Wind Technology Trends: Why Small Steps Matter

More than 31,000 MW of new wind capacity was added worldwide in 2008, a record that can be described as an absolute milestone in the modern history of wind power development. Fortunately that build up -- and the dip in overall wind market demand that has followed the financial constraints -- did not take place at the expense of wind industry development nor technology innovation.

Also from the UK comes a futuristic 5–10 MW

NOVA (Novel Offshore Vertical Axis) Aerogenerator offshore wind turbine

vertical-axis concept, an ambitious 'high-risk' project currently in a

feasibility study phase.

Among the features of the V112 are a three-point gearbox support, a permanent magnet-type synchronous generator with full converter, and a 112-metre rotor. Interestingly, this gearbox support solution signals a return to the drivetrain technology principles of the former NEG Micon, and is a mechanical layout that is also widely applied elsewhere in the industry. The switch of design concept is widely viewed as a departure from the lightweight V90-3.0 MW turbine model, which features a compact design with a semi-integrated drivetrain system. Also new from Vestas is the V100-1.8 MW, which builds on the mechanical design principles of the V80-2.0 MW series.

Compared with the V90-3.0 MW, the new V112-3.0 MW turbine offers a 55% larger rotor swept area, while compared with the V80-2.0 MW, the new V100-1.8 MW offers a 56% larger swept area. Both of these Vestas products also present a new 2009 corporate nacelle design, featuring a distinct CoolerTop radiator on top.

Finally, an 850-kW model version with an enlarged 60-metre rotor (V60-850 kW) has been introduced, specifically focused on low and medium wind speed sites in markets such as China.

Moving on from Vestas, US giant GE began series production of its 2.5-MW GE 2.5xl turbine in both Salzbergen, Germany, and Noblejas, Spain, in September 2008. The company’s focus for this machine is initially European wind markets, but a 60 Hz 2.5xl version will be introduced into the US in 2010.

According to a GE spokesperson, the 2.5xl will offer an alternative to the company’s 1.5-MW workhorse series in densely populated US regions with land constraints. There are now more than 13,000 of GE’s 1.5-MW machine in operation, a record number that is expected to hit the 20,000 mark by the end of 2010. Despite dominating the 1.5-MW sector, in the 2- to 3.3-MW segment, GE faces stiff competition from suppliers such as Acciona, Clipper, Fuhrländer, Mitsubishi, Nordex, REpower, Siemens and Vestas.

Meanwhile, GE has taken Japan’s Mitsubishi to court over a dispute related to rights to variable speed technology, allegedly incorporated into Mitsubishi’s 2.4-MW MWT 92 and MWT 95 models, which have been in operation since 2006. This ‘patent war’ reportedly involves three of GE’s patents, and – depending on court rulings – could potentially ban future US imports of these machines. This is but the latest in a series of patent battles. In the early 1990s, a bitter variable speed patent dispute with GE (which lasted until May 2004) left Enercon of Germany banned from the US market. Since 1992 Enercon has marketed variable-speed direct drive turbines with synchronous generators and a full converter, but ownership of the initial 1992 patent during the period to 2004 changed hands from Kenetech, via the one-time Enron Wind, to current holder GE.

The GE patents relating to the current Mitsubishi dispute were awarded in 1992, 2005 and 2008, according to various media reports, while according to Mitsubishi technical specifications, the 2.4 MW MWT turbine series is fitted with a doubly-fed induction generator, of a type widely applied in the wind industry.

Also during 2008, GE Drivetrain Technologies, a unit of GE’s transportation division, entered the wind industry with a new line of IntegraDrive gearboxes. Earlier in 2009, it announced that it was to immediately offer doubly-fed induction and permanent magnet generators to the wind industry in the 2–6 MW power range.

Liquid Cooled

In 2008, Gamesa of Spain experienced only limited growth and the company’s workhorse remains the 2-MW wind turbine series. However, a prototype of the newest addition to the company’s range, the 4.5-MW G128-4.5 MW, has been erected recently at the Cabezo Negro R&D wind farm located in the Jaulín local authority in the Spanish province of Zaragoza. Its product specifications include segmented rotor blades of a record 128-metre rotor diameter and a 120-metre high tower comprising steel and concrete.

The machine is also expected to feature a single rotor bearing, a two-stage gearbox and an in-house designed permanent magnet, medium-speed, synchronous generator. In terms of transport logistics, Gamesa claims that transportation equipment similar to that used for the G8X-2.0 MW turbine series can be re-employed.

Enercon of Germany also saw only minor growth in 2008, yet it remained the world’s undisputed direct-drive market leader, with about 14,400 systems installed. Enercon manufactures wind turbines ranging from 10 kW (E-10) to its E-126 flagship turbine, currently rated at 6 MW. In the past year, one E-10 turbine has been erected in Antarctica, joining two 300 kW E-30 installations installed in 2003.

In the Netherlands, the company completed a major wind farm, comprising 67 units of its 3-MW E-82 (normally rated at 2 MW) and which had been fitted with a newly designed, liquid-cooled annular generator. Several more operate in Germany, but the future prospects of this model remain uncertain.

In early July the company announced an upgrade in the rated capacity of its air-cooled 2.0 MW E-82 volume model to 2.3 MW. Enercon is also engaged in a number of other product development activities that go beyond wind turbines. Examples include wind power storage technologies, integrated power generation solutions (wind, solar, biogas), an Enercon design hydropower plant, a wind–diesel powered E-ship featuring four rotating Flettner-type rotors, and wind-powered water desalination technology.

Suzlon of India is Asia’s largest wind turbine maker and its 2.1-MW S.88 is the company’s main volume model. Suzlon owner Tulsi Tanti has acquired large stakes in REpower of Germany and Belgian gearbox manufacturer Hansen Transmissions. However, according to a 15 June article in The Economic Times of India, Suzlon – forced by a roughly US $2.5 billion (€1.8 billion) debt burden – is exploring the option of selling a large portion or even its entire 61.28% stake in Hansen.

Suzlon also reportedly made a final payment to Portugal-based Martifer Group, thus completing the acquisition of the latter’s stake in the German subsidiary, REpower Systems. This means Suzlon now owns 90.72% of REpower. It is also ‘close to exercising its option to transfer REpower’s technology to emerging markets such as India and China, where Suzlon plans to increase its presence’, according to the report.

Since taking over Bonus Energy in 2004, Siemens has increased annual installations by a factor of six. Initially, turbine assembly and in-house rotor blade manufacture were in Brande, Denmark, but the company spread its wings two years ago by starting blade manufacture in Iowa in the US. This international expansion is now being reinforced again with new nacelle assembly facilities in Kansas, also in the US, and nacelle plus rotor blade production in Shanghai, China.

Siemens erected a new 3.6 MW direct-drive concept turbine model in Denmark during July 2008 and earlier this year (2009) it introduced a 2.3 MW SWT-2.3-101 (rotor diameter: 101 metres) model, which it says is ideally suited for low to medium wind speed sites. Siemens expects the low to medium wind market segment to grow further to reach up to one-third of the total global wind power market during the coming years.

Floating Wind Turbine

June 2009 saw StatoilHydro of Norway and Siemens install the world’s first large-scale floating wind turbine. The installation is located approximately 12 km south-east of Karmøy, Norway, in about 220 metres of water. StatoilHydro developed the Hywind project, while Siemens supplied a SWT-2.3 MW wind turbine with an 82.4-metre rotor diameter and 65-metre hub height. StatoilHydro is also responsible for the floating structure, which consists of a ballasted steel float that extends 100 metres beneath the surface and is fastened to the seabed by three anchor wires.

Hywind technology is designed for installation in water depths of 120–700 metres, which ‘could open up many new offshore wind turbine technology opportunities,’ Siemens says. The partners have also jointly developed a dedicated turbine control system that addresses the special operating conditions of a floating structure. For instance, the system takes advantage of the turbine’s ability to dampen out part of the wave-induced motion of a floating system. The Hywind turbine is expected to commence generating power by mid-July 2009, marking the start of a two-year testing period.

Several Hywind competitors are also at work on floating structures with a wider shallower base and which are designed to be fixed to the seabed with, for instance, ‘tension legs’ (for example Blue H from the Netherlands) or with anchoring (such as Principle Power from the US).

In the ‘conventional’ offshore wind market, wind turbines are put on fixed foundations with maximum water depths of about 50 metres. During 2008 Siemens captured market leadership in this segment and the company has over 600 MW installed in seven offshore projects today. It also has five on-going offshore projects in Denmark and the UK and an order backlog of 3300 MW of turbines.

Regarding the company’s wind technology, the Siemens 3.6-MW SWT-3.6-107 turbine appears to have rapidly developed into the favoured offshore wind industry workhorse. Offshore wind investors claim that in today’s uncertain economic times, wind turbine track record, company reputation and proven financial strength are all key project equipment decision-making factors.

3 MW-class Entrance from the Chinese

Sinovel of China doubled its sales in 2008 and thereby overtook its Chinese competitor GoldWind. As a relatively new wind market entrant, until recently Sinovel relied entirely on a 1.5-MW turbine model, built under an American Superconductor Corporation (AMSC) Windtec subsidiary license. In 2007, AMSC announced that it signed a multi-million dollar contract with Sinovel Wind, under which 3-MW and 5-MW wind turbines would be developed. The latest serial product is the 3-MW SL 3000 wind turbine, which has GL certification and, Sinovel says, is now available for commercial onshore as well as offshore applications.

Early in 2008, Goldwind of China acquired a 70% stake in German wind technology developer Vensys Energy AG. The latter has developed series-produced direct-drive turbines of 1.2 MW, 1.5 MW, and 2.5 MW all featuring permanent magnet generators. Goldwind had already commenced series manufacture of the two smaller Vensys sister models in China. Another plan under consideration is to build a wind turbine plant in Germany together with Vensys, involving a total investment of about €5 million ($7 million), but the current project status is unknown.

Four years after having launched its 1.5-MW AW-1500 turbine series, Acciona Windpower of Spain introduced a 3-MW AW-3000 series in 2008. This latter machine comes with three different rotor sizes, including a record 116-metre diameter version. Acciona currently has four production facilities, two in Spain, one in China, and one in the US.

Nordex of Germany continues to grow faster than the world market and in 2008 installed a record 1075 MW. Nordex currently produces both 1.5-MW turbines and their rotor blades in China, whereas the 2.5-MW N80/N90 product family and matching blades are supplied from Rostock, Germany. This HQ location is currently being substantially expanded too. Having left the US wind market in 2003, Nordex made a re-entry in 2008. New US production facilities are planned in Jonesboro, in Arkansas, where N90/N100 nacelle assembly (some 750 MW annually) is to commence in 2010 supplemented by rotor blade manufacture in 2012. The latest N100-2500 features an enlarged 100-metre rotor.

Power-rating World Record in Development

During the past year, REpower Systems of Germany introduced two new geared wind turbine models. First is a new 3.3-MW 3.XM land installation with 104-metre rotor and a three-point gearbox support solution. The second is a scaled-up 6M offshore turbine. Furthermore, the company erected three 6M prototypes at an onshore location earlier this year. Built on the proven 5-MW 5M (whose prototype was launched in 2004) design principles, 6M turbines will be fitted with new REpower-designed rotor blades, but will retain the 126-metre rotor diameter of the 5M model. The new flagship turbine is designed for 6.15 MW continuous electrical output, a record.

DarWinD is a Dutch company founded in 2006 that developed a 5 MW-class direct-drive offshore turbine with 115-metre rotor diameter. With a top head mass (nacelle + rotor) of only about 265 tonnes, the installation is a genuine lightweight in its class.

Converteam, one of DarWinD’s two main shareholders, designed and manufactures the permanent magnet-type generator. However, DarWinD’s second main shareholder, sustainable energy company Econcern (NL), recently (June 2009) filed for bankruptcy. DarWinD itself went bankrupt early July, creating uncertainty over the project’s planning – a first prototype planned at the end of 2009 and a second during the first quarter of 2010 – and the company’s future. Besides two Asian contenders, an undisclosed German supplier is also named as a potential DarWinD takeover party.

Mitsubishi

is another future super class entrant, having announced development

of a 5-MW turbine with a rotor in the 120-metre range. However, it

is the case that Clipper Windpower’s 7.5–10 MW Britannia offshore

wind turbine, being developed in the UK and featuring a 150-metre

rotor diameter, remains, for the moment, the largest horizontal axis

wind turbine actually under development today.

Mitsubishi

is another future super class entrant, having announced development

of a 5-MW turbine with a rotor in the 120-metre range. However, it

is the case that Clipper Windpower’s 7.5–10 MW Britannia offshore

wind turbine, being developed in the UK and featuring a 150-metre

rotor diameter, remains, for the moment, the largest horizontal axis

wind turbine actually under development today.

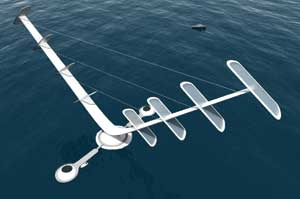

Also from the UK comes a futuristic 5–10 MW NOVA (Novel Offshore Vertical Axis) Aerogenerator offshore wind turbine vertical-axis concept, an ambitious ‘high-risk’ project currently in a feasibility study phase (see image, above). Comprising a pair of V-shape fixed angle composite rotor blades rotating around their central (vertical) axis, this machine is a variant on the Darrieus aerodynamic lift operating principle.

Other known Darrieus models include the classic ‘egg-shape’ and ‘H-type’ – in reference to their rotor shape. The largest envisaged version, at 10 MW, features a wingspan of more than 300 metres, with total height from wing tip to generator bottom section measuring about 130 metres. The corresponding wing length is around 220 metres. As large Darrieus-type turbines – including the envisaged Aerogenerator – typically feature fixed-angle stall-type blades, high wind power output control will represent just one of many major development challenges.

The

German

BARD Group has announced further development of its 5-MW ‘BARD

5.0,’ which is being up-scaled to a 6.5-MW ‘BARD 6.5’ while

retaining the 122-metre rotor diameter (see illustration, left).

The BARD 5.0. offshore wind turbine (with two prototypes installed,

one in 2007 and one in 2008) is a state-of-the-art geared wind

turbine, fitted with a six-pole doubly-fed induction generator and

electronic power converter.

The

German

BARD Group has announced further development of its 5-MW ‘BARD

5.0,’ which is being up-scaled to a 6.5-MW ‘BARD 6.5’ while

retaining the 122-metre rotor diameter (see illustration, left).

The BARD 5.0. offshore wind turbine (with two prototypes installed,

one in 2007 and one in 2008) is a state-of-the-art geared wind

turbine, fitted with a six-pole doubly-fed induction generator and

electronic power converter.

BARD, an offshore wind farm developer, operator and turbine manufacturer, describes the up-scaling as important in achieving higher commercial wind farm viability. This is because BARD’s offshore turbines will typically operate in a harsh environment with average wind speeds of 10 m/s and up, justifying, says BARD, a higher relative power rating.

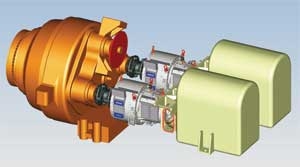

The company is developing two different BARD 6.5 drive system variants – with the first involving a new high-performance gearbox. Winergy AG of Germany – already the supplier of BARD’s 5 MW drivetrain system including main shaft, gearbox, intermediate shaft, generator, and power converter – developed this major component.

For the development of the second variant, BARD co-operated with Voith Turbo, a division of Voith AG Group and a world renowned specialist in hydrodynamic drives, couplings and braking systems for road, rail and industrial applications.

In this version of the machine, the central drive system element is Voith’s WinDrive, a variable-speed planetary gear with integrated torque converter. For this achievement Voith was given a Hermes Award at the Hannover Messe 2009 international wind technology fair. This second drive variant further consists of a newly-designed main gearbox with two parallel output shafts developed by Jahnel-Kestermann of Germany, and each connected to an individual WinDrive and 3.25 MW synchronous generator. Explaining the decision-making process behind this specific layout choice, Voith spokesperson Friedrich Fisher said: ‘Reliable standard synchronous generators offering proven performance are today only available up to 5 MW power rating.’

A key WinDrive operational function is to continuously control and convert variable wind turbine rotor input revolutions into a constant generator output speed. The configuration enables direct grid connection, eliminating the need for an electronic power converter, which is normally required with variable speed wind turbines. BARD 6.5 turbines are expected to enter active service in BARD’s offshore wind projects over the next few years.

In addition, this summer sees the start of the offshore construction of the 400 MW ‘BARD Offshore 1’ North Sea project, located about 100 km north of the German island of Borkum. The company will be making use of its new installation vessel BARD Wind Lift I. This latest BARD-Voith co-operation is the second time a WinDrive has been applied in a commercial wind turbine model. The first was in a 2 MW DeWind D8.2 turbine (see REW March/April 2007). A key design driver on that occasion was the need to optimize total systems efficiency by minimizing mechanical, electrical and hydraulic losses set against a ‘conventional’ variable speed 2 MW D8 which has to contend with mechanical plus electrical losses.

Other Developments

Canadian firm EXRO Technologies has developed a new generator concept for various applications, including wind power, launched under the name ‘Variable Input Electrical Generator’ (VIEG). The VIEG is a modular, scalable, permanent magnet-type (PM) electric machine made up of coil sets arranged in a number of stages and managed by electronic switching. Independent air-cooled coils, or groups of coils, can be configured in any required number of parallel and series combinations. The company claims that with this new generator technology ‘lack of control disadvantages linked to conventional PM type generators can be eliminated.’ EXRO currently conducts extensive bench testing of a-5 kW VIEG, to be followed by field tests with a 50 kW system at the beginning of 2010.

In

another North American development, NextGen, a subsidiary of

Minnesota-based

Juhl Wind Inc., says that it has found a new niche market in

community power applications. The company markets a 33-kW wind

turbine (see image, left), the NG Twelve-Five, with a rotor

diameter of 12.5 metres. A famous two-bladed fixed-speed

pitch-controlled German design of the 1980s, this machine was

originally marketed as the AEROMAN. According to NextGen, demand is

brisk for the turbine, which has now been customized for US Midwest

conditions.

In

another North American development, NextGen, a subsidiary of

Minnesota-based

Juhl Wind Inc., says that it has found a new niche market in

community power applications. The company markets a 33-kW wind

turbine (see image, left), the NG Twelve-Five, with a rotor

diameter of 12.5 metres. A famous two-bladed fixed-speed

pitch-controlled German design of the 1980s, this machine was

originally marketed as the AEROMAN. According to NextGen, demand is

brisk for the turbine, which has now been customized for US Midwest

conditions.

Elsewhere in the small wind sector, a comprehensive one-year test programme involving 10 small-scale wind turbines from various manufacturers was completed in the Dutch town of Schoondijke in March 2009. While the study showed rather disappointing results overall, a 5-kW Fortis Montana and a 1.8-kW SouthWest Skystream 3.7 far outperformed other machines in the test. Besides various technical issues, another major factor explaining the generally poor results was a combination of a location with a relatively poor wind regime and a 15-metre total height restriction on the installations. This latter requirement was based on the persistent misperception that these units can be top performers while simultaneously appearing to be almost invisible in their natural surroundings – a key advantage smaller machines claim over their larger cousins.

Time-critical Operations

Optimized offshore wind turbine installation technology remains another hot topic. In the Netherlands, for instance, several specialized companies including shipyards, naval engineering consultancies and civil engineering contractors are focusing on designing multi-purpose vessels and methods aimed at substantially speeding up time-critical offshore operations. Some of these clever concepts under development can pick up pre-assembled and pre-tested wind turbines from shore, sail to a wind farm construction site, and mount complete units on top of substructures in a single operation. Other integrated concepts can install monopile type foundations and matching transition pieces as well.

Finally, Dutch civil engineering contractor Ballast Nedam has developed a novel prefab concrete drilled monopile that can be floated to offshore wind farm construction sites. It comprises multiple rings of the required length assembled onshore in a pre-stressed assembly with the aid of steel cables inside the concrete walls. A portable drilling device temporarily put inside these monopiles, removes the soil, and under the action of gravity the pile gradually sinks to the required depth.

Conclusion

What all these highly different developments and innovations show is that technology takes a lot of time and effort to develop, test and mature. Sometimes stakeholders succeed in making great strides forward, but it is the small steps which usually set the standard. In any event, sustained global efforts remain necessary to achieve ambitious goals set for rapidly expanding wind power to the overall benefit of the world’s climate protection and long-term energy security.

Eize de Vries is wind technology correspondent for Renewable Energy World.

To subscribe or visit go to:

http://www.renewableenergyaccess.com

To subscribe or visit go to:

http://www.renewableenergyaccess.com