Biofuels: Putting Pressure on Petrol

While the technical and cost potential of bio-products to compete with petroleum grows, can they match its giant scale? Mark Bünger explains why massively ramping up output will be the biggest challenge for bioenergy.

However, even as they seek to mitigate its drawbacks, they want to match oil's primary benefit – the availability of a large quantity of versatile, valuable material.

To date, most biofuels and biomaterials developers have focused on lab- and demo-scale studies to improve performance and reduce cost so they can compete with petroleum products, and those goals are coming within sight.

But in order to truly replace petroleum-based fuels and materials, they would need to reach petroleum parity, meaning that they were competitive on physical properties, cost, and scale. When investigating whether bio-based products can match or beat petroleum on these three measures, Lux Research reached a number of key findings.

Viable Bio-Based Alternatives Already Exist

Bio-based alternatives exist that can substitute for 92% of petroleum's products. Today, biomaterials and biofuels replace just 0.2% of petroleum products such as gasoline, diesel, and polyethylene. But technology exists to manufacture thousands of petroleum-based products from biomass. In principle, many more of the fuels and materials we derive from petroleum today could be replaced by bio-based alternatives like biopolypropylene, biobutanol, and biocrude.

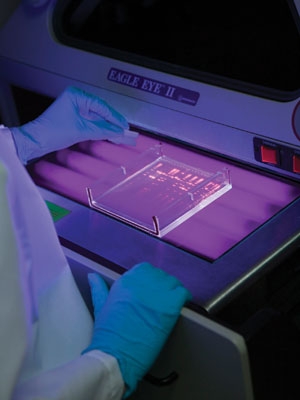

Below: Companies such as DuPont are developing biobutanol processes

For example, starch-based plastics often don't wholly stack up to those made using petrochemicals, but bio-based molecules that are identical to petroleum-derived monomers can simply be dropped into existing processes and products, boosting the substitution potential of bio-based plastics. Processing of bioethanol to ethylene, and thence to more complicated derivatives, allows for biologically derived versions of workhorse materials such as polyethylene (PE), polyvinyl chloride (PVC), and polyamides (PAs).

DSM recently launched castor-oil-derived EcoPaXX, a high-performance engineering plastic with a melting point of 250°C that can replace PA410. Synthetic biology start-ups like Draths, Elevance, and Segetis are using biomass to produce molecules like benzene, olefins, and levulinic acid that can lead to bio-based replacements for industrial chemical mainstays like phthalates, solvents, and nylon. Unlike bioethanol, which can be blended with gasoline only up to 10%, biobutanol is chemically compatible and energy-dense enough to potentially replace gasoline.

Start-ups ButylFuel, Tetravitae, and Gevo are developing biobutanol processes, as is a DuPont–BP joint venture. Dozens of companies such as PetroAlgae and Australia's CSIRO Forest Biosciences are starting to produce renewable diesel and 'biocrude' from algae and bacteria that are direct substitutes for petroleum fuels; Solazyme has even won a contract to supply 20,000 gallons of SolaDiesel to the US Navy.

If biomaterials and biofuels reach their maximum substitution potential with today's technology, they could replace 4.8 trillion litres of petroleum annually, or 92% of the total. In theory, of course, new technologies yet to be developed could produce biologically-based replacements for all petroleum, which is itself derived from biomass.

Cost Parity Achievable Within Five Years

Lux's next key conclusion was that biofuels and biomaterials will be reach cost parity with petroleum over the next three to five years. The cost of biologically-derived alternatives to petroleum products, without subsidies, ranges from 125% of the petroleum equivalent and upward for most fuels and plastics, even at industrial scale. For example, cane bioethanol can be made profitably at US$1.25 per gallon of gasoline equivalent, thanks to the plant yield in rainy parts of Brazil. Corn bioethanol in the US, on the other hand, is reeling from low oil prices and plants are closing. Based on US Congressional Budget Office estimates, with corn currently costing $3.70 per bushel, bioethanol costs $4.11 per gallon of gasoline equivalent; subsidies and co-product sales lower this to about $1.52/gal.

First-generation (cane and corn) bioethanol producers include Cosan, POET, ADM, Cargill, Aventine, Pacific Ethanol, and VeraSun; the latter three, like many other first-generation biofuel producers, are currently bankrupt and looking to be acquired (by Valero in VeraSun's case). Second-generation, or cellulosic, bioethanol currently costs about $6 per gallon to produce (including capital and logistics costs), and one ton of dry biomass will yield around 50 gallons. Petroleum-derived plastics consume only about 18% of petroleum produced, but these higher-value materials provide a disproportionate amount of the revenue compared to fuels – for example, $1.50/kg for ethylene, compared to an equivalent of $0.34/kg for gasoline at $1/gal.

While small-scale producers have cranked out bioethylene for $25/kg, several large projects are underway to produce bioethylene and biopropylene on an industrial scale, starting from bioethanol derived from Brazilian sugarcane. For example, Solvay Indupa's factory in Santo Andre, Brazil is expected to be fully operational in 2010, with an expected annual capacity of 60,000 tons of bioethylene, 360,000 tons of PVC, 360,000 tons of vinyl chloride, and 235,000 tons of caustic soda. Braskem already has a pilot plant, and expects to open an industrial facility by 2011 with a capacity of 200,000 tons per year. Dow Chemical and Crystalsev have a new facility, also planned to open by 2011, with a capacity of 350,000 tons per year, while Industrial Biotechnology and Cosan have announced a plant on the US Gulf coast that will import bioethanol from Brazil and should produce at least 200,000 tons of ethylene per year.

However, even at industrial scale, bioethylene is projected to cost approximately $4/kg – a 270% mark-up on its petroleum-based equivalent. Despite these apparently high costs, process improvements and economies of scale mean that biofuel and biomaterial costs are on a glidepath to intercept petroleum costs within the next three to five years.

Confronting the Challenges of Scale

The biggest challenge facing bio-based alternatives to oil is scale; they must be available in a meaningful fraction of the vast quantities produced by today's $250 billion petroleum industry to make an economic and environmental impact, and much larger scale is needed to help drive down costs. Waste biomass from crops and forests could provide a significant fraction of future fuel. To date, most biofuels have been derived from corn in the US, or from sugarcane in Brazil, but these crops can't be grown in arid regions or poor soil, so their scale is limited. Looking at all biomass, the US government's 'Billion-ton Study' found that the US produces 1.3 billion tons of biomass suitable for conversion to biofuels. Notably, the main sources of feedstock were not purpose-grown crops, but 316 million dry tons of residue from forestlands and 534 million dry tons of crop residues and other waste. In our estimates of global land use potential and yield, we found maximum available biomass actually exceeds oil equivalents, overwhelmingly due to the potential of waste biomass.

Biomass from new crops requires unsustainable land-use changes and water resources. A hectare of soybeans will yield 1.5 tons of dry biomass that can be converted into 200 kg of plastic or 197 litres of diesel. Some plant growers are attempting to refine oily crops to be higher-yield, or to extract oils from non-food plants like jatropha on non-arable land, but unfortunately these plants tend to require as much as 1000 litres of irrigated water per litre of fuel, which could strain water resources as badly, or worse than, simply sticking with current biomass mix.

While policymakers or developers might choose this unsustainable path, more likely future biofuels and biomaterials will need to be derived from biomass sources that demand little or no net water additions or major changes in land use. Doing otherwise would more than eliminate the environmental benefits that were the reason for biofuels and biomaterials in the first place.

Algae cultivated on land also requires far too much water. At the same time, a burgeoning algae industry is working on industrial methods to take advantage of algae's prolific growth for use as a bio-based source of fuels and materials, driving yields up from 5 tons to as much as 15 tons per acre per year. However, not even leading algal producer Martek has got beyond test batches of feedstocks for fuels or chemicals today. Moreover, covering vast areas of land with algae growing in water faces the same water-use conflict as irrigated crops, noted above, suggesting algae-based alternatives will have to be limited to small scale or to algae harvested from open water. If biomaterials and fuels utilize the maximum potential available biomass, with no food substitution, they could replace 21 trillion litres of petroleum annually – 447% of the total.

In the best case scenario, biofeedstocks reach just 3% of petroleum's share in 2020. So while biofuels and biomaterials are an insignificant competitor to petroleum products today, it's at least theoretically possible that could change. Technical performance of biomaterials is potentially good enough to substitute for a large percentage of petroleum. Costs, while still high, are declining, while oil prices have resumed their upward climb. And there's theoretically more than enough biomass feedstock available to meet fuel and material demand. Clearly, scale remains the key problem to solve: To make a meaningful dent in petroleum use, bio-based alternatives need biomass feedstock – a lot more of it than they can get today. We looked at global availability and economics for major feedstock classes, and estimated how much of them could be accessible by typically-sized biorefineries (with a 15 km to 50 km input radius) in 2020. Looking to 2020, what part of then-current demand of 40 billion barrels will come from bio-based matter and energy?

Crops Will Pose Expansion Challenges

Crops like soy, cane, and corn are highly restricted to cultivatable land areas, which occupy about 10% of the nearly 2 billion ha needed to fully replace petroleum. Since the land and the plants were originally developed to their effective maximum potential to provide food, significant expansion of this space almost inevitably means a reduction in food availability, which is politically and economically unfeasible. There are marginal expansions where, for example, grazing land can be cut back as livestock herds shrink, but these do not meaningfully change the overall picture. Nevertheless, aggressive government policies around the world should drive an approximate doubling of biofuel supplies from crops like soy, cane, and corn from 464 million barrels today to 977 million barrels in 2020.

Above: Algae offers potential opportunities but challenges of scale

To wring more from uncultivated land, researchers have explored the use of non-food crops like miscanthus and jatropha that can grow on land unsuitable for food. However, even as the Chinese and Indian governments in particular dedicated vast swathes of land to growing these potential fuel plants, scientists discovered in field tests that the yields are vastly lower than predicted, unless huge quantities of water were applied to the fields – an option that's simply unsustainable. While companies such as Ceres, Agrivida, and Mendel Biotechnologies are working to improve the yield of food and non-food crops like miscanthus with the aid of genetic engineering techniques, slow adoption by conservative farmers means that the additional impact of these crops is minimal. Even assuming that some of the grand projects do proceed, we estimate non-food crops will expand to just 107 million barrels annually by 2020, up from immeasurably small lab quantities today.

Investment Costs and Scale an Issue for Algae

Algae multiply prodigiously, doubling their weight in as little as 12 hours if given enough carbon dioxide, water, and sunlight. Their tendency to proliferate has spurred developers like Solix and AB2E to construct vast artificial ponds and enclosed photobioreactors, where waste CO2 from coal plants, advanced light-catching geometries, and light sources like Bionavitas' maximize their growth potential. Credible analyses show that in the right conditions, algae raised in a photobioreactor could produce 20,000 gallons of diesel fuel per year per acre, beating any other feedstock by one or two orders of magnitude. The dealbreaker, however, is in the vast capital investment these photobioreactors require – from $20/m2 to $100/m2, or $200,000/ha to $1 million/ha – adding $100 to the cost of a barrel of fuel feedstock. These costs are not readily amenable to improvement through scientific breakthroughs, and are at best likely to decline 10% over the next 10 years. Based on the horrendous capital outlays, we believe that closed-system algae are unlikely to contribute measurably to biofuel supply at all.

Companies like Kai Biotechnologies grow algae in open water, where capital costs are negligible, nutrients and sunlight plentiful, and microorganisms literally feel right at home. Given an optimal set of circumstances, open-water breeders might learn within 10 years to cultivate and process algae as productively as photobioreactors today (in addition to solving known problems like contamination and dewatering). At those rates, an area of 325,000 ha would economically produce about 2.6 million gallons annually. Since scale is the issue, developers should consider other companies farming the oceans. For example, Ocean Tech is farming macroalgae (kelp), while Algae Systems, StatoilHydro, and Algasol are growing algae in inexpensive, extruded plastic bags in the ocean, where water, sun, and surface area are abundant. Nonetheless, the likely contribution to total world fuel supply is minimal, at 60,000 barrels annually.

While purpose-grown feedstocks have no hope of significantly changing the petroleum picture, their residues as well as the tracts of land not currently cultivated at all can be more effectively harvested to gather biomass. The US 'Billion Ton' study found 1.3 billion tons of forest and agricultural waste biomass available; extrapolating to global figures and using updated conversion ratios, we find roughly 7 billion tons, or about 7 billion BOE. By 2020, at most 1 billion BOE of this will be economically accessible by nearby biorefineries. Municipal solid waste could potentially add another 102 million barrels annually by 2020, and firms such as Enerkem and Fulcrum are pursuing this by offsetting the $30 a ton it costs to landfill municipal solid water, benefitting from negative raw material costs as producers will pay to have their waste taken away.

Confronting the Sobering Reality

The sobering reality is that even with the benefit of parity on performance and costs, biofuels and biomaterials will lack the scale to meaningfully (more than a few percent) change the petroleum picture for decades to come. In the meantime, petroleum usage and carbon emissions will increase at an even faster rate. To achieve the goals that drove developers, customers, and policymakers to consider biofuels and biomaterials in the first place – securing a supply of affordable transportation fuel and industrial material, and reducing the amount of carbon dioxide entering the atmosphere – these players should focus on feedstocks that can grow a few extra gigatons. With current policies, there is a large risk that the world is fostering a cottage industry of tiny, individually profitable biofuel and biomaterial makers with a collective contribution that's effectively negligible. Technologies, subsidies, and investment must shift from funding research geared to reducing process cost to activities that massively increase scale: more feedstock biomass, more biorefineries, and cheaper transportation that will enable the creation and exploitation of at least five gigatons of additional biomass every year – the amount that would offset the net annual increase of CO2 in the atmosphere from petroleum sources. Making this leap means ignoring animal waste, soybeans, and in fact nearly every feedstock except algae and agricultural and forest waste. It also means supporting activities only indirectly meant to create biomass for biofuels, such as reversing deforestation and desertification. As for securing energy from safer sources, nations need to redouble conservation efforts, and prepare for Plan B – or many Plan Bs.