In 2009, the market for solar products continued to soften, and by September prices had crashed by 32%-42%. This was great for the system integrators and installers who could source cheaper modules (hard to resist at these prices!), but not so good for technology manufacturers who experienced squeezed margins and downward sloping revenues. (In fairness, system integrators have felt pressure to provide ever-lower system prices.)

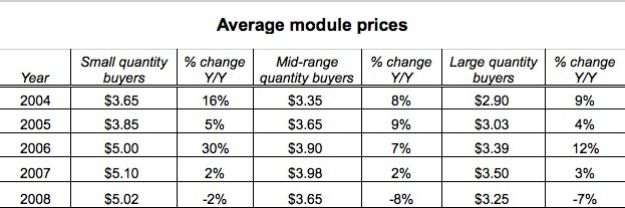

The table below offers average pricing information from 2004 through September 2009 for three pricing categories: those buying small quantities (modules of all sizes in the kilowatt range annually), mid-range buyers (typically up to 10MWp annually), and large quantity buyers (self explanatory -- and with access to the lowest prices).

|

2006 was a particularly auspicious year for price increases,

with average module prices rising by 30% for the small buyers,

7% for mid-range buyers, and 12% for large-quantity buyers. The

significant turnaround in pricing of 2009 -- which could be

described as an overcorrection -- does not mean that an

efficient market price was arrived at. Rather simply, the market

was willing to pay more at one point than it was at another.

In 2009, soft demand because of the loss of a major market

(Spain), a global recession, and problematic debt markets (among

other reasons) drove prices down, while significant levels of

inventory on the demand side allowed a vibrant secondary market

to develop. Suddenly there were daily, always-downward pricing

changes. The global market for cells and modules

pseudo-corrected because it crashed -- not a healthy situation

for anyone.

On the manufacturer side (supply), the module business was

unprofitable for over 30 years, up until the boom; average

pricing during some of these years was below cost. During the

boom, margins swelled along with profit and the industry behaved

as if the party would never end.

The PV industry remains in start-up mode with applications,

business models, marketing strategies, and technologies

continuing to mature. As the high-growth, grid connected

application remains incentive-driven, it is hard to drape solid

economic theory over industry pricing behavior. Moore's Law (the

doubling of transistors per square inch on an integrated circuit

doubles every 12-18 months) does not apply perfectly to pricing.

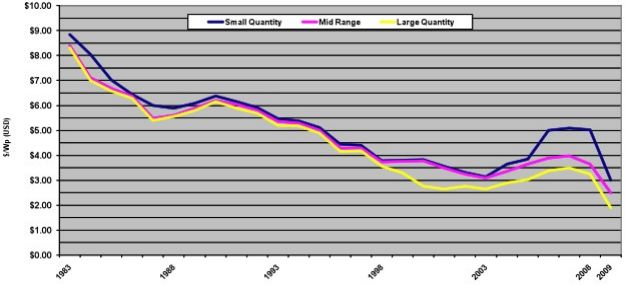

Over the long term -- and only in the long-term -- there is

clearly a systematic reduction in the price of cells and

modules. In the near- to medium-term, though, there are many

hiccups (up and down) in cell and module prices, and a smooth

line cannot be observed (see figure below).

Until there is true, un-incentivized pull in the market for

solar products, wild swings in demand and pricing will continue.

|

| Average module prices, 1983-2009. |

Efficient market theory holds that the market will establish

(with the occasional correction) a rational and correct price

for a good. This is great in theory; however, the market is an

organism that reacts to market pressures by often inflating

prices (supply side) when market conditions are good, and madly

deflating them when market conditions turn in the other

direction. It does this for any good often regardless of its

manufacturing cost.

The supply and demand sides of the market are both guilty of

herd-like behavior, responding in mass to triggers that a good

has a high value and retreating when triggers indicate that a

good's value is inflated. Individual market players will

primarily look at the price others are paying for a good at a

given time, and use this to establish value (high or low).

Early-1900s French mathematician and physicist Henri Poincaré

commented about the difficulties of independent decision making

when people are brought together in a group. With easy access to

information these days, the overload of constant module price

updates can and does trigger much anxiety. Market drives price,

and also value, and people are the market. Understanding this

does not exactly help manufacturers ameliorate pricing anxiety,

particularly when all around prices can be observed dropping

like stones into a pond.

So, accepting that the market is not logical or efficient when

it comes to pricing, what does this mean for solar? It means

that there are no set rules for market pricing, but some

understanding of the triggers might slow panicked selling.

In the case of cost reduction, the PV industry can be proud of

the significant progress it has made in reducing manufacturing

cost and increasing efficiency. In this arena there is some

logic -- and in an industry with downward price pressure (live

by the incentive, die by the incentive), lower costs are a

necessity. Lowering costs -- now there is a rational war worth

fighting.

Paula Mints is principal analyst, PV Services Program, and associate director in the energy practice at Navigant Consulting. E-mail: pmints@navigantconsulting.com.