Recession is Over

Location: New York

Author:

Warren Sherman

Date: Thursday, October 1, 2009

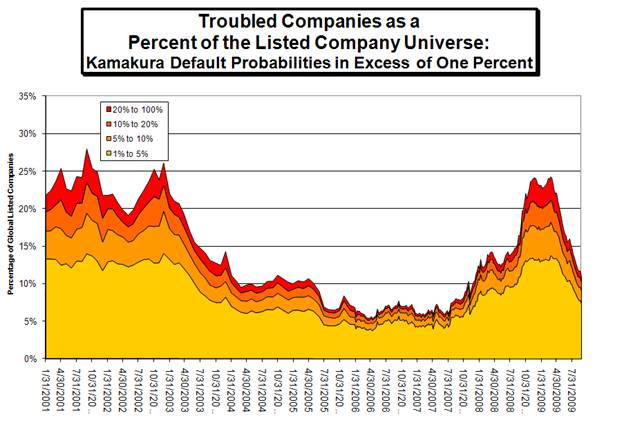

Kamakura Corporation announced Thursday that the Kamakura index of troubled public companies made its sixth consecutive improvement in September, with credit conditions now substantially better than average. After reaching a peak of 24.3% in March, the Kamakura global index of troubled companies dropped an additional 1.5 percentage points to 10.9% of the public company universe in September.

Kamakura defines a troubled company as a company whose short term default probability is in excess of 1%. Credit conditions are now better than credit conditions in 62.9 percent of the months since the index’s initiation in January 1990, and 2.8 percentage points better than the index’s historical average of 13.7%. In March, by contrast, credit conditions were better than only 3.6% of the monthly periods since 1990. The all-time low in the index was 5.4%, recorded in April and May, 2006, while the all-time high in the index was 28.0%, recorded in September 2001.

The index is based default probabilities for 26,965 companies in 30 countries. The absolute number of companies in the “over 20%” default probability category declined by 44 firms to 204 (a decrease of over 17%). To follow the troubled company index and other risk commentary by Kamakura on a daily basis, see www.twitter.com/dvandeventer .

In September, the improvement in credit quality was especially pronounced among the riskiest credits: the percentage of the global corporate universe with default probabilities between 1% and 5% decreased by one percentage point to 7.4%. The percentage of companies with default probabilities between 5% and 10% was down 0.1 percentage points to 1.7%.

The percentage of the universe with default probabilities between 10 and 20% was down 0.2 percentage points to 1.1% of the universe, while the percentage of companies with default probabilities over 20% was down by 0.2 percentage points to 0.8% of the total universe in September. In March, by contrast, 3.1% of the total universe had default probabilities over 20%.

Kamakura’s President Warren A. Sherman said Thursday, “The index’s continued improvement, especially among high risk credits, is excellent news. It’s now increasingly obvious that the recession is over for the economy as a whole. That being said, the credit improvement in September seemed to leave a few companies behind. The rated public companies showing the largest rise in short term default risk in September were all in Japan: Japan Airlines, Pioneer Corp, Mizuho Trust & Banking, NIS Group, and Takefuji.“

To subscribe or visit go to: http://www.riskcenter.com