The Kamakura Corporation Monthly Forecast of US Treasury Yields

Location: Honolulu

Author:

Donald R. van

Deventer

Date: Thursday, April 1, 2010

Concerns about potential rises in interest rates from unprecedented low levels have risen dramatically in the last few months. On January 6, 2010, U.S. banking regulators went so far as to issue an “interagency guidance” on interest rates, warning of the dangers that lie ahead. Beginning in April, Kamakura Corporation will issue a monthly forecast of U.S. Treasury yield curve movements over a ten year horizon. This post introduces the Kamakura rate forecasting procedure.

U.S. banking regulators issued their advisory on interest rate risk for good reason. A copy of that advisory can be found here.

Both because of the current low level of interest rates and the finances of the U.S. federal government, many are warning of a sharp rise in rates in the years ahead. Many others, however, are borrowing short and lending long in the hopes of earning a spread and closing out the position before the inevitable rate rise takes place. This strategy was recently described on www.twitter.com by @Prof_Pinch as the financial equivalent of running in front of an oncoming train to pick up a 25 cent coin from the train tracks.

Kamakura’s clients have long urged Kamakura to employ its yield curve smoothing technology to produce a forecast of future yields that is consistent with the current U.S. Treasury yield curve. Kamakura will launch this forecast beginning in April. U.S. Treasury yield curves will be produced for each month end for 120 months forward. The yield curve produced will reflect the 30 years of forward rates embedded in the current U.S. Treasury yield curve. These forward rates will be extracted by Kamakura using the maximum smoothness forward rate technique originally published by Adams and van Deventer in 1994 and modified by Imai and van Deventer in Financial Risk Analytics in 1996. The technique itself employs a proof by Oldrich Vasicek. A worked example of the maximum smoothness forward rate technique is given in this post entry from January 5, 2010.

A second worked example using bond prices as inputs to the smoothing process is given in this blog entry from January 20, 2010:

The Kamakura U.S. Treasury yield curve forecast takes the U.S. Treasury yield data from the Federal Reserve’s daily H15 statistical release as input. That statistical release is available on this link:

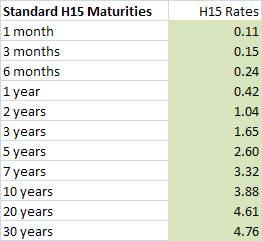

On March 29, 2010, the Federal Reserve reported these U.S. Treasury yields:

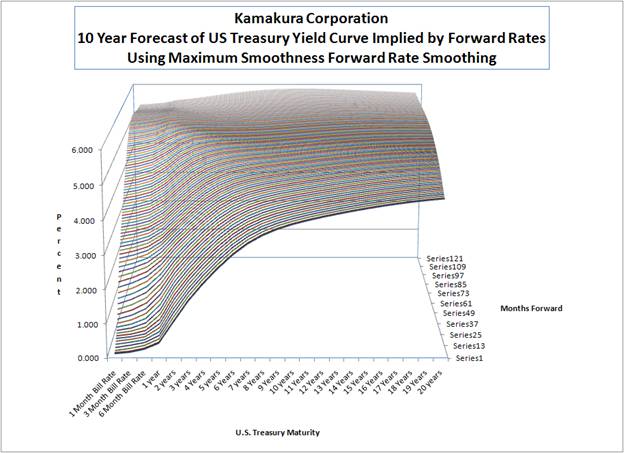

Kamakura then applies the maximum smoothness forward rate smoothing technology that has been embedded in the Kamakura Risk Manager enterprise risk management system since 1993. The Kamakura Risk Manager system is used by clients in 32 countries across a wide variety of interest rate environments. Using the maximum smoothness forward rate technique, Kamakura extracts forward rates and zero coupon bond prices at all forward dates for 30 years. Kamakura then constructs the U.S. Treasury bond yields that would be consistent with a mark to market of par value on each month end for the next 120 months. This graph shows the results of that analysis:

The graph shows that a sharp rise in short term Treasury rates is already embedded in current Treasury yields. It also shows that the current steep yield curve will evolve to a flat yield curve in the 5 to 6% range in the years ahead.

These forward yields can be used as a default forecast for asset and liability management valuation and net interest income simulation. They are at the heart of no arbitrage valuation and are consistent with the Heath-Jarrow-Morton pioneering work that defines what random variation in future interest rates is consistent with a no arbitrage condition.

Kamakura will be making these forward yield curves available in standard Kamakura Risk Manager data base format for clients who subscribe to the yield curve service. The following table summarizes the 10 year forecast for U.S. Treasury yields produced from the March 29, 2010 yield curve:

To subscribe or visit go to: http://www.riskcenter.com