Venture Capital - Some Revealing Facts

Location: Tokyo

Author:

Walter Kurtz

Date: Friday, August 7, 2009

Deloitte recently published their "Global trends in venture capital 2009 global report", a survey of venture capital firms. Here is a quote that sets the stage:

In short, the tourists have left, explained Mark Heesen, president of the NVCA. “Young entrepreneurs who thought they could get rich quickly with just a good idea are now gone and those now left standing recognize the challenges and tenacity needed to establish and build a sustainable business,” he said. “Those out on the hustings trying to get funded are much more astute about the globalization of the economy and worldwide competition. They understand that the value of their company today is not what it will be six months from now and that if they want to be funded, it will likely be at a lower valuation than in the past.”

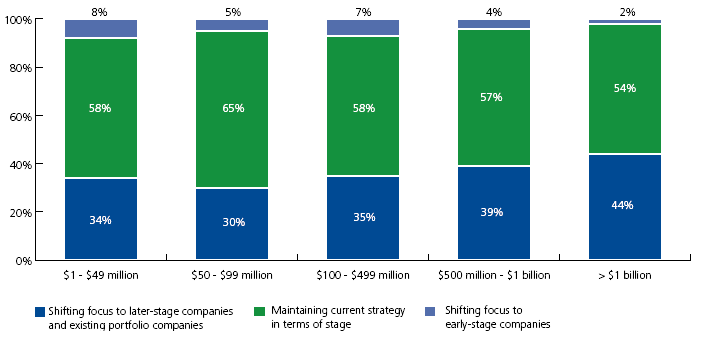

With depressed valuations on established firms, early stage venture is

completely out of favor.

Semiconductor companies are out of favor and "clean technology" is in.

![]()

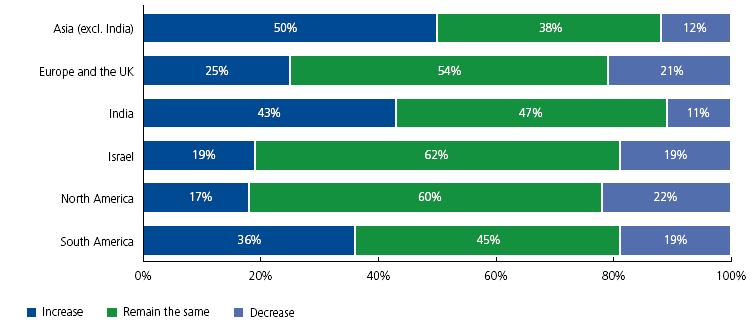

Asian firms will be getting an increased allocation.

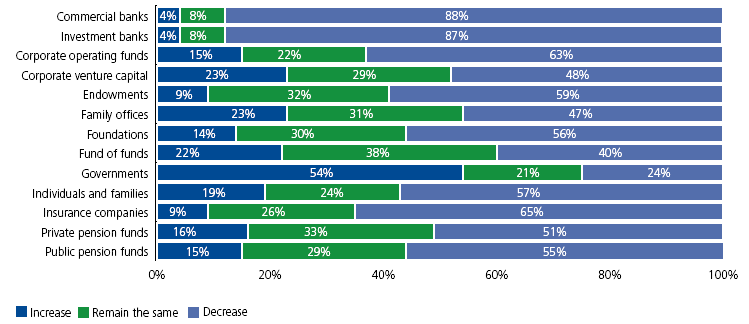

The only investor allocation increases are expected to come from

governments. Everyone else's VC allocations are expected to shrink. Not

surprising.

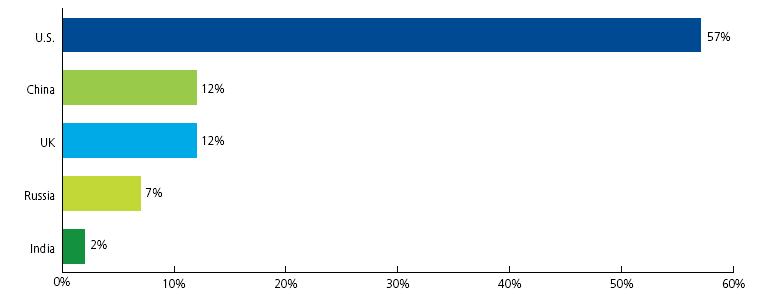

When asked "Top five locations viewed as having the most to lose

in terms of overall economic stature, over the next three

years", this is the response.

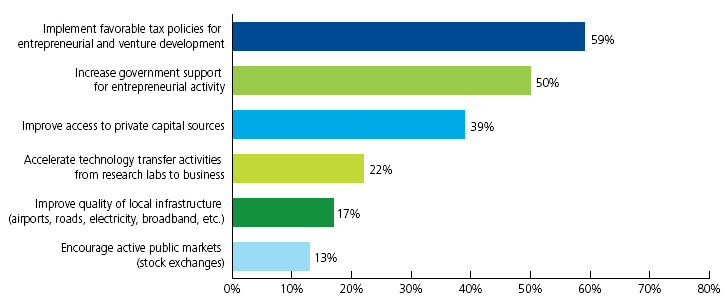

When asked what governments can do to stimulate innovation, guess what

pops up on top. Taxes: it's a sure way to either stimulate or hurt small

business.

The overall issue with the VC industry is the length of time to

monetization, which has been increasing. LPs just don't have the stomach

to wait 10 years for the portfolio companies to be monetized. With the

entrance of secondary investment funds, who buy firms from other VCs,

the time to monetize a good investment may shorten. Here is a bit of

background on this from

Business Week:

Longer waits are bad not just for the VC calculating the return on

investment (ROI). They also result in impatience on the part of limited

partners such as university endowments that invest in venture firms.

It's also demoralizing for individual venture capitalists. There are

many well-regarded VC partners that have never had an exit. Some venture

capitalists are leaving the profession altogether and firms are

shrinking.

Here's where secondary VCs can play a vital role. These firms, most of

which did not exist 10 years ago, specialize in buying stakes in private

companies from VC firms. Some examples include Saints Ventures and W

Capital Partners, which are among the most successful firms this decade.

Secondary firms now account for roughly 3% of the VC market, but their

clout is increasing as they do more deals. San Francisco-based Saints

now has more A-list portfolio companies than most traditional VC firms.

Its investments include Facebook, eHarmony, and QuinStreet.

To subscribe or visit go to: http://www.riskcenter.com