Permanent Solution?

The application of permanent magnet generators (PMGs) to wind turbines is a relatively new, but growing, trend in the energy industry. According to specialist providers, they offer advantages in key areas such as efficiency and design flexibility and PMGs are now being used by leading manufacturers in the industry.

However,

the dominant Neodymium-Iron-Boron (NdFeB) rare-earth material

used for magnet manufacturing is also in high demand for many

alternative hi-tech applications. And, the fact that China

controls up to 95% of the production market for rare-earth

materials, including NdFeB has also caused some unease elsewhere

in the world (see box panel).

However,

the dominant Neodymium-Iron-Boron (NdFeB) rare-earth material

used for magnet manufacturing is also in high demand for many

alternative hi-tech applications. And, the fact that China

controls up to 95% of the production market for rare-earth

materials, including NdFeB has also caused some unease elsewhere

in the world (see box panel).

PMGs are being applied to an increasing number of the latest turbine designs, potentially marking another significant chapter in the industry’s technical evolution. Since the birth of modern industrial wind turbine manufacturing in the late 1970s, conventional fast speed geared wind systems have dominated the global market. This success can largely be attributed to a pioneering fixed-speed concept known as the ‘Danish Concept’, featuring stall-type power output limitation, three blades and a non-integrated drive system. The generators in these turbines were typically squirrel-cage induction machines of the sort widely used for many industrial applications.

Variable speed operation was already active by the late 1970s/early 1980s thanks to wind technology pioneers like the former Lagerwey of the Netherlands. From the second half of the 1990s variable speed operation steadily gained ground, with the doubly-fed induction generator (DFIG) becoming the semi-standard wind industry solution. Generator power is typically fed into the grid with the aid of an AC/DC-DC/AC frequency converter. In a key cost advantage, DFIG machines only require a partial (approximately 35% rated capacity) converter.

Siemens Wind Power served as an exception when it switched to variable speed operation in 2003/04, maintaining the application of brushless squirrel-cage induction machines, but now in combination with a full converter. Over the following years, a steady stream of suppliers has switched to the PMG with full converter solution. This growing list includes GE and Clipper (distributed drivetrain; four generators) for 2.5 MW models and UNISON of South Korea for its 2 MW U88/U93 sister model series. In 2009, Vestas announced a new V112-3.0 MW model featuring a PMG design.

Alternative drive system options – some still under development or at a semi-commercial development stage – either involve a mechanical-hydraulic or fully-mechanical variable speed gearbox system, or a ‘fully-hydraulic’ transmission. These latter solutions enable variable speed rotor operation combined with a fixed-speed directly grid-connected generator, effectively eliminating the need for an electronic power converter. For various reasons, fixed-speed systems with direct grid-connection are, however, now only a minority segment.

In 1992 wind pioneer Enercon of Germany introduced a 500 kW variable speed, direct drive system (no gearbox) as a distinct alternative wind technology solution. The company dominates the direct drive segment to this day with an evolutionary range of successor models currently with a 30 kW – 7.5 MW range of power ratings and an operational track record exceeding 15,500 wind turbines.

Even though widely accepted as a mature wind technology, direct drive’s global market share has never exceeded roughly 10%–15%, but the number of new entrants is growing rapidly. One strong new direct drive player is GoldWind of China, believed to have delivered over a thousand wind turbines of 1.2–1.5 MW, using licensed designs that originate from Vensys of Germany. Among other powerful newcomers in the direct drive segment are GE Energy and Siemens Wind Power. These two, and almost all other new international entrants, apply PMGs in their designs. In contrast, Enercon and Mtorres of Spain chose in-house developed and manufactured generators with electrical field excitation.

A mix between fast-speed geared and direct drive wind systems is often referred to as a ‘Hybrid’ solution. This third, medium speed segment occupies only a minority market position. Areva Multibrid of Germany/France and WinWinD of Finland today manufacture these commercial hybrid-type turbines under aerodyn license, while Gamesa of Spain is currently testing a different 4.5 MW medium-speed prototype. Again, all three of these suppliers incorporate PMGs into their designs.

The

Switch. A PMG Specialist With Big Ambitions

The

Switch. A PMG Specialist With Big Ambitions

Early in 2009, The Switch of Vantaa, Finland, achieved a 1600 MW installed capacity mark, with a product portfolio comprising a range of high-performance permanent magnet-type and induction-type electrical machines, full-power converters and controls equipment. Today over 1000 wind turbines of different power ratings are running its technology, subdivided into low speed (direct drive), medium speed and high speed systems.

The Switch was founded in 2006 via a merger of three companies – Rotatek Finland, Verteco and Youtility. It employs 185 and comprises three divisions: The Switch Electrical Machines, The Switch High Power Converters, and US-based The Switch Controls and Converters.

Late last year [2009], The Switch Electrical Machines inaugurated a new factory in Lappeenranta, Finland. The latter uses a customer-focused product and process development concept aimed at maximizing return on investment, including optimised materials flow control. It also aims to serve as a blueprint for multi-site production with global partners. Known as The Switch Circle, the concept comprises three interdependent major elements or project phases: Design, Production, and Proactive.

Design extends from initial evaluation and consulting to product design, prototype testing and optimization up to a 5 MW power rating. The company offers its clients either standard solutions, which are proven and platform adapted, or dedicated customer-specific designs. Alternative options are technology license agreements for complete generator-converter systems or specific component/product sections. The Production phase aims to accelerate project execution and to provide rapid, on-time deliveries from the prototype phase to series production.

The Proactive element, meanwhile, is dedicated to providing a full equipment maintenance and service package. During the factory opening ceremony, CTO of The Switch, Olli Pyrhönen, explained: ‘Our business focus is on wind power and especially the development and manufacture of PMGs and full-power converter solutions. These are all 690 V low-voltage systems. For medium voltage converter systems there are currently only three or four suppliers, and the price level is by comparison substantially higher.’

Pyrhönen said that compared with state-of-the-art induction generator equivalents, multi-megawatt The Switch PMGs combine high-rated power efficiency in the 98% range whilst retaining near-same value over a wide partial-load range: ‘This matches favourably with wind turbines’ key characteristics, as these installations operate a majority of the time under partial-load conditions, a phenomenon due to inherent wind speed variability. Additional PMG advantages include compactness, developer application flexibility at combined 50 Hz and 60 Hz wind markets, and slip-ring elimination as a reliability enhancing feature.’

Another

oft-claimed advantage is that, compared with DFIGs, PMGs with

full-power converters offer easier compliance with stringent

future grid codes. On the other hand, the iron (Fe) elements in

the NdFeB magnet material makes these components prone to

corrosion, which necessitates long-lasting magnet insulation and

complete protection from harsh exterior environments. Also,

operating temperatures inside the generator rotor must be

limited to a maximum of 80°C in order to retain magnetic

properties. Current manufacturing capacity for The Switch

amounts to 1500 MW for generators and 3500 MW in converters,

with a target to expand generator output volume to 6000 MW and

converters to 7500 MW within two years. DongFang of China, among

the world’s largest suppliers of power engineering equipment,

currently manufactures most generators and power converters for

The Switch’s global distribution.

Another

oft-claimed advantage is that, compared with DFIGs, PMGs with

full-power converters offer easier compliance with stringent

future grid codes. On the other hand, the iron (Fe) elements in

the NdFeB magnet material makes these components prone to

corrosion, which necessitates long-lasting magnet insulation and

complete protection from harsh exterior environments. Also,

operating temperatures inside the generator rotor must be

limited to a maximum of 80°C in order to retain magnetic

properties. Current manufacturing capacity for The Switch

amounts to 1500 MW for generators and 3500 MW in converters,

with a target to expand generator output volume to 6000 MW and

converters to 7500 MW within two years. DongFang of China, among

the world’s largest suppliers of power engineering equipment,

currently manufactures most generators and power converters for

The Switch’s global distribution.

Ingeteam. Don’t Write off the DFIG Just Yet…

Ingeteam of Spain is a leading supplier of components and systems with a 12%–15% global market share for wind turbine generators and converters. The company recently announced construction of a new US$15 million facility in Milwaukee, Wisconsin, dedicated to renewable energy project equipment manufacture. Indar Electric, a 70-year old Ingeteam company specialising in rotating electrical machines, employs some 800 staff. Indar offers tailor-made drive solutions to its customers ranging across high speed, medium speed to low speed (direct drive), Hydro, marine and steel industry applications are also served.

The company’s CTO, Adolfo Rebollo, says: ‘We have many years of experience in developing a wide range of different generator concepts. These include synchronous and induction machines, PMGs and DFIGs in the power rating of range 1–50 MW and 1–15 kV level, depending on customer demand, where the largest units up to 50 MW are direct drive units applied in hydro plants. Our new world-class testing facilities in Beasain offer a full load testing capacity up to 60 MW for both generators and converter systems.’ In wind turbine generators alone the company has supplied more than 12,500 units, corresponding to some 14,500 MW over the past 10 years, he says. One recent project completed by Indar involved a 5 MW offshore wind turbine concept study.

The

outcome indicated a preference between either of two alternative

medium-speed solutions, or a given direct drive system. Rebollo

adds: ‘For medium speed systems in the range 2.5–5 MW size

turbines, we see two different tendencies; a single-stage

gearbox and about 150 nominal generator rpm, and a faster

running double-stage gearbox with generator running at some 450

rpm. In our view a PMG might offer an optimal overall choice for

direct drive and medium speed drive systems, largely due to

[more compact] dimensioning considerations. Following last

year’s reports on rare earth materials sourcing and future

availability, we noticed that some turbine manufacturers have

become very concerned about applying PMGs.’

The

outcome indicated a preference between either of two alternative

medium-speed solutions, or a given direct drive system. Rebollo

adds: ‘For medium speed systems in the range 2.5–5 MW size

turbines, we see two different tendencies; a single-stage

gearbox and about 150 nominal generator rpm, and a faster

running double-stage gearbox with generator running at some 450

rpm. In our view a PMG might offer an optimal overall choice for

direct drive and medium speed drive systems, largely due to

[more compact] dimensioning considerations. Following last

year’s reports on rare earth materials sourcing and future

availability, we noticed that some turbine manufacturers have

become very concerned about applying PMGs.’

Rebollo says that Indar/Ingeteam is not convinced that a PMG is always superior to a DFIG solution at systems level. Referring to a recently completed comparative systems analysis between a fast-speed multi-megawatt PMG with full converter, and a DFIG-partial converter (25%–30%) combination, Rebollo commented: ‘The study was performed for a client and results clearly indicated that the DFIG combination showed superior total efficiency performance over the entire speed range. Although most of our new projects that are being developed comprise a PMG with full power converter, the main concerns of our customers regarding DFIG point to grid codes compliance. However, we are proud that all the tests we have performed in this area showed satisfactory results. In fact, with the right hardware and control techniques even the most demanding grid codes can be fulfilled with an Indar/Ingeteam DFIG system. Indar/Ingeteam during 2009 retrofitted over 2000 DFIG units supplied between 1997 and 2000 aimed at enabling these “older generation” wind turbines to comply with the latest REE P.O. 12.3 grid code.’

A final Indar/Ingeteam solution for fast-speed geared wind turbines highlighted was the Ingecon Clean Power Series. This uses a DFIG with an integrated so-called exciter PMG, together comprising a device known as an xDFM – in essence a permanent magnet-type synchronous machine mechanically coupled to the DFIG inside a standard housing.

In an analogy to a ‘standard’ DFIG system, the Ingecon Clean Power Series System unit comprises a partial power converter with 25%–30% generator rated power. The exciter machine rated capacity is about 16%–18% of generator power rating. Its inclusion makes it possible to connect the power converter to the rotor of the DFIG, and to the stator of the PMG and is thus isolated from the grid with the stator being therefore the only grid-connected output.

By comparison, with a ‘standard’ DFIG generator, rotor power is fed into the grid via a power converter, with the stator directly grid-connected (as is also the case in the xDFM). ‘As the converter is always active and isolated from the network, the xDFM technology offers outstanding grid quality as well as exceptional Low Voltage Ride Through capabilities. That, in turn, limits torque peaks and reduces mechanical peak loads that otherwise typically happened during a grid fault or in emergency situations,’ Rebollo concluded.

Sidebar: Rare Earth-Materials: China’s High-Tech Trump Cards?

Rare earth-materials are used in a wide range of today’s high-tech consumer and industrial products and are critical enablers for many emerging ‘green energy’ technologies, such as plug-in hybrid electric vehicles, some of the latest PM-type generators for wind turbines, compact flourescent lighting and miniaturized components incorporated in computer hard-disks, mobile telephones and MP3-players.

Commentators expect global demand for NdFeB to almost quadruple by 2030 and quantities required for specific applications can be significant. Industry sources quote, for instance, that the 60 kW fast speed electric motor fitted in a Toyota Prius hybrid vehicle contains at least 0.5 kg of NdFeB magnet material. For a PM-type generator fitted in a 5 MW direct drive wind turbine, these same sources quote a figure of up to 200 kg of NdFeB per MW power rating, around one tonne per machine. This is a much higher quantity compared to the relatively light and compact fast speed systems.

Former Chinese leader Deng Xiaoping observed years ago that the ‘Middle East has oil, but China has rare earth-elements.’ Xiaoping’s quote reappeared in the world’s press as the issue of supply of the materials resurfaced last year. This coverage followed a leaked Chinese government report named ‘Rare Earths Industry Development Plan 2009-2015’, which stated that China currently accounts for 93% of the world’s production of rare earth-elements (other sources speak of at least 95%). China also produces more than 99% of the output of dysprosium and terbium, which are vital for a wide range of green energy technologies and military applications.

The report stated that within six years (2015) Chinese rare earth-material exports might be restricted to 35,000 tonnes annually. By comparison, global demand during the past decade increased three-fold to about 125,000 tonnes and might reach 200,000 tonnes annually by 2014. By that time, China is expected to need its full annual rare earth-metals output for its local industries, with exports being reduced to zero. Simultaneously, China is said by the report to contain ‘only’ 53% of the world’s cumulative rare earth-element deposits. A major reason for this huge discrepancy between resource availability and China’s current near-monopoly market position is said to be largely economic.

During the 1990s a combination of surplus production, resulting low price levels and stringent environmental legislation led to a spate of mine closures in the West. China kept its mines open, benefitting from lower wage levels and, it is claimed, less stringent environmental legislation. Any prospect of rare earth-element/materials scarcity represents a worrying scenario for the many non-Chinese high-tech industries that increasingly depend upon their unrestricted availability on the open market.

Options to counteract a looming future shortage include – as some have already done – shifting industrial activity that depends on these materials to China itself, in order to safeguard supply.

However, besides the potential conflict with strategic and national security interests, this strategy might also severely hamper goals in other countries and regions to build strong ‘green Industries’.

A second option is accelerated mine reopening outside China, which is already being implemented in the US at Mountain Pass and Australia’s Mount Weld. Apart from these mines there are at least four additional, but smaller, mining locations spread over Canada and Australia. A third option is to search for other solutions outside the rare earth-material scope.

In a sign of its concern, the Japanese government has compiled a ‘Strategy for Ensuring Stable Supplies of Rare Metals’. Europe, like Japan, is not in a favourable strategic position as it lacks any significant resources in this area leaving the continent, according to some experts, fully dependent on imports for supplies.

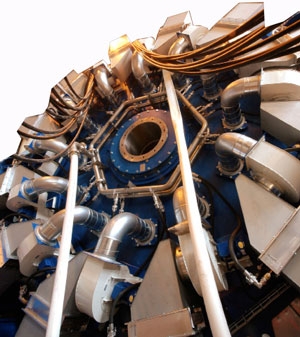

Siemens installs its first direct drive turbine test station with gearless technology that uses permanent magnets.

© Copyright 1999-2010 RenewableEnergyWorld.com - All rights reserved.

RenewableEnergyWorld.com - World's #1 Renewable Energy Network for

News & Information