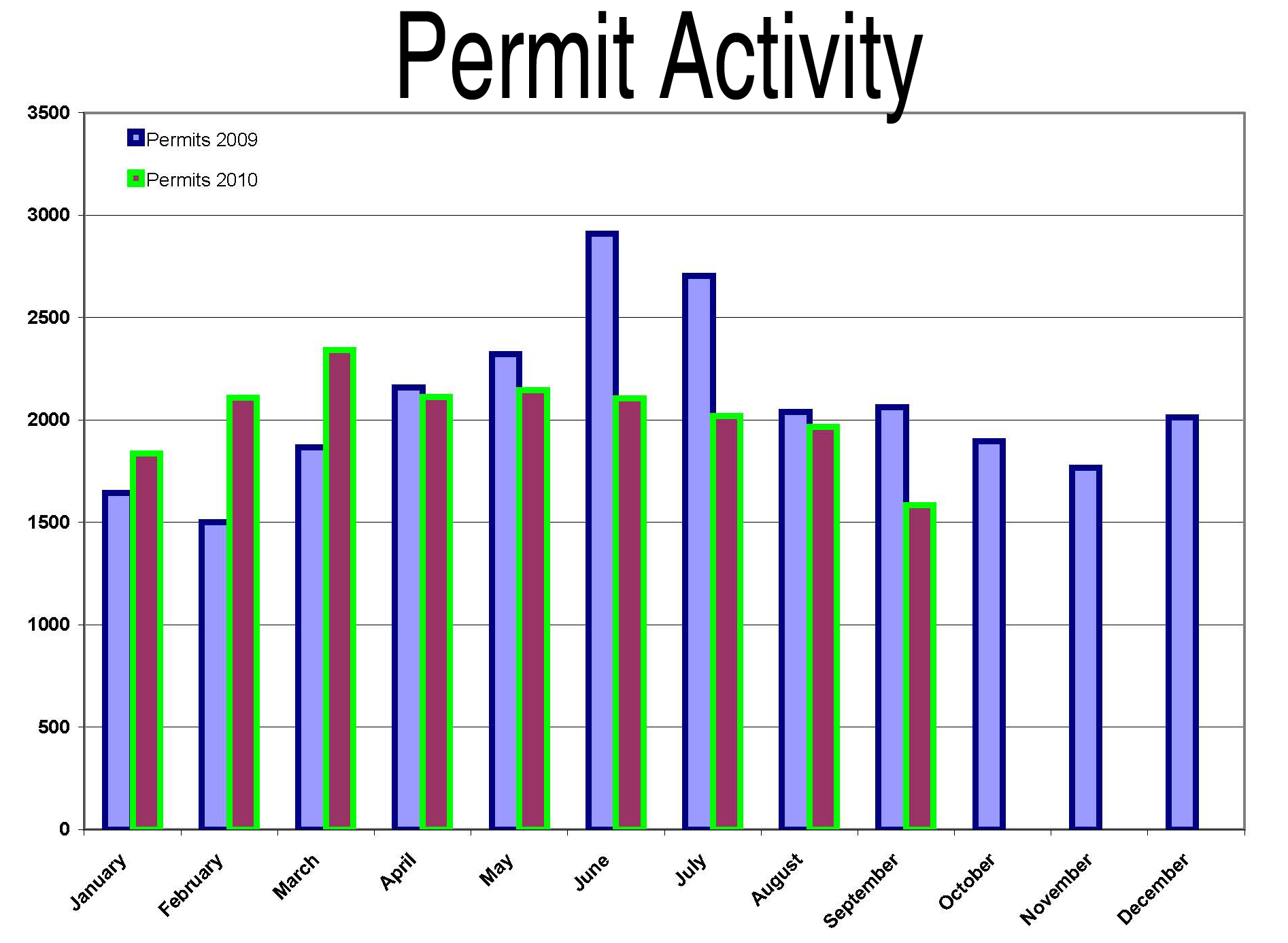

Building Permits: Time to Buckle Down.

The Good: Properties affected by a

foreclosure accounted for over half of all

residential permits (additions, remodels, etc.)

issued in the third quarter. As long as a steady

stream of REO properties are being resold in the

region then contractors should have plenty of

prospects to target. Though the summer showed

some weakness, as we approach the fourth quarter

we expect the declines to level off from here.Â

Also, there are several new builders breaking

ground in Pinal County which should bring

numbers up in the future.

The Bad: Permitting levels

fell a combined 12.44%, primarily dragged down

by low totals coming out of production/tract

home starts. Home starts in the area dropped

7.6% overall and are well below the highs set in

the first quarter. This is not to be unexpected;

builders in the area are dealing with a very

different market than they were in the first

quarter when production was ramped up due to a

hot housing market. Commercial construction

(tenant improvements, shell construction) also

dipped further in all three counties.Â

Outlook: It appears the summer

swing is finally over as permitting totals

dropped 19.57% in September to lead us into the

4th quarter. We expect current permitting volume

to persist throughout the quarter as the usual

holiday slowdown sets in. Those working in

construction related industries should prepare

themselves for lower levels of activity until

next year.