The U.S. PV Market: A Tale of David vs. Goliath?

The American PV installation and manufacturing sectors are

becoming increasingly fragmented.

Despite recent headlines that might suggest otherwise, leading installation and manufacturing players are losing market share. We believe this is a healthy indication of both market growth and increasing acceptance of solar as "mainstream" in the eyes of both contractors and homeowners.

Here are a few recent news highlights in the U.S. that may suggest a trend toward centralized, national installers:

- SolarCity’s acquisition of groSolar’s Northeast residential installation activities and $90 M project finance fund with U.S. Bancorp

- Sunrun’s $55 M Series C funding round and $100 M project financing agreement with PG&E

- Sungevity’s $15 M Series C funding round and $24 M project finance fund with U.S. Bancorp

- Real Goods Solar’s agreement to install the project pipeline of Akeena Solar

Some people in the PV industry and the media have concluded that the Goliaths are increasingly dominating the market. Moreover, these observers seem to believe that acquisition activity is indicative of a trend towards consolidation. As Americans we are familiar with the idea of large national companies and franchises dominating an industry; however, in PV, the Davids appear to be winning.

Large installers are clearly growing and we congratulate them on their success in helping to build the PV industry. Nevertheless, despite the eye grabbing headlines, large installers appear to be losing market share in the core US market of California. Taking the California Solar Initiative (CSI) database* as a representation of the total California market, the data clearly indicate a strong trend towards fragmentation in both the residential and commercial PV installer and manufacturer base.

At first we were taken aback by these findings, but not completely surprised. Similar trends are taking place in other international markets and fragmentation makes sense given the local nature of the installation business.

The Installer Analysis

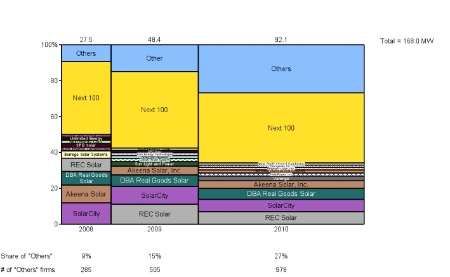

In the California residential segment (see below) the “top 10” installation companies are clearly losing market share. Though growing, the “top 10” are doing so at a slower pace than the market.

Some players focusing on the financing and project management, such as Sungevity that often subcontract out the installation, may be underrepresented in the data. But we believe the overall trends hold true regardless.

Meanwhile, the “Next 100” largest players have managed to hold, but not win, market share, staying at ~40% of the total residential volume. Thus the “top 10” installation companies have not been able to outcompete the relatively established players of the “Next 100.”

(Note: To view the document with full-sized

slides,

click here.)

Far from consolidating, the market is fragmenting. New players are entering in large numbers, with the “Others” segment increasing from ~275 to ~975. These new players have won market share at the expense of the incumbent “top 10" players.

Market share captured by the “Others” has increased from ~9% in 2008, to ~15% in 2009, to ~27% in 2010. These trends indicate a healthy market with low barriers to entry.

The new players comprise enterprising new solar specialists and traditional contractors in the roofing, HVAC, construction, and electrical industries. Many of the traditional contractors continue to focus on their core business but see PV as attractive adjacency. Both the growth and fragmentation in the market is indicative of the increasing consumer acceptance of PV and its validity as a profitable business.

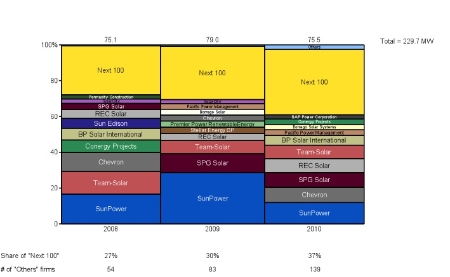

Commercial installation (see below) has fewer active

players but the same trends prevail. The “Next 100”

share increased from 27% in 2008 to ~37% in 2010.

Moreover, name brand leaders like SunPower, Chevron, and

Team-Solar appear to have lost significant market share.

In both residential and commercial there has been significant churn in the top 10 installers. Some players have entered or exited either the residential or commercial space. There have clearly been winners and losers as competition has heated up. It all appears that the commercial installation environment appears somewhat more volatile for leading players than the residential segment.

Here are the key takeaways for the installation market from this data:

- The number of installers is growing dramatically

- The leaders are losing market share

- The residential sector is growing much faster than the small commercial sector

- Despite slow market growth, the number of small commercial players is also increasing significantly

- The success of new entrants and their ability to take market testifies to the very local nature of PV installation. Large players do not necessarily enjoy a competitive advantage

- Assuming the majority of small new entrants are not able to provide financing products like PPAs and solar leases, it appears that these products are not necessary for success

- As might be expected, the value of a name brand appears to be more significant among residential customers than small commercial customers

The Manufacturer Analysis

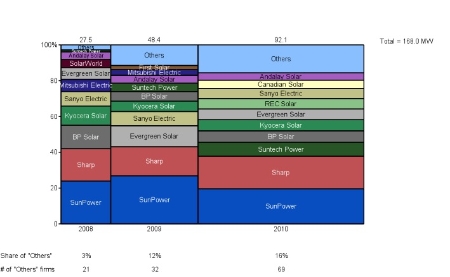

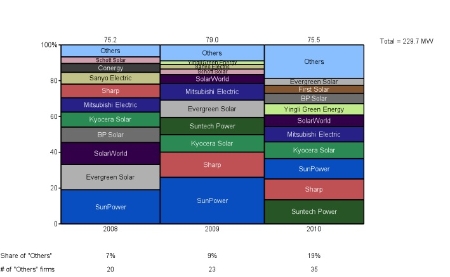

Upstream, the manufacturer market, though more consolidated at the moment, is moving in a similar direction to the installer market.

As you would expect to see in a growing and increasingly competitive industry, the US market is clearly fragmenting. Though the top 10 manufacturers in California represent ~80% of volume in both the residential and commercial market, this share is down from >90% in 2008.

Additionally, there is increasing churn in the

leading manufacturers. The total number of manufacturers

noted in the CSI data is also increasing dramatically.

In 2010 it appears that the trends of fragmentation and

churn have accelerated. We expect this to only

intensify.

Though growing, there are only 79 different brands listed in the CSI database. In the EU, the manufacturer base is much more fragmented than the US; installers and financiers in Europe are comfortable with a large number of manufacturers because the process for achieving bankability is understood and streamlined.

In the EU, pvXchange alone traded modules from over 200 different manufacturers in 2010. Our Director of Global Sales, Florian Meyer-Delpho, estimated that there were ~500 manufacturers present at last week’s SNEC trade fair in Shanghai. Though currently formidable, we expect the barriers to entry for foreign manufacturers to continue to erode.

As US financiers gain experience in PV and the installer base continues to grow and professionalize, more modules will become accepted. The data from California already clearly shows this process at work. There are many notable manufacturer names in the “Others” category that are widely used in the EU like Schuco, Trina, ET Solar, DelSolar, Chaori, and Ningbo.

Many project developers and installers already

testify that modules are increasingly becoming a

commodity and are relatively indistinguishable from the

consumer perspective. We believe this will lead to

healthy competition that will continue to drive down the

cost of modules and lead the industry toward

grid-parity.

Here are the key takeaways in manufacturing:

- The market is fragmenting. Despite many observers’ beliefs that the PV module manufacturer base is destined for major consolidation, the market appears far from that point

- Incumbent manufacturers are losing market share

- Chinese manufacturers, most notably Suntech, Canadian Solar, and Yingli, have successfully entered the market and taken significant market share

- It appears there is decreasing brand loyalty, and the number of “acceptable” manufacturers is increasing dramatically

- In the “Others” category a number of less well known manufacturers are rapidly gaining market share

We believe that this process of fragmentation in both the installer and manufacturer base represents a healthy evolution of an increasingly vigorous PV market in California and the US in general.

A larger/more fragmented installer base means a larger and more diverse market for module manufacturers and for consumers; a greater number of manufacturers will mean more options, better quality, and lower prices of modules for installers; The increasing fragmentation, though indicative of increased competition, may mean that the weak US PV manufacturing base still has time to develop and compete with Asia based manufacturers; and increased competition amongst installers will continue to drive innovation and reduce total installed system costs for consumers

Overall we expect these trends to help drive the adoption of solar PV in the US faster than ever before.

The company we work for, pvXchange, intends to facilitate that process by creating North America’s first transparent PV module and inverter exchange. As we watch these trends unfold, we’re developing a tool for installers to make sense of this increasingly fluid and complicated market.

We believe it is in the best interest of the US economy to have a thriving small business sector. The current trends show that David’s slingshot is still effective against Goliath.

Elliott Gansner is the Director of Business Development, North America for pvXchange.

Scott Mueller is the Manager of Business Development, North America for pvXchange, the leading global exchange for PV components.

* The data used for this analysis comes from the CSI database. We are aware of the discrepancies in the data and have taken care to address some of these issues. While the data is far from perfect, we believe the imperfections do not drastically alter the general trends. To analyze market shares we have taken the name of the company performing the actual installation.

The information and views expressed in this article are those of the author and not necessarily those of RenewableEnergyWorld.com or the companies that advertise on its Web site and other publications.

To subscribe or visit go to:

http://www.renewableenergyaccess.com

To subscribe or visit go to:

http://www.renewableenergyaccess.com