First Deterioration in Corporate Credit Quality in 8 Months

Location: New York

Author:

Warren A. Sherman

Date: Wednesday, December 2, 2009

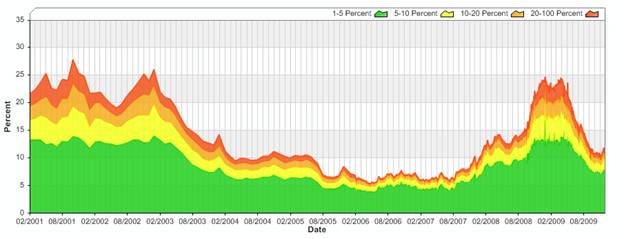

Kamakura Corporation announced yesterday that the Kamakura index of troubled public companies increased in November for the first time in the last 8 months. The index jumped from 10.68% in October to 11.45% in November. Kamakura’s index had reached a peak of 24.3% in March. Kamakura defines a troubled company as a company whose short term default probability is in excess of 1%. Even after the increase, credit conditions are now better than credit conditions in 58.5 percent of the months since the index’s initiation in January 1990, and 2.25 percentage points better than the index’s historical average of 13.7%. The all-time low in the index was 5.4%, recorded in April and May, 2006, while the all-time high in the index was 28.0%, recorded in September 2001. The index is based on default probabilities for almost 27,000 companies in 30 countries.

In November, the percentage of the global corporate universe with default probabilities between 1% and 5% decreased by 0.26 percentage points to 7.63%. The percentage of companies with default probabilities between 5% and 10% was up 0.24 percentage points to 1.85%. The percentage of the universe with default probabilities between 10 and 20% was up 0.08 percentage points to 1.09% of the universe, while the percentage of companies with default probabilities over 20% was up by 0.17 percentage points to 0.88% of the total universe in November.

Kamakura’s President Warren A. Sherman said Tuesday, “It is too early to tell whether the strong recent improvements in credit quality we’ve seen recently have come to an end. The increase in the troubled company index in November was a significant one that we are updating daily at the request of clients on www.twitter.com/dvandeventer. The rated firms showing the largest increase in short run default risk in November included YRC Worldwide, U.S. Concrete, Ambac Financial Group, Bank of Ireland, Allied Irish Banks, and Citadel Broadcasting. Ambac and Citadel Broadcasting also were among the biggest increases in credit risk last month also, along with CIT which defaulted the next day after the index was reported.“

To subscribe or visit go to: http://www.riskcenter.com