November 15, 2010

Study Finds 44% of U.S. Consumers Interested in Plug-In Electric Vehicles

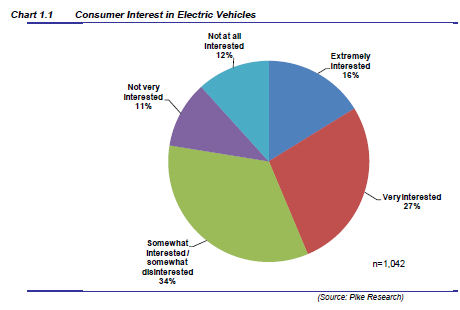

A new Pike Research survey finds that 44 percent of consumers are “extremely” or “very” interested in purchasing a plug-in electric vehicle (PEV) with a driving range of 40 to 100 miles and an electricity cost equivalent of $0.75 per gallon but unproven technology and reliability concerns may be major roadblocks to demand.

“Despite the skepticism of many consumers, the early adopter market should easily meet the industry’s expectations for the first few years of electric vehicle sales,” says Dave Hurst, Pike’s senior analyst.

The first highway-capable PEVs for the mass market will be available for sale by the end of 2010. Initial vehicles will include the battery electric Nissan Leaf and the plug-in hybrid Chevrolet Volt, which will enable drivers to reduce both gasoline expenses and greenhouse gas emissions, say researchers.

Although “range anxiety” — the effective range of a PEV on a single charge — has been widely discussed in the industry as a major issue for consumers, it’s the “wait-and-see” approach about the technology that is the greater issue for consumers, says John Gartner, senior analyst for Pike Research.

The report, “Electric Vehicle Consumer Survey,” finds that 83 percent of survey respondents drive 40 miles or less in a typical day, making “range anxiety” a non-issue for the majority of prospective PEV drivers.

But pricing will be a major challenge for automakers, according to the survey. The survey finds that the optimal price point (OPP) for PEVs is 18.75 percent above the base price of a comparable gasoline vehicle, but this is still significantly lower than automakers’ intended prices, according to Pike.

Consumer levels of interest in PEVs also were not dramatically different between demographic segments such as age, gender, income, and level of education, which suggests that these vehicles should have solid mass-market appeal in the long term, say researchers.

When asked to choose between five different plug-in hybrid and all-electric range/price options, respondents did not state a clear preference for any single configuration. For example, interest levels were very similar for less expensive plug-in hybrids with a 10-mile range and more expensive all-electric vehicles with a 100-mile range, say researchers.

When asked which vehicle brands they would consider for an electric vehicle, most respondents choose Ford (51 percent) and Honda (50 percent), two automakers who do not currently have PEVs on the market. Chevrolet (45 percent) and Nissan (33 percent), the two major manufacturers launching models in 2010, ranked third and fifth, respectively.

When asked about vehicle charging, 63 percent of survey respondents indicated that they would be “extremely” or “very” interested in upgrading to a residential “fast charging” outlet, which would reduce charging times from 5 hours to 1 hour.

But pricing would be an issue. Only 20 percent of respondents say they would be willing to pay $500 or more for fast charging. Currently, residential fast charging outlets cost about $500 to $800, says Pike Research.

Workplace and private charging stations were each important for 72 percent of respondents, and public charge points ranked as the third priority.

Survey findings are based on an online survey of 1,042 adult consumers in the United States.

A similar online study conducted in August by the Consumer Electronics Association (CEA) found that 40 percent of consumers would likely test drive an EV. The biggest concerns cited by respondents were mileage potential before needing to recharge and battery life. Other key concerns included cost of the vehicle, reliability and availability of charging stations.

© 2006-2010 Environmental Leader LLC. All rights reserved. Green Resources