United Nations (FAO) estimated that cost to import food

has been increasing steadily since 2000 but the rise in cost accelerated in

the last few years, most recently resulting in an estimated increase of 25%

from 2006 to 2007[v].

Prices in the U.S. has been rising as well, especially corn, as a direct

result of ethanol production. The

June 2007 report by the Michigan Corn Growers Association notes that

corn prices had increased 97% since 2006, while other commodities during the

same time actually dropped:

“The incremental impact of higher input costs, including corn, will be to increase the consumer rate of inflation by 9-15% (3-5% annually) during 2007-09. Assuming food inflation would have been 3% without the increase in corn prices, this implies a food inflation rate of 6-8% during 2007-09. The study suggests the greatest inflation for consumers would be in meat, poultry, fish and eggs. Inflation for these items could be, on average, 4 to 11 percent higher annually than without the rise in corn prices. If the higher price of corn is maintained, the increased cost will be passed on to consumers. …For example, $1.00 worth of food in 2006 would likely cost $1.03 in 2007 absent of the rise in corn prices. With the increase in corn prices, $1.00 worth of food in 2006 might cost the consumer $1.06-1.08 in 2007.”

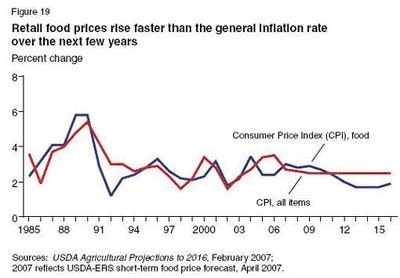

Overall, the food prices in the U.S. is expected to inflate at a higher

rate than the general inflation rate for the next seven years due to the

growing use of corn for ethanol production[vi].

Conclusion

While the desire to wean ourselves away from foreign oil is a noble purpose,

one that I applaud, the execution of the desire has severe risk consequences

that will affect the global economy and socio-political landscapes. As more

countries include grain and meat into their diet, supply of these food

staples has not be able to catch up with the rapidly increasing demand. This

has caused inflationary pressures in countries around the globe, leading to

civil unrest and governments taking drastic measures such as guarding their

grain storage with their military.

USDA’s own projection also indicates that the U.S. is not spared the

consequences of rising grain prices. In its report “Ethanol

Expansion in the United States -- How Will the Agricultural Sector Adjust?”

USDA clearly notes the destabilizing risks of increased use of corn for

ethanol production:

- “Soybeans compete most directly with corn and on the largest amount of land. Thus, much of the expansion in corn plantings comes from soybeans, and soybean plantings and production decline.”

- “Reduced production and higher prices for soybeans also bring higher prices for both soybean meal and soybean oil.”

- ”In response to higher corn prices, red meat production declines and growth in poultry output slows in the United States, particularly during the next several years as ethanol production ramps up.”

- “With reduced production, prices for meats at both the producer and retail level rise…”

- ” As a result, consumer prices for red meats, poultry, and eggs are expected to exceed the general inflation rate in 2008-10. Consequently, overall retail food prices in USDA’s 2007 long-term projections rise faster than the general inflation rate for several years.”

It is going to be interesting to see how this will play out. Stay tuned for updates on this topic.

[i]

http://www.earth-policy.org/Updates/2007/Update63.htm

[ii]

http://www.usatoday.com/money/industries/food/2008-02-11-food-prices_N.htm

[iii]

http://www.usatoday.com/money/industries/food/2008-02-11-food-prices_N.htm

[iv]

http://www.usatoday.com/money/industries/food/2008-02-11-food-prices_N.htm

[v]

http://www.ers.usda.gov/AmberWaves/February08/Features/RisingFood.htm

[vi]

http://www.ers.usda.gov/Publications/FDS/2007/05May/FDS07D01/fds07D01.pdf

Source: riskyops.blogspot.com