How to Compare Power Generation Choices

Understanding a few basic factors will help make an informed

comparison.

by John Hynes, Partner, Excidian

People like to compare the cost to generate electricity from various

renewable resources, like wind or solar, to the cost to generate

electricity from coal, nuclear and natural gas. Comparing these costs is

like comparing apples to oranges. Power generation is a complex business

and without considering load factor; capacity (kW) and energy (kWh); and

fixed and variable costs, these comparisons are not legitimate for

evaluating power generation technologies.

Let’s begin with load factor, or the percentage of hours that a power

plant operates at its maximum capability in a given time period. So if a

1,000 MW nuclear plant has an annual load factor of 98 percent, it is

operating at 1,000 MW for 98 percent of the hours in a year.

Power plants can be categorized by load factor. Base load power plants

typically have annual load factors that exceed 75 percent, but usually

are more like 90 percent to 98 percent. Power plants that fall into this

category can be large (400 MW and larger) fossil fueled plants (coal,

natural gas or–less often–fuel oil) as well as nuclear plants. On the

renewable resource side, geothermal and biomass plants can be placed in

this category. Not many hydro plants in the U. S. fall into this

category unless the dam is large or the flow rate on the river is high

and the weather cooperates.

Intermediate loaded power plants typically have annual load factors

ranging from 40 percent to 60 percent Small (100 MW to 300 MW) coal

plants may operate at these load factors. However, the most common

technology that would operate economically in this load factor category

is the combined cycle combustion turbine, or CCT, fueled by natural gas

with fuel oil as a back up fuel. Most of the hydroelectric plants in the

Western part of the U.S. can operate as intermediate loaded plants,

providing that the weather cooperates, which means that the western

mountain ranges receive an above-average amount of snow during the

winter months. Offshore wind power will also likely operate in this

category. Concentrated solar power, or thermal solar, may break into the

low end (40 percent) of this load factor range as will wave energy

technology (30 percent to 45 percent).

The third load factor category is peak load generation. Power plants in

this category usually operate at very low annual load factors ranging

from 5 percent to 15 percent. This means these types of power plants are

operating at their maximum capability for only 5 percent to 15 percent

of the hours in a year. The most common type of power plant in this

category is the combustion turbine (CT) or simple cycle turbine (SC),

fueled by natural gas with fuel oil as a back up source of fuel. The

next most common type of power plant would be the internal combustion

engine (IC) fueled by natural gas. Renewable resources that would fall

into this category are wind on land, photovoltaic solar, concentrated

solar (thermal solar) and tidal current technology.

For wind on land, the average annual load factor ranges from 20 percent

to 30 percent. Photovoltaic solar has load factors that range from 20

percent to 25 percent. Concentrated solar load factors vary between 25

percent and 40 percent, allowing this resource to linger between a

peaking facility and an intermediate facility. The load factor for tidal

current technology is estimated to average 27 percent.

Now that all of the power generation resources are in an appropriate

load factor category, think of each category as a customer need. Then

think of the types of power generation technologies within a load factor

category as the various products that compete to satisfy that need. This

means it makes no sense to compare the cost per kWh to generate

electricity from wind on land with the costs per kWh to generate

electricity from coal because these two technologies satisfy two

different customer needs; namely, one is a peaking technology, while the

other is a base load technology.

Is there a way to compare technologies from two different load factor

categories? Yes, but one technology would need to be altered to make it

operationally equivalent to the other. In other words, alter one

technology so that both are then in the same load factor category. To do

this for wind on land versus coal, it would be necessary to run the coal

plant as a peaking unit, recalculate all of its costs and compare those

new costs to the wind on land power plant costs. The wind on land power

plant could also be altered to operate base loaded. However, before

trying these more complicated comparisons, it is necessary to understand

the concepts of capacity versus energy.

Capacity versus Energy

To learn how to compare technologies within a load factor category, one

has to understand a number of terms and concepts, like the difference

between capacity — measured in kilowatts (kW) or megawatts (MW) — and

energy, measured in kilowatts-hours (kWh) or megawatt-hours (MWh).

People often quote costs/kW when they are really talking about

costs/kWh. Since these sound similar, they must be similar.

Unfortunately, they are not.

Capacity for a power plant (kW or MW) is probably best explained with a

highway analogy. A 10-lane highway is able to allow more cars to get

from one point to another in a given time period when compared to a

three-lane highway. Likewise, a 1,000 MW power plant has the ability to

put more energy, or MWh, to the grid in a given time period than a 500

MW power plant. The size of the highway is analogous to the capacity, or

MW rating, of the power plant. The number of cars that pass from one

point to another on the highway during a given time period is analogous

to the energy, or MWh, that the power plant delivers during the same

time period.

So the more lanes on the highway, the more cars that can pass from one

point to another in one hour. Therefore, the larger the power plant’s

capacity, the more energy the plant can deliver to the grid in one hour.

Now that we understand the difference between capacity and energy, we

can begin to compare the costs of one power plant to another.

Initial Cost Comparison

The cost to build a power plant, or its capital cost, is usually

discussed in $/kW of capacity. When you hear that the latest estimate

for a brand new nuclear plant is $4,400/kW to $7,700/kW, this means the

cost to build a new 1,000 MW nuclear plant ranges from $4.4 billion

($4,400/kW x 1,000 MW x 1,000 kW/MW) to $7.7 billion ($7,700/kW x 1,000

MW x 1,000 kW/MW).

Note that this has nothing to do with the cost to operate or maintain

the plant. It is just the upfront cost to build the plant. This is a

quick way to compare which technology is the most expensive or least

expensive to build. In general, base load technologies will be more

expensive to build than intermediate load technologies, while

intermediate load technologies will be more expensive to build than

peaking technologies.

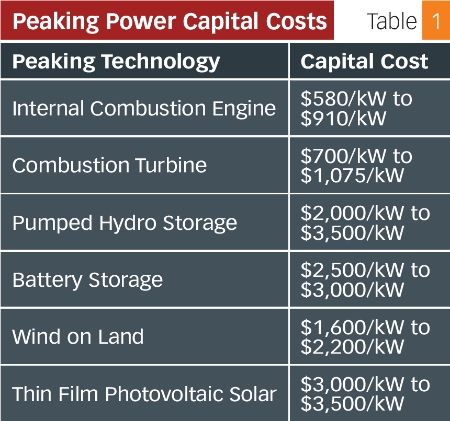

Suppose a utility has a 100 MW customer load that needs to be supplied,

but the load is only on the system for three hours a day. The utility

needs to build a power plant to supply this load. What should it choose?

First, determine the load factor. Load factor is: 3 hours/24 hours =

12.5 percent, which calls for a peaking power plant. Next, compare the

cost to build the various competing peaking power generation

technologies. The peaking options are laid out in Table 1 (above).

Perhaps the utility needs to know a little more about this load. At the

very least, the utility needs to answer the following questions:

* Does this load always run for three hours or can its duration vary?

* Does the load come on and go off at the same time each day?

* If “yes” to question # 2, then determine what time of day the load

runs?

Suppose the load duration does not vary (that is, the load turns on and

off at the same time each day) and that time is from 12:00 noon to 3:00

p.m. In this case, whatever technology the utility chooses has to be

capable of providing capacity and energy from 12:00 noon to 3:00 p.m.

each day.

If the utility narrows its choices for peaking options down to the three

least expensive technologies to install, then the concerns related to

those peaking technologies need to be addressed. These concerns are

summarized in Table 2.

After reviewing the options in Table 2, can the utility make a decision?

No. At least four concerns related to these technologies must to be

quantified and compared in a fair manner. Those four are: fuel costs,

pollution costs, operating and maintenance costs and capital costs. The

most objective way to compare these costs across technology choices

within a load factor category is to divide them by the output of the

power plant (kWh), or “per unitize” them.

Variable vs. Fixed Expenses

Before per unitizing these costs, the terms “variable” and “fixed” costs

need to be defined. A variable cost is an expense that varies with

revenue or the volume of sales. Be careful: most people revert to the

dictionary definition of variable and think it means that it is an

expense that varies with time. This is incorrect. In the financial

world, a variable expense varies with revenue or volume.

A fixed expense is an expense that does not vary with revenue or volume.

For every expense, you ask and answer a simple question: “If I produce

and sell one more kWh do I spend more money on this expense?” If the

answer is yes, then it is a variable expense. If the answer is no, then

it is a fixed expense.

Fuel costs are driven not only by the cost of the fuel that is being

converted to electricity, but also by the efficiency of the conversion

process. Fuel costs are truly variable costs. That is, these costs vary

directly with the kilowatt-hours (kWh) generated by the plant. When more

electricity is produced, more fuel is consumed.

Pollution costs are the cost to purchase pollution credits, like NOX and

SO2 credits. These are market based credits that are a function of the

tons of NOX or tons of SO2 that the plant emits. The amount of NOX or

SO2 that the plant emits is directly proportional to fuel consumed,

which is a variable cost. Therefore, pollution credit costs are also

variable costs.

O&M costs, on the other hand, are not generally considered to be

variable costs. The plant staff earns a base wage plus benefits that are

fixed. Overtime for increased production is an extremely small

contribution to variable costs; so small that it is usually disregarded.

Similarly, routine and overhaul maintenance are considered fixed costs.

Incremental plant operation, unless much more than typical, does not

alter the usual maintenance routine and intervals. Finally, many costs

associated with the plant, like insurance and property taxes, are fixed

and change only with variables outside the plant domain. Both of these

costs generally increase yearly with the inflation rate.

Cycling a plant from full output to lower output levels causes an

increase in wear and tear on the plant components. Although the money

spent on labor and material to operate and maintain the plant does not

change at the time the cycling occurs, the increase in wear and tear can

increase the frequency of future maintenance, thus causing an increase

in average O&M costs. Therefore, O&M costs do not usually increase with

each new kWh generated by the plant.

Although this seems like a minor point, it is financially crucial that

individuals making short-term pricing and running decisions for the

plant understand this concept. The financial implication is that

increasing the plant output by 10 percent when it is already running

does not increase the plant’s O&M costs significantly. Therefore, the

generation company can maximize profit by accepting a lower price for

the incremental kWh that the plant generates as long as the price the

company receives covers the plant’s increase in variable costs, which in

this case would be the plant’s increase in fuel costs and pollution

credit costs. In fact, a large portion of the incremental revenue that

the generation company realizes from the 10 percent increase in plant

output will be added right to profit if the plant’s incremental fuel

cost and pollution credit costs per kWh are small in comparison to the

incremental market price the company charges for the additional kWh.

A company experiences capital costs (namely depreciation and financing

costs for plant construction) with the passage of time. Whether the

plant produces one kWh or a million kWhs has no effect on the amount of

depreciation and interest costs the plant incurs. Therefore, capital

costs are also fixed costs. So, fuel and pollution credit costs are

variable costs, while O&M costs and capital costs are fixed costs.

Cost per kWh Comparison

Even though some of the cost categories discussed so far do not vary

directly with the kWh generated by the plant, it is useful from a

competitive analysis point of view to look at all plant costs (fuel,

pollution credit, O&M and capital) on a per kWh basis. This is easy to

do for fuel and pollution credit costs since they do vary directly with

the plant’s kWh output.

For O&M costs, however, take the total amount spent on O&M over a one-

to three-year period and divide that number by the kWh produced during

that time period. This will provide an average O&M cost per kWh.

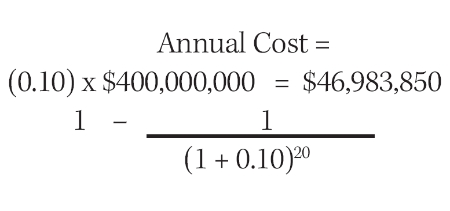

Obtaining the capital costs in a $/kWh form will require a few

assumptions.

Although equity requirements can be a large percentage of any project

today, for the ease of explanation let’s assume 100 percent project

financing (a form of bank financing). To obtain the capital costs in a

$/kWh form, we must annualize the total cost of the plant and then

divide that annual cost by an estimate of the average annual kWh that

the plant is expected to produce. The following formula is used to

calculate the annual cost of a plant.

Where n = number of years over which the plant is expected to be

financed.

Suppose a series of wind turbines total 200 MW of capacity. Assume these

wind plants cost $2,000/kW to install or $2,000/kW x 200 MW x 1,000

kW/MW = $400,000,000. Assuming an annual cost of financing of 10 percent

(or 0.10) and a loan term of 20 years, calculate the annual cost of this

wind farm using the formula above.

Next, estimate the average annual kWh output of the plant. A generous

estimate would be to assume that the plant would operate at an average

annual load factor of 30 percent over its life. This means it would be

running at rated capacity for 30 percent of the hours each year. This

would amount to 0.30 x 24 hrs/day x 365 days/ year or 2,628 hours/year.

At this load factor it would generate 200 MW x 1,000 kW/MW x 2,628 hours

= 525,600,000 kWh/year.

Thus, for the 200 MW wind farm, the estimate for its annual capital

cost/kWh would be: $46,983,850/525,600,000 kWh = $0.0894/kWh or

approximately $0.09/kWh. One can follow this same procedure for any type

of power plant.

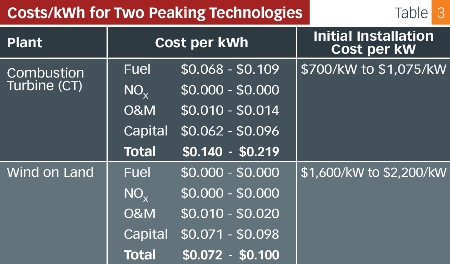

Now that all of the relevant costs/kWh for a power plant can be

obtained, let’s look at all of the costs/kWh for two of the peaking

technologies. Those costs are summarized in Table 3.

Assume that all of the other choices for peaking power except for the

combustion turbine and wind on land have been eliminated. At first

glance, it appears that wind on land is the clear winner. But is it?

All Table 3 shows is what the power plant’s total cost per kWh will be

if it operates at a 30 percent load factor. Now compare this total cost

per kWh to what you think a reasonable market price would be. You want

the total cost per kWh to be lower than a reasonable market price. Once

you know that each technology can be profitable, you need to go one step

further and consider the risks involved with each choice.

The risk the utility is taking in choosing the wind plant is weather

risk. If the wind does not blow coincident with the utility’s peak

demand, then this plant is useless. Note that the total costs/kWh for

the combustion turbine are double those compared to the total costs/kWh

for the wind on land plant. The utility pays a premium for the

combustion turbine because it is available 24 hours a day.

If, by looking at all of the costs/kWh there is still no definitive

answer for which technology is best, then why go through all of these

calculations? Having these costs/kWh for all of the technologies a

company is considering helps it to organize and recognize the risks

associated with each type of power plant. In other words, in this form

the utility can quickly see how sensitive each technology’s total costs

are to changes in fuel costs, changes in the cost of pollution credits,

changes in O&M costs and changes in load factor or capital costs. This

exercise allows the company to identify those technologies it wants to

consider for its final analysis, the capital investment analysis.

The company then chooses to perform a capital investment analysis on the

technologies that have a reasonable chance of being cost competitive in

their respective load factor market and which have risks the company

feels comfortable managing. In this final analysis, perform a 10-, 15-,

20- or 30-year net present value analysis on the cash flows for the

construction and operation of each relevant technology. The technology

that has the highest probability of maintaining a positive net present

value over the analysis period and under various changes in cost and

operating assumptions is the one the company should select.

In the end, when it comes to comparing the costs of generation

technologies, don’t automatically believe everything you hear or read. A

legitimate comparison of generation technologies takes into account load

factor, identifies risks associated with the costs/kWh for each

technology and then performs a net present value analysis on those

technologies with risks that the company feels comfortable managing.

This is the only the legitimate way to evaluate power generation

technologies.

John Hynes began his career in the energy industry in 1983. He

developed and facilitated technical training programs for nuclear

operators, telecommunications technicians, relay protection technicians

and high voltage equipment maintenance technicians before moving on to

senior positions in sales, marketing and strategic planning. Drawing on

perspectives gained from his wide-ranging background and real-world

management experience Hynes develops and facilitates Excidian’s Business

Finance and Energy Industry Knowledge programs.

To subscribe or visit go to:

http://www.renewableenergyaccess.com

To subscribe or visit go to:

http://www.renewableenergyaccess.com