Location: Honolulu

Author: Donald R. van Deventer

Date: Thursday, September 10, 2009

Commentators on the current credit crisis have correctly claimed that, by many measures, the current credit crisis is the worst economic slump since the great depression. Nonetheless, there are other measures that one can use to show that the current crisis has been sharp and dramatic, but it has been nowhere near as devastating for financial institutions as a whole as the savings and loan crisis of the late 1980s and 1990s. This post explains why.

On September 1, 2009, Kamakura Corporation released its monthly index of troubled companies among a public universe of 27,000 firms in 30 countries:

That index defines a company as “troubled” if its short term annualized default probabilities are over one percent. The percentage of troubled companies as a percent of the public firm universe has declined dramatically from a recent peak of 24.3% in March 2009 to 12.4% in August, a decline that has been dramatic over each of the last five months. Much to the surprise of many, the percentage of companies that are troubled is now lower than the 13.7% average that has prevailed from 1990 to 2009. Moreover, the peak of 24.3% of the troubled company index was well below the all time high of the index, 28.0%, recorded in the depths of the high technology collapse in September 2001. In short, the best available default technology indicates that the current crisis was intense and dramatic, but at its worst it was not as bad as 2001 and it was resolved much more quickly as the graph in the press release makes clear.

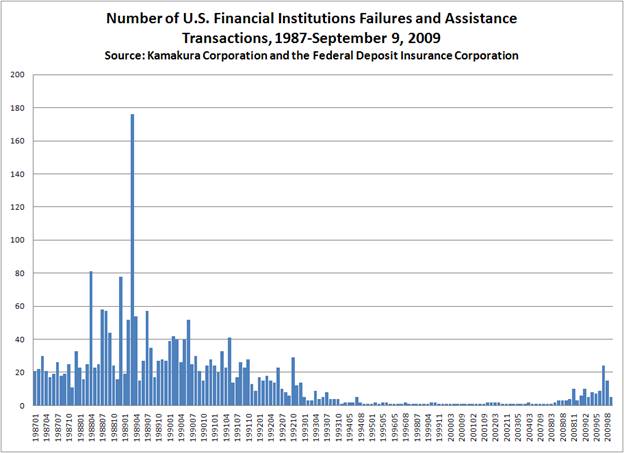

What about financial institutions, given the conservatorships announced for firms like FNMA, FHLMC, and corporate credit union Wescorp and failures or rescues of firms like AIG, Citigroup, Lehman Brothers, Bear Stearns and many others? The graph below, derived from data available on www.fdic.gov, shows the number of financial institutions that either failed or were formally assisted by the FDIC from January 1987 to September 9, 2009.

The monthly totals of these failed financial institutions pale in

comparison to the number of failures month by month in the 1987-1992

period. What is different in this crisis is the failures of big banks on

Wall Street. It’s the largest and most aggressive institutions and those

most concentrated in mortgage related businesses that have failed in the

crisis so far. Failures in 1987-1992 were much more broad-based and they

involved small banks on Main Street much more than big banks on Wall

Street.

The magnitude of government bailouts in the current crisis has been huge

in dollar terms, but this historical perspective on past problems is

humbling. The current crisis could have been much more broad-based, both

for corporate and financial institutions, than it has been so far. With

commercial real estate prices falling still, the current crisis may end

up affecting a broader spectrum of financial institutions than it has so

far. The more important worry is whether or not risk managers and

regulators are ready for the next risk epidemic. So far, as expensive as

the current crisis has been for taxpayers world-wide, the current crisis

has more in common with the swine flu than with the black plague. It

could have been much worse, and we need to be ready if we’re not as

fortunate in the next crisis.

To subscribe or visit go to: http://www.riskcenter.com