Stimulating Energy

Location: New York

Author:

Christopher Perdue

Date: Thursday, September 24, 2009

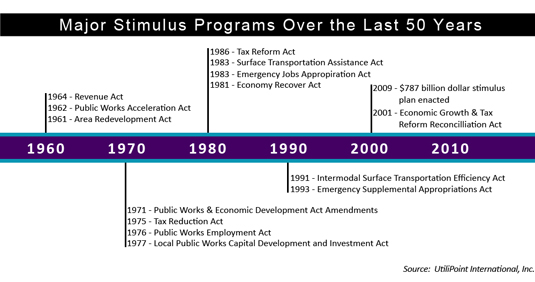

It has become almost common place for politicians to utilize increased spending and/or tax cuts in hopes of jump-starting a sluggish economy. In fact, stimulus bills have been enacted during six of the past eight recessions.

If we have learned one thing from the stimulus packages of the past, it is that they do not always work. Sometimes the stimulus policies were permanent, and the long-term damage in terms of increased deficits and debt outweighed the initial benefits. Often times politicians took too long to identify the problem or too long to take action. Still other times the actions were not properly targeted, and most of the funds did not get spent.

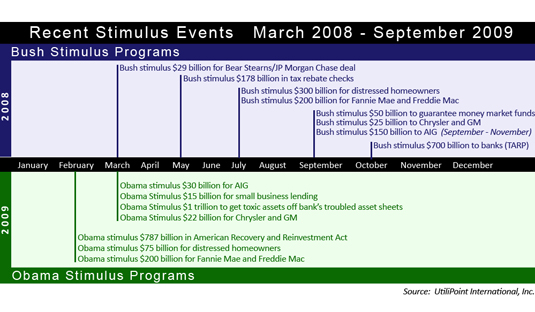

The government's latest attempt to stimulate the economy is the American Recovery and Reinvestment Act (ARRA) of 2009. The ARRA will pour $787 billion into the U.S. market over the next year. It is designed to have a quick and dramatic impact on the economy. It's not, however, the only economic stimulus package that's in play. Below is a timeline of the various economic stimulus packages that have been introduced in 2008 and 2009 by the Bush Administration and the Obama Administration.

One of the biggest criticisms of the ARRA is that it is taking too long to implement. A recent report shows the Department of Energy (DOE) has struggled in getting its $38.7 billion share of the money out the door. After the first six months since the passage of the AARA, DOE had paid out less than $500 million, which represents less than 2 percent of DOE's total stimulus allotment.

In DOE's defense the agency has made "funding commitments" to spend about $9.5 billion of its stimulus funds, or about 25% of what it received under the bill. These funding commitments are political speak for funds that will "likely result in payment," but that have not been paid out yet. And the pace of funding should be picking up this month. The department intends to have a full 50 percent of its stimulus money (more than $19 billion) committed by the end of the September.

Show Me the Money

So far one of the biggest recipients of energy stimulus funds appears to be Iberdrola SA. The Spanish energy firm received grants worth $294 million for five new wind energy projects in Minnesota, Oregon, Pennsylvania, and Texas. Iberdrola received more than half of the $502 million of grants handed out earlier this month by the U.S. Energy and Treasury departments for renewable energy power-generation projects. The company has also requested aid for another $200 million, which it hopes will be approved in the next few weeks. The grants provide a 30% cash grant to projects that have been built and are in service generating electricity.

First Wind Energy Holdings LLC, a company backed by private-equity investors, also received an impressive amount of the grant funds. The company received $74 million in grants for wind projects in Maine and upstate New York.

Other winners included Horizon Wind Energy, the U.S. arm of Portuguese energy company Energias de Portugal SA, which will also receive $47.7 million for a wind farm in Oregon, and EverPower Renewables which will receive $42.2 million for a wind farm in Pennsylvania.

Two other smaller grants were handed out to solar projects, but the vast majority of the $502 million awarded were for wind projects.

Smart Grid Funding

The distribution of stimulus funds for Smart Grid applications is about to get interesting. DOE received 431 applications last month for federal stimulus funding for Smart Grid plans, with the total project value of all the applications at $24.6 billion. Given the short timeframe that utilities had to build and submit applications (DOE did not release full funding requirements until June), that is an impressive feat. It could suggest that many utilities were contemplating smart grid projects prior to the stimulus legislation being passed.

I had the opportunity to talk to Jim Robb, senior vice president of Enterprise Planning and Development at Northeast Utilities about their recent application for Smart Grid stimulus funds. The utility applied for federal funds that would support half of the implementation of a smart grid in Connecticut, New Hampshire and Western Massachusetts—a development that is expected to total about $253 million. I asked Mr. Robb how was his utility able to respond so swiftly to the initial August 6th deadline. "We have had various bits of smart grid investment experience already," said Robb. "Our utility had already performed a great deal of distribution automation, and we were also aware of what the various smart grid technologies could and could not do. We had also been working with our regulatory authorities, and piloting a dynamic pricing program in Connecticut. Even so, it was still a massive effort given the level of compliance that DOE requested, and took a dedicated 'small army' of people to put together the application."

In the stimulus bill, $3.3 billion was set aside for Smart Grid investment grant applications, which could be used to fund 50 percent of a project proposed by a utility or customer group, and another $615 million was set aside for Smart Grid demonstration projects, also with 50 percent Federal funding. When the DOE released the final funding opportunity laying out requirements for smart grid grant applicants, the agency set three different application deadlines: August 6 and November 4, and March 3, 2010.

With the majority of applicants seeking funding for 50 percent of their projects, and the total project value of all the applications at $24.6 billion, this would suggest that the smart grid applicants are seeking approximately $12 billion in federal funding from DOE's August 6 deadline. Since there is only $3.9 billion available for smart grid applications in the stimulus bill, this would imply that there may not be any stimulus funding available for utilities that were eyeing the November or March deadlines. The amount of funding awarded in the first round will largely depend on the quality of the applications and whether applicants met DOE's criteria. For now, DOE is not making the applications available to the public.

The winners in the first round for Smart Grid funding are expected to be announced in the mid November to early December timeframe. For these utilities the work is just beginning.

UtiliPoint's IssueAlert® articles are compiled based on the independent analysis of UtiliPoint consultants. The opinions expressed in UtiliPoint's® IssueAlert® articles are not intended to predict financial performance of companies discussed, or to be the basis for investment decisions of any kind. UtiliPoint's sole purpose in publishing its IssueAlert articles is to offer an independent perspective regarding the key events occurring in the energy industry, based on its long-standing reputation as an expert on energy issues. © 2008, UtiliPoint® International, Inc. All rights reserved. To subscribe or visit go to: www.utilipoint.com