Economist Issues Stark Warning America Is ‘Spending Itself Into the Economic Grave’

Boston University’s Laurence Kotlikoff made headlines recently with his startling calculation of the real debt facing U.S. taxpayers — $202 trillion. It’s not a hard figure to reach, he says, if you take the facts about our spending seriously and honestly.

Our “official” debt of $9 trillion is laughable, Kotlikoff argues. Add up our promises to pay for retirement and healthcare and our outstanding debts and compare that to realistically projected revenues: Unless we immediately double all taxes, we already are completely broke, he says. America’s entitlement programs are going to “spend us into the economic grave,” the economist warns.

Kotlikoff’s new book, Jimmy Stewart is Dead: Ending the World’s Ongoing Financial Plague with Limited Purpose Banking, lays out a radically simple solution, one that involves government, yes, but also cuts Wall Street out of the picture. He would turn virtually all of our riskoriented financial system into regulated mutual funds. No more “too big to fail.”

In fact, the only serious answer, Kotlikoff argues, is a wholesale re-engineering of social programs put in place a generation ago to end poverty. He’s not for pushing the elderly out into the cold. Instead, he makes the case that we’ve already guaranteed that outcome unless action is taken now.

“There is a way to fix things, which is you have to get your financial system in good shape,” Kotlikoff tells Moneynews.com and Financial Intelligence Report. “You have to reform very simply and fundamentally and radically the healthcare system so that everybody has a health insurance plan but it doesn’t drive the country broke. You have to reform the Social Security system so it’s not driving us broke, which it is.”

He doesn’t believe that government has no role — it would continue to run a version of Social Security and would manage healthcare through the expansion of an existing Medicare voucher system — but that its role should be understandable by ordinary people.

Among other strategies, for instance, he would create a financial version of the Food and Drug Administration, what he calls the Federal Financial Authority, to replace the more than 115 agencies seemingly incapable of stopping the economic lurches of the past decade.

“Unless we do it with very simple solutions like the kind I’m outlining with respect to the financial reform, we’re going to have a mess. We’re going to have the country having to print trillions upon trillions of dollars to pay these bills that are coming due,” Kotlikoff warns.

Kotlikoff is a William Fairfield Warren Professor at Boston University, a research associate at the National Bureau of Economic Research, and president of Economic Security Planning, Inc., a company specializing in financial planning software.

Kotlikoff received his B.A. in economics from the University of Pennsylvania in 1973 and his Ph.D. in economics from Harvard University in 1977. From 1977 through 1983 he served on the faculties of economics of the University of California, Los Angeles, and Yale University. In 1981-82 he was a senior economist with the President’s Council of Economic Advisers.

Here is the complete interview with Laurence Kotlikoff:

Your new book is entitled Jimmy Stewart Is Dead. Please explain the meaning behind the title.

We have this image of the financial system as being run by Jimmy Stewarts, by George Baileys [Stewart portrayed Bailey in It’s a Wonderful Life], who are trustworthy, honest bankers who can be relied on to have our interests in mind, but that’s no longer the case. We have huge financial conglomerates. They are not our buddies, our neighbors. They could care less about us, and what we saw in the last few years is that these companies are engaged in systematically producing fraudulent securities. That’s what we saw.

We saw the production of trillions of dollars of what we call “toxic” assets. We need to have a financial system where there is full disclosure and transparency before people are going to trust it again and before the economy is actually going to get back to working again.

You’re not seeing that in this new financial legislation that the president and Congress have just passed, the Dodd-Frank Bill. You’re seeing the ability of these financial giants to continue to disguise what they are doing under the heading “proprietary information.” They are all saying to us, “Hey, you can’t see what we’re doing because it’s proprietary. If we reveal what we’re doing, we’re going to hand over our secret formula for making you a mint. So you, our customers, cannot see what we’re doing with your money.”

That’s a prescription for making up fraudulent securities and then trying to sell them to us and people around the world, and that’s what we saw happen. So, until we get some transparency, we’re not going to get a fix to the financial system. That’s the fundamental flaw with the Dodd-Frank Bill.

What is limited-purpose banking, and why do you see it as a solution?

Limited-purpose banking is simply taking all of these financial intermediaries, banks, insurance companies, hedge funds, private equity companies, anybody that wants to operate with limited liability so that the owners can’t personally be sued — if they want to operate that way, they have to become mutual fund companies.

They can no longer borrow money and say to the lenders, “Don’t worry, we’re going to pay your money back and then go and invest it at risk and then lose it, and then turn to the taxpayer and say make good on our loans here because we can’t do it and we’re too big to fail.” That doesn’t happen under limited-purpose banking.

Under limited-purpose banking a Citigroup becomes a mutual fund company just like Fidelity Investments. Citigroup then does one thing, which is it markets mutual funds. Their investment banking becomes a consulting business; their trading becomes a matching of buyers and sellers of securities. They are not going to have any net exposure and otherwise they are just marketing mutual funds. Money comes into the mutual funds on a 100 percent equity basis.

People buy shares in the mutual funds. The mutual funds will be investing in stocks or bonds or, you know, Treasury bills, whatever it is. Citigroup could have hundreds of mutual funds that they are marketing.

The public will know what it is that they are investing in and these securities that the mutual funds are dealing with would be fully disclosed and rated and verified in terms of their collateral values by this Federal Financial Authority.

So we’ll have a transparent, simple system. People will buy mortgage mutual funds, and those people trying to borrow to buy a house will sell their paper to the mutual fund who is investing in mortgages in their area, and there will be many, many mutual funds investing in mortgages.

We already have them. We have to realize that a third of the financial system is already mutual funds. In other words, the financial system, a third of its assets are held by mutual fund companies. The glass is already one-third full. I want to make it threethirds full.

The mutual fund companies did not collapse. We had a problem with the Primary Reserve Fund where the government agreed to back the buck, but under what I’m proposing no mutual fund would be backed to the buck.

There’s only one mutual fund that would be backed to the buck, one type of mutual fund, and that would be a cash mutual fund that just holds cash.

So there would be a buck there for every buck that’s invested. Otherwise, everything floats on the market and nothing can go bust.

You say the real debt is many times over what the government says — a staggering $202 trillion. How did you arrive at that astounding figure?

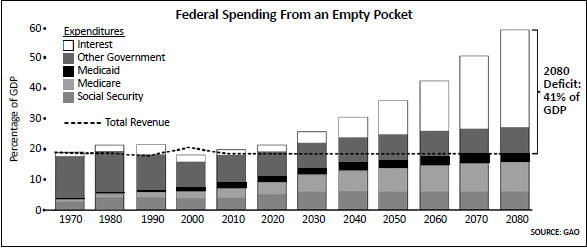

Well, I took the Congressional Budget Office (CBO) projections, long-term projections that they released in June of this year. It’s called their Alternative Long-term Fiscal Scenario, and I just formed the present value difference between all of the spending that we have projected to do according to the CBO and all of the tax revenue, and I formed this “fiscal gap.”

This present-value difference between all of the future spending and all of the future revenue turns out to be $202 trillion. So that’s a prescription for bankruptcy. The country cannot pay, cannot come up with $202 trillion. We’d have to more than double all of the taxes we have — the federal

| corporate income tax, the federal personal income tax, the FICA taxes, estate and gift taxes. We would have to double all of the taxes going forward every year through time into the indefinite future to come up with $202 trillion.

So we have to understand that we’re going to have to get spending under control. I’ve outlined in the book Jimmy Stewart Is Dead how to do that, and there are ways to get control of things. But, unless we do it with very simple solutions like the kind I’m outlining with respect to financial reform, we’re going to have a mess. We’re going to have to print trillions upon trillions of dollars to pay these bills that are coming due. You recently wrote that the United States is one foot away from a deep and permanent economic grave. Now, did you mean to overstate things deliberately, or have we really gone that far? No, that wasn’t an overstatement. You see, when you have this kind of fiscal situation out there, it’s like a sword of Damocles hanging over the economy. At any point in time, the Chinese or the Koreans or the Japanese, somebody, can decide that our debt is too risky to hold and that the only way that Uncle Sam is going to pay these bills is by printing money. If you’re holding a 30-year Treasury bond and we have 10 percent inflation — just 10 percent inflation — that’s enough to wipe out the value of your 30- year Treasury bond. Now, obviously, right now the inflation rate is very low, if not negative. But we have already more than doubled the base money supply, what’s called the monetary base, since 2007. The monetary base has increased by a factor of 2.4. Ben Bernanke has discussed increasing it by even more, and if you look at the bills that are coming due and the fact that we’re not really being serious about tax hikes or serious about spending cuts, then the only way you can pay for this stuff is by printing lots of money through time. That leads to inflation — if not hyperinflation — and then you don’t pay back in real terms what you actually promised to pay. That’s actually a definition of bankruptcy — when you don’t pay back your creditors. You expect three effects of this debt: benefit cuts, higher taxes, and inflation, that is, money printing. Is there no bottom from which we presumably can recover or at least finance part of this? There is a way to fix things, which is you have to get your financial system in good shape. You have to reform very simply and fundamentally and radically the healthcare system so that everybody has a health insurance plan but it doesn’t drive the country broke. You have to reform the Social Security systems so it’s not driving us broke, which it is. On its own, it’s one quarter underfunded, just looking at Social Security, and then you have to fix the tax system, which is a terrible mess. And you have to pull back on defense, because we’re spending too much on defense. So, if you do these things you can get the economy to move ahead, but it’s very late in the day. What can the Federal Reserve or the government do at this point, if anything, about the economy? The Fed really is not in a position to fundamentally reform the healthcare system so we know for sure that we can keep federal expenditures at 10 percent of GDP, which is what Switzerland spends on all of its healthcare. That’s what we need to do. We need to have a federal policy that limits federal expenditures on healthcare to 10 percent of GDP and gives everybody a basic plan based on that, and I outline that in the book. Printing money is a sure-fire route to massive inflation. Can this realistically be avoided? We need real leadership at the top. We need the president to understand that the 2,000-page solutions are not real solutions, and that the anger that the country has with his solutions is partly his fault. That he has put together a team of economists who focused on things that are politically “feasible” as opposed to things that are economically useful. That’s what we need — economically useful, transparent, simple things that will give people the encouragement to think positively about the economy. If we have very simple solutions, then people will realize that the government is not in the way. It’s actually part of the answer. Investors can’t seem to get enough of Treasury debt. That seems insane considering the risk of quickly rising rates. It’s insane. It’s absolutely insane because the investors don’t seem to understand that most of our debts are not the official debts. They are the unofficial debts to pay off Medicare benefits into the future; Medicaid benefits; Social Security benefits; this new health exchange; the defense spending. All of those bills are why our fiscal gap is $202 trillion and not $9 trillion, which is the size of the official debt. So we have these unofficial debts which are huge. The official debt is relatively small. The bond traders are focused on the official debt. They don’t realize that the unofficial debt is more likely to get paid off than the official debt. You can easily renege on the official debt just by printing money. The unofficial debt is in large part indexed to inflation. So it’s absolutely insane for anybody to buy long-term nominal bonds that are denominated in dollars, whether they’re issued by the U.S. government or by a U.S. corporation because, as things now look, we’re going to be printing money out the wazoo. Let’s talk about your alternative to Social Security — the Personal Security System. You figure that Social Security is 26 percent underfunded. How does your idea close that gap? Well, first of all, I don’t figure it. The Social Security Trustees figure it. If you look at the Social Security Report, you’ll see the fiscal gap that they calculate over the infinite horizon for Social Security. It turns out it’s 26 percent of Social Security taxes. So, this system needs an immediate and permanent 26 percent hike in payroll taxes, or an immediate and permanent 26 percent cut in Social Security benefits. So imagine going to everybody who’s collecting Social Security benefits, 62 and over, and telling them, “Guess what folks, we’re going to cut your Social Security benefits immediately and permanently by a quarter.” That would, obviously, not be a very happy announcement for those people. That’s the magnitude of the adjustment that is needed just in Social Security. So what I’m proposing is to freeze Social Security in place. You don’t take the benefits away from anybody who is currently collecting and you just give everybody who’s now working what they have accrued under the old system.

You fill in zeros in their earnings records. You freeze the current Social Security system in place. You in effect retire it, and then what you do is you force everybody to contribute to an individual account, a personal account. The government makes matching contributions to make it progressive. The contributions are split between spouses and legal partners so that a non-working spouse is covered, and then the entire investments are invested in a global market-weighted index fund by the government, by a government computer, not by Wall Street. So Wall Street doesn’t get its hands on any of this money. It’s invested automatically by a computer and the government guarantees the downside so that people get back for sure an annuity based on what they contributed, adjusted for inflation. So they are going to at least get a zero real return under what I am proposing, a floor to their investment return, but otherwise they are going to do better and then at retirement age their account balances are gradually sold off and converted into inflation-protected annuities. This is done by the government — not by the insurance industry. So you are using private markets but you also have very strong involvement by the government and you have compulsory saving, compulsory annuitization, and you have a very simple solution to Social Security. And you save that system lots of money because you’re just paying the accrued benefits and not the projected benefits — and there’s a big difference in present value between those two things. Do you believe a market-based retirement system will fly, considering how badly it was rejected when George W. Bush floated the idea? Well, George Bush’s proposal was really halfbaked and a con job set up to enrich Wall Street. I’m proposing something where Wall Street makes nothing — zero. You know what that word means, zero? Zero. There’s no fees. There’s no involvement at all by Wall Street in what I’m proposing. And I’m proposing something in a much higher scale with downside protection that’s doing all of the legitimate things that the government should be doing here — forcing people to save, protecting the downside, and then making sure that they get their old-age income in a form that continues until they die so they can’t run out of money and the insurance industry won’t be making money off of them. So, yeah, I think this would fly if we really sat down and explained this to the public. What are the objectives of Social Security? What are the legitimate objectives? What’s the financial problem? What’s the solution that doesn’t involve paying middlemen who are out for themselves? Let’s try and use the financial architecture that we have. The other point that you need to understand here is that there’s an illusion that Social Security benefits are safe. But what we’re seeing is tax hikes coming that are going to cut people’s net Social Security benefits because the threshold beyond where Social Security benefits are subject to federal income taxation is not inflation indexed. So the next generation is going to get about a 20 percent benefit cut through that route. They are also going to lose probably about 20 percent of their benefits if the retirement age is raised by three years, which is what the Fiscal Commission is likely to propose. That’s a 40 percent cut in the Social Security benefits of my kid. Now, you’re telling me that that is a safe system? What’s safe about it? It’s not safe. We’re just trying to confuse ourselves by not really realizing that the risk of this economy is coming at us either through the front door or through the back door. We can’t avoid it. All we can do is try and make sure the risk is real risk, not man-made risk, and what we’ve done now with our fiscal problems and our financial system is set up a system with man-made risk, enormous man-made risk, and that’s what I’m trying to stop. You suggest that all Americans should simply be enrolled in Medicare Part C. Elaborate, please. Medicare Part C is exactly this medical security system I outline in the book and have mentioned here. Medicare Part C gives everybody a voucher which is individual specific. You don’t actually get a piece of paper in the mail if you’re in Medicare Part C. What happens is that you sign up with an insurance company and the government sends the insurance company some money, and the amount of money that they send the insurance company depends on your pre-existing conditions. So, if we can get everybody enrolled in Medicare Part C, it’s an existing institution. It’s the Republican part of Medicare. Medicare is a Democratic program. Medicare Part C is a Republican part of it. If we can get Medicare Part C to work the way I am proposing, where the vouchers that are being handed out to the public — and I’m talking about including everybody in Medicare Part C, every single American in Medicare Part C — everybody gets a voucher and then you would have a panel of doctors.

You can call it a “life panel,” a “death panel,” I don’t care what you call it, but it’s a panel that would determine what is covered by the basic plan so that the total cost of the vouchers does not exceed 10 percent of GDP. That will do wonders for getting our fiscal problem under control. Warren Buffett likes to talk up America as the greatest country for investors. It can be easy to attack economists as infected with negativity, that they discount ingenuity and resolve. What do you say to this kind of reaction? Well, Warren Buffett is a great investor, and I think he’s a great American, but that doesn’t mean that our country doesn’t have fiscal problems. It has enormous fiscal problems. He’s not even probably looking at the magnitude of them. He’s probably looking at the official debt numbers as opposed to the true fiscal gap. The fact that Americans are ingenious and inventive and resourceful, that’s fine, but if you have a fiscal system and a financial system that is a bureaucratic mess everywhere you look, how is that ingenuity and inventiveness going to actually get a chance to show itself? You’ve got a tax system with 17,000 pages of IRS code. We have taxes within taxes within the income tax. You have a Social Security system with 2,728 separate rules in its handbook, rules that nobody can remotely understand. You have a healthcare system that can’t control its spending. You’ve got Medicare and Medicaid and this new health exchange that has just been passed, three programs that are going to spend us into the economic grave. So we have to fix things. And, you’ve got a financial system that is set up for people to engage in con jobs. We’ve just seen that, and nothing fundamental there has changed. Jimmy Stewart is dead. We need to have a new financial structure. We need to have a new Social Security system, a new healthcare system, a new tax system, and we need to get control of defense spending because we can’t be running wars that we’re not winning. Where should investors put their money now? Well, I would stay far away from any long-term U.S. dollar-denominated bonds. So I would stay away from long-term U.S. Treasury bonds — by long-term I mean 10 years or longer — any longterm U.S. corporate bonds. I would be concerned about investing in the U.S. market because of the course of our fiscal policy and the interaction with our financial fragility. We could have another run on our banking system that’s kicked off because of the fiscal problem. We could have a run on our bonds, and then we could have that turn into a run on our banks. Now, that means you want to invest away from the U.S. You want to invest in perhaps Australia, which has a good fiscal policy; New Zealand; you want to invest in commodities. You are going to be relatively insulated from inflation. Chile, Brazil, there’s other places around the world to invest in than the U.S. market, where there’s a concern that I have about what taxes will be on corporations in the U.S. and how productive the U.S. economy is going to be if we’re going to continue down this path of making bureaucratic answers to simple problems.

|

|