America's Financial Doomsday

An historic, world-changing event is about to crush the U.S. economy and stock market.

It will destroy the income, savings, investments and retirements of millions of Americans.

It will plunge vast numbers of families into the nightmare of poverty ... hunger ... and homelessness.

Only a minority of investors will survive intact. And some will actually build their wealth in the process.

|

In this video, I’m going to reveal some very disturbing facts about America’s economic decline and how it’s now threatening your financial security.

These facts are so shocking, that I’ve decided to present them to you in a special format that is absolutely clear and fully documented, starting right now ...

I’m Martin Weiss, founder of Weiss Research.

You may know my company because every day, more than 500,000 people get our financial publications.

And hundreds of thousands more have used our Weiss Ratings on banks, insurance companies and stocks to help make prudent financial decisions.

You may also know us because we’ve been on TV and in the newspapers a lot lately:

We were the first rating agency in the word to tell the truth, the whole truth and nothing BUT the truth about the financial mess the United States government has gotten itself into.

Unlike Moody’s, Fitch and even S&P which still give the U.S. a stellar rating despite its financial troubles, we gave Uncle Sam a credit rating that places him where he really belongs — just above nations that are already on the brink of bankruptcy.

And boy, did the media ever have a field day with that story!

The Wall Street Journal and Barron’s reported that the Weiss Rating on Uncle Sam is a mere two notches above “junk” — the category assigned to near-bankrupt nations.

Fortune expressed shock that we ranked America’s finances below several smaller countries.

And Forbes reported that Weiss beat Standard & Poor’s in downgrading the U.S.

You may also know me because, in the 40 years since I founded this company, so many of our prior warnings made the news.

Months in advance, we warned about the S&L crisis of the 1980s, the giant insurance company failures of the 1990s, plus the great “Tech Wreck” of the early 2000s.

More recently, ours was the only firm in the world to issue low ratings — and specifically name — nearly every major company that collapsed.

We gave advance warnings about the failure of Bear Stearns, Lehman Brothers, General Motors, Fannie Mae, Wachovia, Citigroup, Bank of America, and many others.

These kinds of on-target warnings prompted Worth magazine to say, “Weiss’s record is so good compared with that of his competitors ... consumers need look no further.”

And the New York Times to say, “Weiss was the first to see the dangers and say so unambiguously.”

Barron’s wrote, “Weiss is the leader in identifying vulnerable companies.”

And NEWSMAX said, “Weiss’s prediction of the current economic crisis is uncanny.”

More importantly, our forecasts allowed investors to avoid big losses and even make money as the crisis unfolded. On average, the 15 investments we gave the highest ratings to rose 467% DESPITE the worst debt crises in recent years. And we also recommended investments that are designed to make you money BECAUSE of the crisis.

I expect they’ll do even better in the months ahead. Because now, a far more dangerous phase of this crisis is beginning. Barring a miracle in Washington ...

An historic,

world-changing event

is about to permanently alter your life.

This doomsday event will plunge vast numbers of families into the nightmare of poverty, homelessness and hunger. In the worst case scenario, you will see soaring crime, the confiscation of property, the suspension of civil rights, and even martial law enforcement by the U.S. military ...

But while the vast majority of Americans will suffer, a select handful will use this crisis to build substantial wealth. If you act on the easy to follow recommendations I’ll give you in this presentation, you could be one of them.

This unhedged

warning

will NOT make me any friends

in Washington OR on Wall Street!

I’m well aware that these forecasts will be controversial even among my closest friends. But in our time together today, I’ll present powerful evidence of their accuracy.

I’ll describe exactly what to expect as America’s great debt crisis continues to unfold — how it’s likely to impact you, your family and your finances. I’ll NAME the giant banks that are most vulnerable.

And, I’ll give you my strategies for protecting and improving your finances as this crisis unfolds.

In a moment, I’ll tell you about the doomsday event that will trigger America’s decline and change our lives forever. But first, let me tell you about how this has actually happened before!

I personally

lived through

the kind of disaster

the U.S. is facing now.

I went to high school in a large foreign country, one of the largest in the world. And when their leaders made the same mistakes Washington is making now, all hell broke loose.

First, the cost of living exploded. Suddenly, everything we needed to buy cost ten times more. In some cases, the crisis became deadly: Prices rose so quickly that construction companies began using lower-quality concrete.

Developers added more floors to buildings in an attempt to recoup rapidly rising costs.

So when one of these skyscrapers collapsed, a teacher who lived next door found his home crushed under the rubble, his wife still inside.

Later, in sheer desperation, the government begged the people to donate their gold jewelry and coins to help save the economy.

One woman even pulled the wedding ring off her finger to give it to the government. Local officials shook her hand but corrupt politicians pocketed the gold.

Later, the government got so desperate; it summarily froze everyone’s bank accounts. It confiscated their money and replaced it with a new, far-less valuable currency. And that was only the beginning of the people’s suffering.

In the end, they were doomed to decades of intense financial pain, shame and lost personal liberties. I can assure you these stories are true — because I witnessed them personally:

The teacher who nearly lost his wife when the skyscraper collapsed was my teacher.

The patriotic woman who donated her gold wedding band was my best friend’s mother.

These things happened when I was a young man living in the third largest country in the capitalist word at that time — Brazil.

But my story

is definitely NOT unique ...

More recently, this kind of crisis has also struck a very powerful European nation.

After its leaders made the same mistake ours are making now, the country’s bonds collapsed in value, interest rates exploded to over 200%. In just six months, its stock market plunged 75%.

The common people suffered tremendously: A staggering 60% of the workforce was paid only partially and received their paychecks months after they were due.

As the economy collapsed, millions of average citizens fell victim to crime and corruption. The police demanded bribes for traffic violations — both real and imagined.

Organized crime syndicates divvied up the country into their own private fiefdoms, profiting from protection rackets, prostitution, smuggling, narcotics-peddling and even murder for hire.

The government itself admitted that the criminals owned or controlled about half of the country’s private businesses.

A friend of mine said:

“Many banks, including some of the largest in the country, shut down. They closed their doors forever. Our savings were wiped out.

“All people could do about it was to go to their banks and hammer on locked doors.

“Other people demonstrated on the streets. They carried their devalued money in miniature coffins and marched past our central bank.”

All this happened in the 1990s — in Russia, formerly one of the most powerful nations on the face of the Earth.

Of course, the U.S. is not Russia; we have far stronger democratic institutions. And our economy is far larger than Brazil’s, but when a nation’s larders make the same mistakes Brazil and Russia made, the consequences are invariably going to be similar.

The people of Brazil and Russia paid dearly for their leaders’ blunders. Barring a miracle, the American people are also about to pay a very big price.

Europe is

suffering through

this same kind of crisis

RIGHT NOW!

For a sneak preview of the doomsday event about to strike the United States, just look at the catastrophe taking place in Western Europe right now. In Greece, a friend of mine reports:

“Everywhere in Greece, home values are plunging. Unemployment is soaring. One in four Greeks, including over 450,000 children, live in poverty. Crime is exploding.

“Athens is beginning to look like a ghost town. Everywhere you look, shop windows are boarded up. Of those that are still open, most are running going-out-of-business sales.”

Greece is not alone!

But Greece is not alone! In Spain, similar stories are being told in Madrid, Barcelona and 50 other cities across the country.

Tens of thousands of workers have taken to the streets to protest a problem they thought they’d NEVER see again in their lifetime:

Not just 10% official unemployment like we’ve recently seen in the U.S. — but 21% official unemployment!

A friend of mine in Madrid says:

“You wouldn’t believe what I’m seeing here on the streets of Madrid. Beggars outnumber tourists and protesters outnumber beggars.

“In front of Parliament, riot police stand watch to protect lawmakers from angry mobs. All over the country, in Viscaya, Cataluña, Andalucía, we see the same thing.”

In Ireland, the government faced immediate default and was forced to impose harsh austerity measures that plunged the country into depression.

In London and cities all across England, similar kinds of austerity measures recently triggered the worst riots of modern times.

Entire neighborhoods went up in flames.

Even large commercial buildings were set on fire, and left in ruins. Worse, this financial and social crisis is threatening to spread to countries like Italy, France and even Germany.

Now, you may be thinking, “But we’re different! Nothing like that could ever happen here.”

I assure you: The people of Brazil, Russia, Greece, Ireland and Spain never dreamed it could happen there, either!

The truth is our own leaders have made the same financial blunders that their leaders made.

As my Greek friend says:

“You can’t save a nation that’s drowning in debt by throwing more debt at it any more than you could save a drowning man by throwing more water on him.”

Look, in every one of these countries, the pattern is clear:

First, the government spends everything it has.

Next, the government borrows all it can from its people.

Then, it borrows still more from foreign countries and banks.

Finally ...

The debts become so onerous and horrendous that they trigger the doomsday event that I’m going to tell you about in just a moment.

That’s when panicky political leaders turn on their own people. They confiscate their wealth and destroy their freedoms.

Yes, America is still the richest country in the world. But that fact has enabled our leaders to take the greatest and most dangerous risks in the world.

As a result, you could argue that ...

The U.S. is now

in WORSE shape

than Brazil, Russia, Greece or Spain have ever been

Consider the high-risk gambles that super-investor Warren Buffett calls “financial weapons of mass destruction.”

I’m talking about special kinds of investments called “derivatives.” They were a major cause of the real estate and debt crisis that nearly wiped out all of our largest banks in 2008 — along with the entire U.S. economy.

Russia’s banks never exposed themselves to large amounts of these financial time bombs.

Neither did Brazil’s banks.

And you’d think that, after the 2008 meltdown, U.S. banks would have learned their lesson. But you’d be wrong.

According to the Comptroller of the Currency, a division of the U.S. Treasury Department — U.S. banks held $176 trillion in derivatives at the height of the debt crisis in 2008. Today, U.S. banks hold $244 trillion in derivatives — nearly 40% more.

That fact alone places the U.S. in greater danger than many other countries, past or present.

U.S. debt and

obligations

are now OVER $120 TRILLION!

America is also in great danger for another big reason. Washington is now sitting on the largest pile of debt in the history of civilization: About $14.5 trillion and counting.

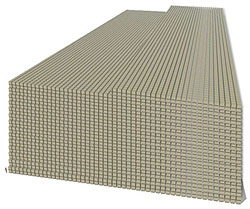

|

Hard to visualize what that much money looks like? Maybe this will help ...

If you asked your bank to give you a stack of $100 bills worth one million dollars, it would look like this — a neat little pile of money ...

One billion dollars looks a LOT more impressive.

But here’s what one trillion hundred-dollar bills would look like.

And this is our current national debt: $14.5 trillion.

It’s a positively staggering amount of money.

And it doesn’t even begin to include the debts Washington inherited from Freddie Mac and Fannie Mae or all the money Washington owes to seniors for Social security and Medicare, or to veterans and government pensioners.

Add that in, and Washington’s total obligations are over $120 trillion.

But it’s not just the sheer size of our nation’s debt that’s so frightening. It’s the fact that it’s mushrooming so rapidly — at a speed that’s far greater than anything we’ve ever seen:

Washington is now growing the debt by AT LEAST $1 trillion each and every year.

Now, at this point, you’re probably thinking: “But surely — our leaders will ultimately do the right thing and STOP bankrupting us — right?”

But the reality is that Washington has consistently made the opposite choice.

The die was cast in 2008, when the housing bubble burst and giant banks were going bust.

At the time, the U.S. government could have simply allowed those who had made the big gambles to suffer the natural consequences of their actions.

Instead, Washington bailed out the banks, absorbed those bad debts, and spent trillions of dollars to fight the recession.

Washington

lies,

the economy dies.

At the time, some people thought that was a god idea. But look what happened.

In just 12 months between 2007 and 2008, Washington TRIPLED the federal deficit from $161 billion to $459 billion. Of course, our leaders swore on a stack of Bibles that this was a one-time-only event, needed to fight the recession.

They lied. Washington tripled the deficit AGAIN ... to $1.4 trillion in 2009.

Then, again, they solemnly promised that this, too, was temporary — for emergency purposes only.

But that was a lie, too. The 2010 deficit was $1.3 trillion.

Plus, the deficit for 2011 is the biggest of all: More than $1.5 trillion.

And in a double-dip recession, the deficit could surge to $2 trillion dollars.

All these dramatic changes and all these lies are what inevitably lead to the doomsday event that is now on the near horizon for America.

Still skeptical? Then consider this shocking change ...

We’ve sold our

American birthright

for a mess of porridge.

In the past, Washington always borrowed nearly all the money it needed from its own citizens. But in recent years, it has borrowed most of the money from foreigners, especially China, and now it owes foreigners over $4 trillion dollars.

That’s over four times MORE than it owed foreigners when the U.S. plunged into recession in the early 2000s.

But it still hasn’t been enough. The White House and Congress wanted to spend even more money than Americans and foreign investors would loan us — combined.

The Fed

declared WAR

on the value of your money!

So the Federal Reserve printed hundreds of billions of paper dollars and loaned most of that money to the Treasury, too.

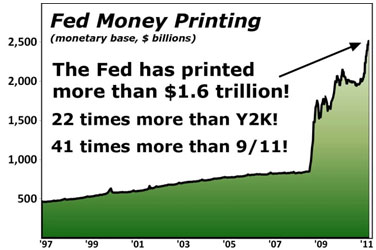

How many hundreds of billions of dollars? Let me put it into perspective for you.

|

Remember 1999, when everyone was worried that the Y2K bug would crush our economy? Well, to avert a collapse, the Fed printed $73 billion to keep the banks from collapsing.

That’s the first blip on this chart.

Now let’s go to 9/11, when the terrorist attacks in New York and Washington paralyzed the economy, the Fed printed another $40 billion. That’s the second blip on the chart.

Every time, the Fed cranked up the printing presses, financial experts went ballistic. They said the amounts were so huge; they might diminish the dollar’s value. And sure enough, the value of the dollar did plunge.

But that was only a drop in the ocean compared to what the Fed has been doing lately.

Since the big debt disaster of 2008 — when the giant Lehman Brothers failed. The Fed has printed more than $1.6 TRILLION dollars.

That’s twenty-two times MORE money than the Fed created during Y2K.

And it’s FORTY-ONE times more than it printed after 9/11!

That’s why the buying power of your money is cratering.

That’s why your cost of living is soaring.

That’s why butter has jumped 22%, gasoline has soared 35%, and coffee has skyrocketed a mind-boggling 42% — all in a single year!

And that’s also why America is headed for the financial doomsday I will soon describe to you. But first ...

SHOCKER:

You’re only HALF as rich

as you think you are!

|

Look at silver! Since the Federal Reserve began its latest money-printing binge at the height of the debt crisis, the price of silver more than quadrupled.

And look at gold; it has more than doubled in price!

But all this is only the beginning.

In Brazil, Russia, Greece and Ireland what happened next was that revenues and tax collections began to fall.

It became impossible for those governments to repay its debts.

And here again, the United States is following a similar pattern: Despite the massive amounts of money Washington has thrown at it, the U.S. economy is sinking — and government revenues are falling — AGAIN!

The U.S. Bureau of Labor Statistics reports that long-term unemployment in the United States is now at catastrophic levels.

|

More than 14 million Americans are now out of a job — and every week, hundreds of thousands more get their pink slips. And once someone loses a job, it takes an average of more than 25 weeks — nearly half a year — to find a new one.

That’s not just “a little bit” worse than during prior recessions. It’s more than 2.5 times worse than during the big recession in the mid-1970s. And it’s also far worse than during the financial crisis of 2008-2009.

Plus, the housing crisis that triggered this great recession in the first place is now growing more severe.

Consider the conclusions of Case-Shiller, the real estate industry’s most trusted source of home price information:

|

They report that the median price of a home is down more than 31% and is still plunging.

That’s right. The price of existing homes in America has fallen BELOW the lowest level it reached in depths of the Great Recession of 2008-2009!

In short, despite the trillions Washington has blown on stimulus and bailouts, we are now staring down the barrel of a huge double-dip recession.

That’s especially scary this time around. Because this time, the government isn’t putting money into the economy with more stimulus.

The government has no choice but to take money OUT of the economy with budget cuts! And as the economy falls, instead of collecting more from taxes, it collects LESS.

The money Washington so desperately needs to pay the interest on its debt simply vanishes.

Look, throughout history, we’ve learned that when a nation becomes this deeply indebted and in this much economic trouble, the next step is always the same:

In every case, the next step is the monumental event, the far greater calamity that I promised to tell you about.

COMING

NEXT:

The moment when all hell breaks loose ...

So what is the ultimate catastrophe that doomed the people of Russia and Brazil to decades of poverty and dependence?

What is the next bombshell that’s beginning to explode in Europe, destroying the people’s wealth and threatening to rob them of their personal freedoms?

What is the historic, life-changing, world-changing event that is also about to vaporize massive amounts of wealth and potentially threaten our liberties right here in the United States of America?

It’s the singular moment in time when the last investor willing to loan money to the government calls it quits.

It’s when the government can no longer borrow and simply runs out of money.

That’s the moment when all hell breaks loose.

No, I’m not talking about what would happen if Congress simply failed to raise the debt limit like it almost did in August of 2011. That was a just a sneak preview of the true big event still dead ahead.

|

“I have made twenty times what I paid for

the subscription. I like your style, love the profits.” — Rick N. |

I’m talking about, a sudden rejection of U.S. debt by the world’s investors — a creditors’ revolt that suddenly leaves Washington with no choice but to live within its means.

Think about that: What would happen right now if our federal government was no longer able to find more willing lenders, no longer able to borrow money?

Before you answer though, remember this: Washington has to borrow nearly half of every dollar it spends today.

It has to borrow nearly half of every

dollar it spends on national defense, and homeland security.

It has to borrow nearly half of every

dollar it spends on national defense, and homeland security.

It has to borrow nearly half of every

dollar it pays in Social Security, Medicare benefits, and unemployment

benefits, plus half of what it gives to U.S. veterans, government

pensioners, the poor and the disabled.

It has to borrow nearly half of every

dollar it pays in Social Security, Medicare benefits, and unemployment

benefits, plus half of what it gives to U.S. veterans, government

pensioners, the poor and the disabled.

And it has to borrow half of every dollar

it spends to repay money it borrowed five years ago ... ten years ago

... even 30 years ago.

And it has to borrow half of every dollar

it spends to repay money it borrowed five years ago ... ten years ago

... even 30 years ago.

What will happen when global investors deny our application for yet another loan? When the Chinese and other foreign lenders say “No more!” to losing their shirts as Washington guts the value of the dollars they earn?

When they simply say:

“Sorry — but America’s line of credit is CANCELLED. Washington’s loan application is DENIED!”

This is not far off. The warning signs are already here ...

Warning sign #1: According to Beijing officials, China, the world’s largest buyer and holder of U.S. government securities, has suffered a loss of $271.1 billion between 2003 and 2010 as a result of the dollar’s steady depreciation.

Warning sign #2: In June of 2011, China’s National Development and Reform Commission announced it could lose another $578.6 billion if it continues to hold these huge loans to the U.S.

Will they continue to suffer these losses passively?

The answer is ...

Warning sign #3: Two high officials — Zhou Xiaochuan, the head of China’s central bank and Xia Bin, a member of the monetary policy committee of the central bank — are ready to bolt.

Both recently made it clear that they could easily get away with a huge reduction in the amount of U.S. treasuries they own.

I repeat:

This is already beginning to happen!

Other nations are also shifting their reserves from U.S. Treasuries to gold and silver, plus oil, coal, and other tangible assets.

Mexico, Russia and Thailand have recently bought well over 100 tons of gold instead of U.S. treasuries.

Even Tanzania is planning to shun the dollar and shift its reserves into gold!

Gains of 245%

... 369% ...

and more are possible!

Put simply, that fateful day — when Washington is no longer able to borrow the money it desperately needs is speeding toward us like a runaway freight train.

This is why Congressman Ron Paul recently issued this somber warning:

“At the present time the Chinese have backed off from what they’re loaning us, interest rates are starting to go up, inflation factors are coming up.

“Believe me, that next step is a currency crisis because there will be a rejection of the dollar. The rejection of the dollar is a big, big event.”

Congressman Paul is correct.

The worst-case scenario ...

When Washington can no longer borrow money, it will have no choice but to immediately slash spending.

And since nearly half of every dollar it spends is borrowed, our leaders will have no choice but to radically reduce, delay or even cancel payments to seniors, veterans, the poor, the disabled and pensioners.

Millions who count on government checks will suddenly find themselves on the ropes, struggling to survive.

Therefore, with government programs slashed or cancelled ...

With consumers paralyzed in fear ...

With the U.S. economy in intensive care ...

With tax revenues plunging, and ...

With global investors refusing to lend more money to Uncle Sam ...

Here is the worst-case scenario — the scenario I fear the most ...

Hunger and homelessness explode to

pandemic levels from coast to coast.

Hunger and homelessness explode to

pandemic levels from coast to coast.

The victims take to the streets. Rallies

turn into demonstrations ... then, into protests ... and finally, into

riots.

The victims take to the streets. Rallies

turn into demonstrations ... then, into protests ... and finally, into

riots.

With law enforcement severely crippled

by the spending cuts, crime skyrockets.

With law enforcement severely crippled

by the spending cuts, crime skyrockets.

With fire departments running at

austerity levels, cities burn.

With fire departments running at

austerity levels, cities burn.

With emergency services and hospitals

out of money, people die.

With emergency services and hospitals

out of money, people die.

As we saw in Brazil and Russia,

Washington has no choice but to restore order by taking away your

personal freedoms.

As we saw in Brazil and Russia,

Washington has no choice but to restore order by taking away your

personal freedoms.

And never forget this final, devastating fact: No bank ... no government ... no group of nations ... is rich enough to save America.

Members of

Congress:

“Armageddon”

“A Fiscal Titanic”

“A Death Spiral”

Still finding all this hard to believe? Then consider these ten former heads of the Council of Economic Advisors.

|

They are the men and women who directly advised presidents of both major parties, including President Obama, and all of them have since departed from their office. They recently wrote that that the next debt crisis could, and I quote “Dwarf 2008!”

That’s an absolutely shocking assertion: In 2008, Wall Street came within a hair of a massive, devastating meltdown. Virtually ALL of our largest banks were pushed to the brink of failure. The entire country was only a few hours away from a fatal collapse.

Now, these ten former White House advisors are warning that this next debt crisis could dwarf the last one. Why? What could cause that?

They say it’s precisely the doomsday event I just told you about: The fact that one day foreigners may simply stop lending more of their money to the United States.

And these ten former presidential advisers are not the only ones ringing the alarm bells.

Senator Mark Warner says, “We’re approaching financial Armageddon.”

Senator Joe Manchin calls this crisis “A fiscal Titanic.”

Admiral Mike Mullen, the chairman of the Joint Chiefs of Staff, is warning that this crisis is “the biggest threat to our national security.”

Senator Mike Crapo says it is “a threat to not just our way of life, but to our national survival.” It has the power to “ ... guarantee that this nation becomes a second-rate power with less opportunity and less freedom.”

And David Walker — the former U.S. Comptroller General and director of the Government Accountability Office says:

“The bottom line is: We’re not Greece. But we could end up with the same problems!”

And mind you, these men are not extremists. They have nothing to gain by trying to scare you. They are merely following the facts to their logical conclusion.

|

“Integrity and dedication |

That’s what I’ve done in this report. The warnings I’ve given you are based on nothing more — and nothing less — than economic reality and historical fact.

My research team and I have simply crunched the numbers and let the chips fall where they may — just like we did when we issued “D” ratings on nearly every big bank and savings and loans that subsequently failed.

Just like we did when we gave a “C” rating to the United States.

We have no political axe to grind. We are not beholden to Republicans, Democrats, or any other political party. Nor do we owe allegiance to Wall Street or any of the thousands of banks, companies and countries that we rate.

In fact, most of them would probably prefer that we just kept our mouths shut. One giant company even threatened my life by saying “Weiss had better shut up or get a body guard.”

But to quote Harry Truman, “I never give them hell. I just tell the truth and they think it’s hell.”

Our loyalty is with the people — consumers, savers, investors and everyday citizens — who rely on us to tell them the truth about what we see in the future, and about the companies or governments they entrust their money to, invest in, or do business with.

The good, the bad and the ugly.

This is how my company has become the last line of defense for the average Joe against greedy and power-mad CEOs, politicians and bureaucrats.

And this is why, in just a moment, I am going to give you the steps you need to take to prepare and I am even going to NAME the banks most likely to fail.

Believe

it or not,

THIS is the calm before the storm!

Nevertheless, if the crisis I’ve just described is hard for you to imagine, I certainly understand.

We’ve never seen anything like this happen before in America.

We always believed we were somehow insulated from these kinds of catastrophes.

Besides: Things still seem so “normal” for most of us today — so routine. It’s hard to imagine that such terrible things could happen to us — and that it could all happen so quickly, in the twinkling of an eye.

But isn’t that always the case? Isn’t there always a calm before the storm? Aren’t people always caught by surprise when historic crises strike?

After all — nobody believed the Soviet Union would collapse virtually overnight — and when it did, it caught everybody by surprise. Even our own C.I.A. failed to see that one coming!

And remember, for years, Islamic extremists made no secret of their determination to knock down the World Trade Center. They actually tried to do it in 1993.

But among the thousands who streamed into the twin towers on September 11, 2001, how many — if any — believed they had anything to worry about?

Many, including my cousin’s daughter and some friends, just kept going to work as they always had — and thousands paid the ultimate price.

In Japan, even though they had been repeatedly warned, nobody — including my own son, who lives in Tokyo — believed the nuclear power plants would suffer multiple meltdowns.

Once again, their denial was costly in the extreme.

Even in my own 40-year career as a ratings analyst, I’ve seen denial exact a hefty price over and over again.

A few years ago, only a handful of people believed our senior analyst Mike Larson when he repeatedly warned that the real estate bubble was about to burst.

And of course, very few listened when we warned that Lehman would go belly up and that even the almighty Bank of America would come within an inch of its life.

So I’m under no delusions here. I know that the vast majority of Americans will fail to heed this warning and fail to get ready for this crisis.

I sincerely hope — for your family’s sake — that you are not one of them.

Because the precautions required to weather the coming tempest are not difficult.

And even if the storm turns out to be less severe than I fear it may be, the worst that’ll happen is that you’ll sleep better at night and you could make some money in the process.

Take these six

steps immediately

to protect and grow your wealth

So WHEN should you expect to see this cataclysmic event — the moment when Washington runs out of money? Soon. VERY soon.

The U.S. Treasury holds a 30-year bond auction about every month — and it auctions shorter-term notes and bonds even more frequently. So it could happen at virtually any moment.

There is, however, some good news:

|

“I made approximately a $31,000

profit on the first two transactions. Needless to say, I was delighted.” — Stuart U., Haute Nendaz, Switzerland |

First, you still have some time — but not much — to prepare. If you take action right away, you can still use the defensive steps I’m about to recommend to protect your family.

And second, there are simple things you can buy that will not only protect you, but also give you the opportunity to build substantial wealth.

Here are the steps I recommend you begin taking immediately to protect yourself and your loved ones from the coming storm ...

STEP #1 is to prepare your defenses: If you count on the government for anything, you’ll need to plan to live without it.

As we’ve seen, all levels of government — federal, state and local — will have no choice but to cut spending as this crisis unfolds.

That means you’ll need a plan for getting by on your own — without help from Social Security, Medicare, or other government programs.

Also keep this in mind. Washington may no longer be able to bail out your bank or guarantee your deposits when skyrocketing loan defaults push it to the edge of the precipice.

If the government owes you money — tax refunds, for instance — be aware that the payments could be delayed.

It would also be a good idea to make preparations to personally ensure your family’s safety. Because police, fire and emergency services will probably be hard to come by in many communities.

If you live in a city, have a plan and a place to go if things become uncomfortable for you.

Those are the basics. But there’s so much more I need to tell you to help you through this crisis, I couldn’t begin to cover it all in this presentation.

That’s why I’ve just put the finishing touches on Four Horsemen of the American Apocalypse: Protect Yourself and Profit It’s the ultimate survival guide for 2011 and 2012 — and I want you to have a copy free of charge.

|

In this free but indispensable emergency guide, I show you how this great debt Armageddon is likely to unfold, including the outrageous things the government could do to fight it and how they’ll impact you!

I give you very specific instructions on the steps you must take to get your financial house in order. And I show what to do immediately to protect your savings, your investments, your real estate, and everything you own.

I show you how to shield your bank account safeguard your insurance policies, and defend your 401(k) retirement account. I give you a handy tool to insulate your stock portfolio and even show you how to protect the value of your home and other real estate — no matter how bad things get.

PLUS, I lay out the steps you need to begin taking right away to defend your family and to help ensure their physical safety even in a worst-case scenario.

STEP #2 is to make sure your bank is the safest one you can find.

Here, there’s even more I can do to help. Our Weiss Ratings is the nation’s leading provider of independent ratings on 16,000 banks and credit unions.

Since 1990, we have issued grades on a total of 1,533 banks that subsequently failed.

On 90% of those banks, we issued a clear warning to consumers ONE FULL YEAR ahead of time. And on nearly all of the rest, we issued a warning or a caution flag at least a few months before the failure. Now, the problems in the banking industry have gotten a lot worse.

Not only do we have more bank failures, we also have more BIG bank failures.

In fact, just in the last two years, 49 relatively big banks and thrifts with assets of $1 billion or more, have failed. We issued an advance warning on EVERY SINGLE ONE. So it’s important that you make sure you are NOT using any of the weakest banks on our list:

Those include:

|

Weiss Rating

|

| Bank of America | D+ |

| Compass Bank | D |

| Huntington National | D+ |

| Harris Bank | D |

| JPMorgan Chase | D- |

| Regions Bank | D+ |

| Sovereign Bank | D+ |

| SunTrust Bank | D |

| US Bank | C |

| Wells Fargo | C |

If you are currently doing business with any of these banks, I’d recommend that you switch most of your money to a more stable institution right away.

I’m talking about a bank with a rock-solid balance sheet ... with high lending standards ... and without those time bombs in its portfolio called derivatives.

Banks like that have the financial strength to see you through no matter what happens!

|

And here, too, we can help. Because Weiss Ratings ALSO has a flawless record of identifying the truly SAFEST banks.

So to help you get your money through this crisis unscathed, I want you to have a complimentary copy of:

The Weiss Ratings “X” List: America’s Weakest and Strongest Banks

In this guide, I give you the complete list of the weakest banks and credit unions that you should avoid at all costs, and also. A full list of the strongest banks and credit unions, well equipped to weather the coming storm.

STEP #3 is to build an impenetrable wall of privacy around your finances: Make no mistake — the United States government will NOT be your friend as this crisis unfolds. Neither will your state, county or local governments.

If history proves anything its’ that there’s virtually nothing as dangerous as a big government that’s being threatened with extinction.

If the worst-case scenario, if a politician or bureaucrat comes to the conclusion that your rights and property stand in the way of saving the government ... you can kiss them good-bye.

You’re also going to have to think about others who will be desperate enough to seize your wealth — especially if you live in a city or even the suburbs of a large metropolitan area.

Privacy — keeping a low profile for yourself and your assets — will be among your best defenses.

And in the third emergency guide we created for you — The Invisible Man: Hide Your Assets from Prying Eyes — we give you simple, legal ways to enhance your privacy and protect what you own — and more — including ...

|

* What Washington snoops can already know about you: The four surprising ways Washington spies on you and how the information it collects could be used against you as this crisis unfolds.

* Six outrageous assaults on your money and liberty: The shocking steps Washington could take to violate your rights as this crisis worsens.

* SIX legal ways to protect your money and your life: Quickly and easily get your money off of the government’s radar screen ... and more!

Now, let’s move on ...

STEP #4! It’s to own mankind’s greatest crisis hedge — GOLD: Since we first began recommending them in 1999, gold bullion coins and bars have risen by 450%. An initial $10,000 investment is worth $55,000 today.

And just since 2008, gold bullion coins and bars have more than doubled in value.

So we strongly recommend that you hold a reasonable portion of your ready money in physical bullion — mostly smaller denomination bullion coins.

|

Did you know that you can actually get some free gold simply by selecting the right bullion coins to buy?

It’s true! And the fourth report we’ve prepared for you — The Weiss Guide to Prudent Gold & Silver Investment — shows you how.

Plus, we give you ...

* Our list of recommended bullion dealers ...

* How to hold your gold bullion offshore for greater privacy ...

* How to securely store your precious metals ...

* Why keeping part of your holdings in smaller gold and silver coins could prove to be a godsend for you, and ...

* Much more.

STEP #5 is to hedge against financial losses — with investments designed to spin off substantial profits when the economy implodes.

You don’t need a Ph.D. in economics to know that the crisis I’ve described in this presentation is NOT going to be good for most stocks.

So your first priority as an investor is to make sure that you do not own the stocks that are most likely to plunge.

And one of the services my company provides is a powerful free tool you can use to help decide precisely which ones they are.

Your second priority is to harness the power of those declines — not merely with a special class of investments that rise in spite of them, but with things that soar because of them!

|

In your next free report — Shield Your Wealth in Terrible Times — we’ll give you our comprehensive strategy for using these muscle-bound investments as portfolio insurance — to protect your other investments against loss.

In 2008, for example, the bank stocks we warned about plunged up to 98%.

Well, you could have used our warnings to go for gains of 51% ... 76% ... up to 99% and even more with simple investments that cost as little as $10 each and that anyone can buy. We’ll show you how in this free emergency guide.

STEP #6 is to go for truly huge gains as this crisis unfolds: At a time like this, a powerful offense is your best defense.

Building up substantial cash reserves is the best way to ensure your family’s safety and comfort.

Plus, when you see a trend that is this imminent, this clearly defined, and this powerful, you may want to take some risk and swing for the fences.

After all — it may be your last chance to go for truly huge gains for quite some time!

|

In your free copy of The Ultimate Crisis Investment — we introduce you to an entirely NEW way to invest: A way to keep your money growing safely no matter how rocky the stock market becomes.

It’s a way to know which stocks are likely to collapse at the first sign of trouble and also a way to know which are likely to rise even in bad times.

The data shows that, if you had used this strategy from 2001 through the end of 2010, you could have beat the S&P 500 by 10.5 to 1, with an overall return of 467.8%.

That’s enough to turn $10,000 into $56,780 or $100,000 into $567,800.

You don’t need a lot of money. You don’t need to have a lot of experience as an investor. And you don’t even need to use exotic investment vehicles.

Best of all, this was possible even in the worst of times. Right now ...

You can

download all six

of these reports instantly

and be reading them

just a few minutes from now!

I’ll invite you to do just that in a moment.

First, let me tell you why my company is going to such extreme lengths to get this indispensable information to you.

|

TURNED $352,000

INTO MORE THAN $2.1 MILLION! “I started my subscription in 1998. Thanks to the sound financial advice of the Safe Money Report and some fortunate investment choices, my original $352,000 in my 401(k) is now worth $2,171,000.” — John D., Medina, Ohio |

Frankly, we’ve never seen a crisis that even comes close to equaling this one. And I’m deeply concerned that you and millions of other Americans could lose everything.

That’s why we prepared these six emergency survival guides for you. They won’t cost you anything and you can download them right now.

All I ask is that you also take a look at our monthly newsletter, Safe Money Report.

Safe Money Report is our flagship publication here at Weiss Research. It has the distinction of having warned investors of every major financial threat of the past 35 years.

|

As the publisher, I work closely with Mike Larson, its editor, to bring you everything you need to protect and grow your wealth in these troubling times.

You’ve probably seen Mike on CNBC with Maria Bartiromo, or on Fox Business News with Brian Sullivan, or on one of the many other financial programs where he regularly appears.

You’ve probably also seen him in the Huffington Post, New York Times, Wall Street Journal, Dow Jones Newswires, AP, Reuters, and many other major news outlets.

The media is right to turn to Mike for his analysis: If you had been listening to him since 2005, you wouldn’t have had to lose a dime in the housing bust, debt crisis or market crash ...

You could have actually grown your wealth even while others were losing theirs!

I hand-picked Mike as editor of my Safe Money Report because of his uncanny ability to foresee future economic trouble. We make a great team.

And if you agree to check out Safe Money Report for yourself, we’ll give you instant access to all six of the emergency survival guides I just described:

|

1. Four Horsemen of the American Apocalypse: Protect Yourself and Profit

2. The Weiss Ratings “X” LIST: America’s Weakest and Strongest Banks

3. The Invisible Man: Hide Your Assets from Prying Eyes

4. The Weiss Guide to Prudent Gold and Silver Investment

5. Shield Your Wealth in Terrible Times

6. The Ultimate Crisis Investment

Just agree to examine my Safe Money Report and we’ll send you a fresh copy the first week of every month.

Mike Larson and I will also make sure you have all of our recommendations for the investments we’re counting on to grow your wealth as this crisis continues to intensify.

Plus, as an extra bonus, Mike and I will also give you a second subscription — to our DAILY online newsletter, Money and Markets ...

To make sure you’re up to date on each day’s new developments, threats and opportunities.

SAVE $149 NOW

— SATISFACTION GUARANTEED

And we’re making it remarkably easy for you to grab your free reports and also to check out Safe Money Report for yourself.

|

“The information you provided regarding the real estate and financial meltdown was invaluable! “Your ratings on the companies in trouble helped me to make about 200% in a period of 2 to 3 months. “Nobody else, that I know of, was giving the kind of accurate guidance that you were, and I really appreciated it! “Now you are saying that

something similar is about to happen again. I, for one, will be

listening very carefully to what you have to say!” |

First, we’ve cut the price nearly in half — and then half again:

Normally, a full year of Safe Money Report is $198. But right now, you can test-drive Safe Money Report for just $49. That’s 75% below our regular rate.

Want an even better value? Great: Join us for two years for just $89. You’ll save a whopping $307 off the regular $396 rate!

But you don’t even have to make your final decision now.

Just join us and get your six free reports now. Then, take all the time you like — up to a full year — to make your final decision. Even if you decide to cancel on the very last day before your membership expires, we owe you a full refund.

And we’ll even insist that you keep all six free reports and every issue of Safe Money Report we’ve sent you in the meantime.

Plus, if you join us in Safe Money Report within the next ten minutes, we’ll also give you our latest ratings on your banks, your credit unions, and your insurance companies.

|

“My two grandsons are two lucky boys. They

got two big gifts for Christmas this past year and it was from

one of your investment picks in Safe Money.” — Sam H., Kirkuk, Iraq |

Plus, we’ll give you the ratings you need to identify which of YOUR stocks, ETFs and mutual funds are the most and least vulnerable right now.

And I have one more very important thing to say: I wish I could tell you that our leaders will pull us back from the brink in the nick of time.

Sadly, though, it’s probably too late for that. The mountain of debt that Washington has created — and the huge gambles our banks have taken — virtually guarantee that America will fare no better than Brazil, Russia, Greece or the other nations that have made similar blunders.

The numbers don’t lie. Yes, it’s a crying shame that our once-great nation has come to this. It didn’t HAVE to happen.

Never before has a nation possessed the vast riches that America has amassed.

Never before have 311 million souls enjoyed such personal wealth, comfort and security.

And never before has so much been squandered so needlessly or in such a thoughtless manner.

|

“We started about eight years ago. Our

money is growing and we sleep a lot easier knowing our

investments are safer.” — Gerald C., Savannah, Georgia |

Mike Larson and I are committed to getting you through this great crisis with your wealth intact and growing — and the six free emergency guides are a great place to begin your preparations.

When you click on the appropriate button below, it will take you to a secure order form where you can make your final decision.

Then, after you finish your purchase, check your inbox for an email containing all the information you need to download all of your free reports and access all your free ratings.

To get your free reports and ratings now, just click on the appropriate buy button below.

Good luck and God bless!

Martin D. Weiss, Ph.d.

Publisher, Safe Money Investor Service