Is Natural Gas Cheap?

Jul. 22, 2009

At the height of its late 2005 rally, natural gas in the U.S. was selling

for just over $16/ MMBtu , 350% higher than today’s price of $3.56. The

oil/gas ratio, now over 18, is an all-time high… suggesting that natural gas

is dirt cheap. So, it’s a buy, right?

In a phrase, not exactly.

According to a recent report by Natural Gas Intelligence, U.S. natural gas

available for production “has jumped 58% in the past four years, driven by

improved drilling techniques and the discovery of huge shale fields in

Texas, Louisiana, Arkansas and Pennsylvania, according to a report issued

Thursday by the nonprofit Potential Gas Committee (PGC).”

According to the report, the increase in gas discoveries and production

improvements means that North America shouldn’t have to be concerned about

gas supplies for up to 100 years!

Dr. Marc Bustin provided an overview of the situation in

the May edition of Casey Energy Opportunities.

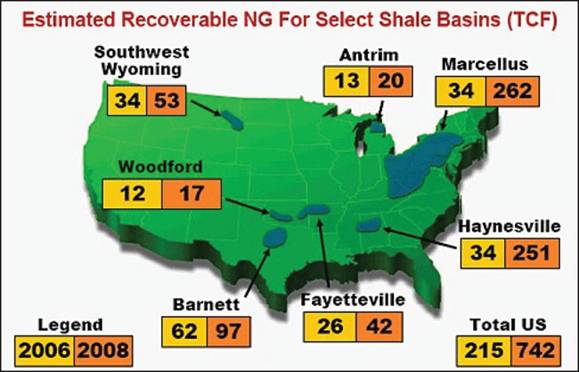

In the United States, the tremendous growth in natural gas resources and

estimated recoverable natural gas, particularly from gas shales, just in the

last two years (Figure 1) is sending tremors through the entire industry.

These tremors include the risk of making obsolete the proposed $26 billion

Alaskan and $16 billion northern Canadian pipelines to tap northern gas

resources and a slue of proposed LNG terminals... unless they are for

export!

The numbers currently kicked around are that something around 2,000 trillion

cubic feet of gas are technically recoverable in the United States. At

current production rates, this supply would last about 90 years.

Some analysts are predicting that even if the U.S. economy recovers in the

next year, the amount of gas discovered to date in gas shales will severely

dampen any increase in gas price for some time. According to a new study by

energy consulting firm CERA ( Cambridge Energy Research Associates), new

technologies for unconventional gas fields are being applied so successfully

that supply is essentially no longer a driver in either production or price

in the North American gas market – whatever the market wants, North American

gas fields can supply. CERA reports that natural gas production in the Lower

48 states has risen a startling 14% from 2007 to 2008, for example.

Figure 1. Major shale areas or formations in the U.S. and the estimated

recoverable natural gas in 2006 and 2008. Modified from Daily Oil Bulletin

(May 4, 2009).

Given the increase in production and the small slide in demand, the price of

natural gas has fallen to around $3.50-$4.00 per MMBtu (down from $13 per

MMBtu last summer). At these prices, many gas prospects are uneconomic, and

thus there has been a marked decline in the number of wells being drilled.

Rig activity (how many rigs are operating) is down about 50% in North

America.

But here is where an interesting feedback mechanism kicks in. One of the

characteristics of unconventional shale gas wells, and to a lesser extent

natural gas wells in general, is that the production rate declines through

time. Most shale wells’ production rates decline 60 to 90% in the first

year. If you were a gas company trying to survive amidst today's low prices,

the rate of return on your capital investment would also be painfully low

for a significant amount of gas if this were your initial year of

production.

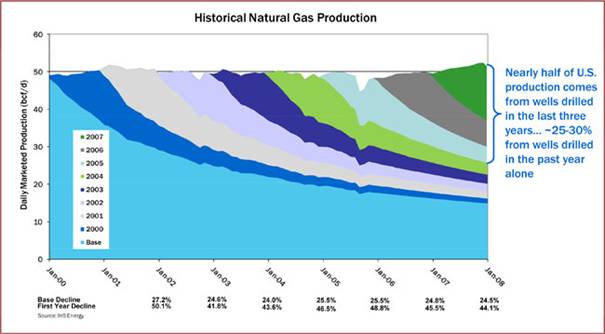

Another complementary fact is that over 50% of natural gas consumed in the

United States today is from wells drilled less than three years ago, and

25-30% of the gas produced today comes from wells drilled last year (Figure

2).

Hence it follows that if there are 50% fewer wells drilled this year (from

the drop in rig activity), new production will decline about 35-40% by the

end of the year, so there will be gas shortages. Those will in turn lead to

higher North American prices, which in turn should lead to additional

drilling.

Figure 2. Historical gas production in the U.S. showing the percentage of

production from vintage of well (modified from Chesapeake April 2009

Investor presentation from original data of HIS Energy)

Everything else being equal (which it's not, this being the real, not the

mathematical world), gas prices and drilling will see-saw until an

equilibrium is reached. In detail, of course, things are more complicated,

but it is pretty clear that gas prices will have to rise within the year,

and the big losers will remain the more expensive plays that require higher

gas prices to be economic.

Where will the gas price end up in the short term? A poll of analysts by

Reuters suggests $6 MMBtu in 2010 (Daily Oil Bulletin, May 4, 2009), but I

don’t think I would bet on a gas price based on a vote by analysts. At the

same time, it's an interesting coincidence (or not – coincidence, that is)

that many prospects become economic at around the $6 MMBtu range. Among them

are the Haynesville and Marcellus shales – and it's no large leap from there

to see their tremendous gas production potential acting as a buffer to gas

prices going much higher in the near term.

Thus, while there may be some seasonal and relatively short-term trading

opportunities in natural gas, the overhang of ready supply places a fairly

firm cap on the price. Which begs the question, which big-trend energy

opportunities should be getting our attention today?

Marin Katusa , who heads the Casey Research energy team, answers the

question by, correctly, cataloging the opportunities according to geography.

In North America

1. Geothermal -- the most interesting of the alternative energy sources, by

a wide margin.

2. Nuclear.

3. Oil.

In Europe

1. Unconventional gas has, by far, the most upside.

2. Unconventional oil.

3. Small hydro (such as run of river).

In Africa

First and foremost, you want to avoid infrastructure plays (pipelines,

refineries, etc). Then you want to look for areas with huge oil potential,

which have been held off the market by concerns over political risk. I like

what Lukas Lundin is doing in Ethiopia, Somalia, and Kenya, hunting for

“elephants” with the idea of eventually selling the discoveries off to the

Chinese.

In Asia,

1. Liquid Natural Gas (LNG)

2. Coal Bed Methane (CBM)

Lessons to Learn

There are a couple of useful lessons to be derived by investors looking to

tap into the virtually unlimited opportunities in energy.

First, just because something is “cheap” doesn’t mean it can’t stay cheap,

regardless of historical ratios -- if there has been a fundamental shift in

the supply/demand equation. Which is very much the case with North American

natural gas.

Secondly, geological and transport considerations make much of the energy

complex a “local” market.

For example, while North America enjoys an abundance of natural gas, Europe

is forced to rely on the heavy-handed Russians for the bulk of supplies. As

you read this, there are companies looking to break the Russian grip by

applying the same unconventional gas technologies that have so successfully

built gas supplies in the U.S. -- technologies that are only just now being

applied in Europe. Early investors could reap huge profits.

In short, the real opportunities are not found by simply “investing in

energy” but rather by taking the time to understand the structural

differences within the energy complex and cherry picking the special

situations that invariably exist in a sector this large.

David Galland

Casey Research

David Galland is the managing director of Casey Research,

LLC., a private research firm providing independent analysis and investment

recommendations to individual and institutional investors in North America

and over 100 other countries around the globe. To learn more about the

monthly Casey Energy Opportunities advisory, including a

special

three-month, fully guaranteed trial subscription, click here now.