Fossil Fuel Subsidies More Than Double Those for Renewables

The largest U.S subsidies to fossil fuels are attributed to tax breaks that aid foreign oil production, according to research from the Environmental Law Institute (ELI). The study, which reviewed fossil fuel and energy subsidies for Fiscal Years 2002-2008, revealed that the lion's share of energy subsidies supported energy sources that emit high levels of greenhouse gases.

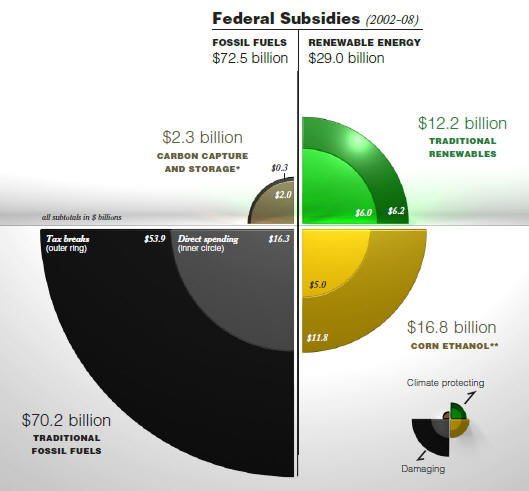

More than half the subsidies for renewables—$16.8 billion—are attributable to corn-based ethanol. Of the fossil fuel subsidies, $70.2 billion went to traditional sources—such as coal and oil—and $2.3 billion went to carbon capture and storage.

“The combination of subsidies—or ‘perverse incentives’— to develop fossil fuel energy sources, and a lack of sufficient incentives to develop renewable energy and promote energy efficiency, distorts energy policy in ways that have helped cause, and continue to exacerbate, our climate change problem,” said John Pendergrass, ELI senior attorney. “With climate change and energy legislation pending on Capitol Hill, our research suggests that more attention needs to be given to the existing perverse incentives for ‘dirty’ fuels in the U.S. Tax Code.”

The subsidies examined fall into two categories: foregone revenues, mostly in the form of tax breaks and direct spending, in the form of expenditures on research and development and other programs.

ELI researchers applied the conventional definitions of fossil fuels and renewable energy. Fossil fuels include petroleum and its byproducts, natural gas, and coal products, while renewable fuels include wind, solar, biofuels and biomass, hydropower, and geothermal energy production.

To subscribe or visit go to:

http://www.renewableenergyaccess.com

To subscribe or visit go to:

http://www.renewableenergyaccess.com