The Reserve and the SEC, the Saga of Money Market Funds

Location: Tokyo

Author:

Walter Kurtz

Date: Tuesday, July 28, 2009

In September of 2008 about $300 billion of cash has been withdrawn from US money markets funds. This was the direct result of the events at The Reserve fund. The Reserve broke the buck due to their excessive holdings of Lehman's commercial paper. Bruce Bent, the owner of the oldest money market fund believed the government will not let Lehman go. His claim to fame was that he avoided asset backed commercial paper in 07 - he was a hero in the press. However, with money markets being his only business, he wanted to compete on yield and juiced up returns by loading up on short term debt of financial firms (mostly banks). In fact nearly 100% of the Reserve's Primary Fund were in financials.

After the Lehman default, redemptions from The Reserve (who had both corporate and individual accounts) were so massive, that the SEC had to step in and freeze further withdrawals. One of Putnam's funds also broke the buck shortly after that.

Here is an update from the SEC on The Reserve:

The SEC charged several entities and individuals who operate the Reserve Primary Fund in an enforcement action on May 5, 2009, and is seeking to return the fund's remaining assets to investors expeditiously on a pro rata basis.

The Reserve Primary Fund "broke the buck" last September when its net asset value fell below $1 per share. Since then, the fund has withheld a significant amount of money from investors pending the outcome of numerous lawsuits filed against the fund, its trustees, and other officers and directors of the Reserve entities.

The Reserve has been returning funds as portfolio holdings mature. Other

than Lehman, which was 3-7% of the fund (more than one of their funds had

exposure), The Reserve had not experienced further credit events. So you

would think they should be able to figure out the fund's NAV by now to let

people know what their holdings are worth. They haven't:

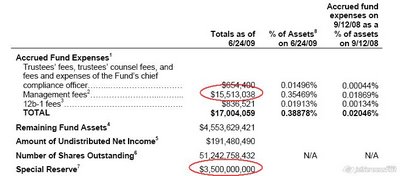

People still have no idea what the value is of their trapped funds. Also

it's quite amazing that they are charging fees:

The fund has set aside a "special reserve" of $3.5 billion to deal with all

the law suits. That's some nice attorney fees:

Pursuant to the Plan of Liquidation and the Fundís governing documents, the Board of Trustees created the Special Reserve, which will be used to satisfy (a) anticipated costs and expenses of the Fund, including legal and accounting fees; (b) pending or threatened claims against the Fund, its officers and Trustees; and (c) claims, including but not limited to claims for indemnification, that could be made against Fund assets.

Now the SEC is moving in with their regulation proposals, some of which make sense while others rely on the rating agencies. From the SEC:

The proposed amendments would, among other things:

* Require that money market funds have certain minimum percentages of their

assets in cash or securities that can be readily converted to cash, to pay

redeeming investors.

* Shorten the weighted average maturity limits for money market fund

portfolios (from 90 days to 60 days). <=== not clear if this helps with

anything other than a run on the fund. A portion a 90 days should be fine.

* Limit money market funds to investing in only the highest quality

securities (i.e., eliminate their ability to invest in so-called "Second

Tier" securities). <=== this would not have helped The Reserve. Lehman

paper was "highly rated" by the rating agencies.

* Require funds to stress test fund portfolios periodically to determine

whether the fund can withstand market turbulence.

The proposals also would:

* Require money market funds to report their portfolio holdings monthly to

the Commission and post them on their Web sites.

* Require funds to be able to process purchases and redemptions at a price

other than $1.

* Permit a money market fund that has "broken the buck" and decided to

liquidate to suspend redemptions while the fund undertakes an orderly

liquidation of assets.

Here is a talk from the SEC's Schapiro on the topic. We definitely need action on money market funds, if anything just for the sake of confidence. One can't have confidence in other asset classes if the stability of cash itself is in question. As we discussed earlier, the key is to make sure the SEC doesn't make things worse.