Date: 09-Jul-09

Country: US

Author: Scott Malone - Analysis

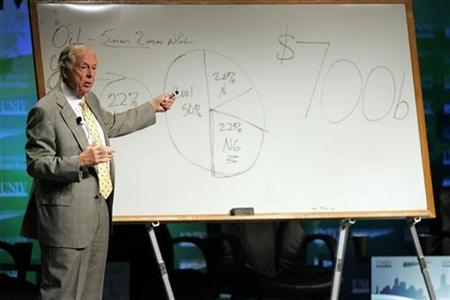

Pickens's Pullback Could Signal Shift In The Wind Photo: Las Vegas Sun/ Steve Marcus

Chairman of BP Capital Management T. Boone Pickens explains

his energy policy plan during the National Clean Energy Summit at the

University of Nevada, Las Vegas August 19, 2008.

Photo: Las Vegas Sun/ Steve Marcus

BOSTON - Oil billionaire T. Boone Pickens's step back from his plan to build

the world's largest wind farm in Texas shows how a brutal recession could

change the way the United States invests in renewable energy.

The economy has changed drastically since the tycoon last year called for

the United States to cut back on its oil imports in the face of record-high

prices and said he planned to invest $10 billion in wind power.

With credit costlier and harder to come by, and oil and natural gas prices

down sharply over the past year, the nation's nascent wind industry may

begin to focus on smaller projects that are closer to major population

centers rather than massive developments like 81-year-old Pickens

envisioned, industry officials said.

"You've got an industry that is kind of hanging on by its fingernails," said

Denise Bode, chief executive of the American Wind Energy Association.

Developers last year invested $17 billion in new U.S. wind capacity,

according to the AWEA, enough to generate 8,545 megawatts of electricity,

which has the potential to meet the needs of 6.8 million typical American

homes.

The group estimated that at least 5,000 megawatts of new wind capacity would

be built this year, meaning the amount of new wind development in the United

States could decline for the first time since 2004, when the expiration of a

tax credit caused a sharp drop in the number of new turbines installed.

Construction has ground to a near halt as developers wait for the Obama

administration -- which has said green jobs and alternative energy will be a

key part of its $787 billion stimulus package -- to deliver on promises that

include allowing companies who build wind farms to collect tax credits

quickly, Bode said.

The industry is also hoping for a national renewable energy standard and

more focus on building transmission lines to connect the isolated

Southwestern communities where many wind farms are being built to major

population centers where power is needed.

TRANSMISSION TROUBLES

Pickens, who spent about $58 million promoting his "Pickens Plan" on

television and in newspapers last year, said both troubles in the credit

market and access to transmission lines would push back his plans in wind.

"The capital markets have dealt us all a setback and I'm less aggressive

with the Panhandle project than I have been," Pickens said in a statement.

"Transmission issues and the problem with the capital markets make that

unfeasible at this point."

He still expects to develop the wind farm eventually, and said he would take

delivery of the 667 electricity-producing General Electric Co wind turbines

he had ordered. He aims to use those turbines in smaller projects.

Some in the industry argue that the easiest way to overcome the transmission

challenge is to locate wind farms closer to major population centers --

namely, along the coasts.

"If you look at the 28 coastal states, they consume over 73 percent of the

electricity in the United States," said Jim Gordon, president of Cape Wind,

which plans to build a $1 billion, 130-turbine wind farm off the coast of

Massachusetts' Cape Cod resort area, near Boston.

"We have this vast offshore wind resource right next to these coastal

states," Gordon said. "If you're building a wind farm in Texas and then

investing in the billions of dollars of transmission line to bring it to the

East Coast ... It just seems to me to make more sense to harness the

offshore wind right next to these big demand centers."

Pickens's move also reflects a drop in U.S. demand for electricity due to

the recession.

"Electricity demand is down generally so in addition to his reconsidering

the pace of his plans, you are also seeing slowdowns in the deployment of

technology for generation whether it's (natural) gas, coal or nuclear," said

Christine Tezak, an analyst at Robert W. Baird and Co.

A key question facing the industry is how much focus will remain on

developing alternative energy sources now that conventional energy prices

have eased from last year's record highs. When Pickens unveiled his plan

last year, he predicted oil would never again trade for less than $100 a

barrel.

It surged to $147 last summer, but has since pulled back to about $60. Some

in the industry argue they expect energy prices to continue to rise when the

recession ends, which would continue to stimulate demand for alternatives.

"While it's way down from its peak, gas and oil is still way up over the

past several years," said Scott Sklar, president of Stella Group Ltd, a

Washington D.C.-based energy consultancy. "China and India are still growing

and this really is a supply and demand issue ... no one sees energy prices,

whether it's oil, gas or electricity, go lower."

(Editing by Tim Dobbyn)

© Thomson Reuters 2009 All rights reserved