Gold, Early 1930s vs Early 2010s

Location: Chicago

Author:

Paul Kasriel

Date: Wednesday, June 2, 2010

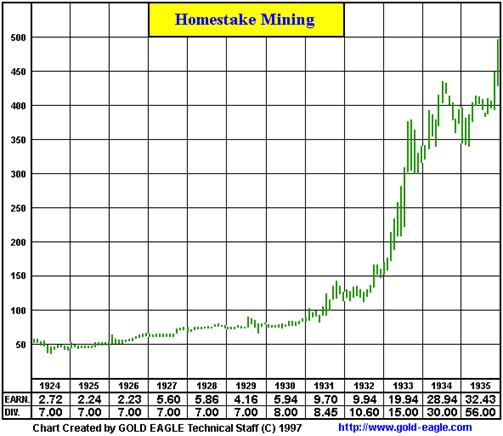

Much is being made of late of the out-performance of gold mining stocks vs. stocks in general in the early 1930s. Charts 1 and 2 show the behavior of the Dow-Jones Industrials stock average and the price of Homestake Mining Company from 1924 through 1935. From its peak in October 1929 through December 1935, the Dow-Jones stock average was down 64%. During the same interval, a share of Homestake Mining Company, a gold mining stock, was up a whopping 519%. Some commentators are arguing that the investment performance of gold mining stocks vs. general stock during the early 1930s will repeat in the early 2010s Ė i.e., gold will outperform stocks in general.

Chart 1

Chart 2

Before rushing to sell your SPDRs and buying GLD, consider some important differences between the early 1930s and the early 2010s. Until May 1933, the U.S. maintained the price of an ounce of gold at $20.67. This meant that gold producers could receive a guaranteed price of $20.67 per ounce of gold presented to the U.S. mint regardless of their costs of production. I do not have production costs for gold mining companies, but if their costs were related to the behavior of the CPI and the unemployment rate, there is a high probability that their production costs were falling in the early 1930s. Chart 3 shows what was happening to the U.S. unemployment rate and the percentage changes in the U.S. CPI in the years 1929 through 1935. The average annual unemployment rate rose from 3.2% in 1929 to a cycle high of 25.2% in 1935. The unemployment rate was above 20% in each of the four years from 1932 through 1935. The annual average CPI was declining from 1930 through 1933. It increased by 3.48% and 2.55% in the years 1934 and 1935, respectively. So, from 1929 through May 1933, gold miners had a guaranteed selling price of $20.67 per ounce for their output as their production costs likely were falling. During the same period, non-gold-mining corporations also likely enjoyed falling production costs. But unlike gold producers, they endured falling sales prices and declining volumes.

Chart 3

But it got even better for gold producers soon after FDR assumed the presidency in early March 1933. On March 6, 1933, FDR closed the nationís banks for four days and ordered that banks to cease redeeming deposits for gold certificates. On April 5, FDR ordered that the publicís holdings of gold coins and gold certificates in excess of $100 be turned in to the Federal Reserve by May 10 at a redemption value of $20.67 in fiat currency. On April 20, 1933, FDR ordered an embargo on gold exports, effectively taking the U.S. off the gold standard. On May 12, 1933, Congress passed legislation allowing the president to decrease the gold content of U.S. the dollar price up to 50%. During the autumn of 1933, FDRís Treasury gradually increased the dollar price of gold. Then in January 1934, the U.S. established a dollar-gold convertibility for foreign entities and, presumably for domestic gold producers, of $35 per ounce of gold. This represented a 69% increase in the price at which gold mining companies could sell their production compared with March 1933. Given the behavior of the CPI in 1933 and 1934, it is doubtful that there were many other industries that enjoyed a 69% increase in their sales prices during this period. Moreover, the Treasury stood ready to purchase as much gold as was presented to it at $35 an ounce. Is it any wonder, then, that gold mining stocks outperformed stocks in general from 1933 through 1935?

Letís fast forward to today. No government is pegging the price of gold in terms of its currency. Despite bouts of quantitative easing policies by various developed-economy central banks, despite near-zero policy interest rates being maintained by various developed-economy central banks and despite significant increases in borrowing by various developed-economy central governments, CPI inflation remains relatively low. As Chart 4 shows, year-over-year changes in the CPIs of Japan, the Euro-zone and the U.S. through April of this year are well below their peaks just after the onset of the last global recession and are generally running at rates below those of the previous nine years. Moreover, not only is the current rate of inflation relatively low in various developed economies, with Japan experiencing deflation, the outlook is for continued low inflation given the relatively slow rate of growth in the M2 money supplies in these economies (see Chart 5).

Chart 4

Chart 5

If goldís primary appeal as an asset to hold is a hedge against future inflation, whatís the hurry to get into gold? Current inflation is relatively low and the outlook for inflation over the next several years would seem to be that inflation will remain low given the growth in national money supplies. Yes, there are political incentives for central governments to create higher rates of inflation, but the inflation ďtransmissionĒ is not functioning. That is commercial banks and other private monetary financial institutions (MFIs) are not creating the credit necessary to increase inflation rates (see Chart 6).

Chart 6

U.S. gold mining stocks were strong performers in the 1930s not because investors gravitated to gold as a hedge against future inflation or because of a loss in the faith of fiat currency. U.S. gold mining stocks were strong performers in the 1930s because the U.S. Treasury was guaranteeing gold miners a steady or rising price for their production as their production costs were falling. Moreover, gold miners could sell as much as they wanted at the guaranteed price. So, their margins were widening as were their volumes. For most other industries, margins were being compressed as selling prices were falling faster than production costs. And with the collapse in private aggregate demand, other industries were experiencing decreasing volumes of unit sales until the economic recovery commenced in April 1933. It may be that gold turns out to be a superior investment asset in the next several years. But if this occurs, it will be for entirely different reasons than why gold mining stocks proved to be a superior investment asset in the early 1930s. Think about this before you dump your SPDRS in favor of GLD.

One last thought. A lot of commentators are making the argument for rising gold prices based on the fact that major central banks are keeping policy interest rates exceptionally low. Many of these commentators are interpreting the low level of policy interest rates as an indication of excessively accommodative monetary policies. But one of the major contributions of Milton Friedmanís economic research was that you cannot judge the degree of accommodation or restrictiveness of a monetary policy by the level of interest rates. In environments when the demand for credit is very low and the ability of MFIs to create credit is capital-constrained, money supply growth would likely be low. In this case, a low level of the policy interest rate should not be viewed as indicative of an accommodative monetary policy. In environments when the demand for credit is strong, MFIs are not constrained by capital in their credit creation and money supply growth is high, a high level of the policy interest rate should not be viewed as indicative of a restrictive monetary policy. Charts 5 and 6 suggest that the current low level of policy interest rates would not be considered indicative of accommodative monetary policies according to Friedmanís analysis. To paraphrase George Bernard Shaw: We learn from Friedman that we learn nothing from Friedman.

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

To subscribe or visit go to: http://www.riskcenter.com