Second in the Series: Major Headwinds Confronting Banking Industry

European Financial Crisis Looms Larger than Ever

by Gene Kirsch, Senior Banking Analyst | August 28, 2012

Last month, we discussed the threat that the Libor rate-rigging scandal poses to major U.S. and global banks. The second headwind threatening the banking industry is the ongoing European financial crises. While the most immediate danger currently engulfs Greece, Spain and Italy, the debt crisis could potentially bring down the entire European Union and, along with it, the global economy.

While the current U.S. economy seems to be stabilizing and the stock market robust, don’t be fooled. Evidence of this already exists by looking at the GDP Annual Growth rates of the world’s 15 largest economies1:

Of the top 15 economies, Italy and Spain are clearly headed for, if not already in, a recession as defined by two consecutive quarters of negative GDP growth rates. In total, 10 of the 15 have had a decline in annual GDP growth rates from Q4 2011 to Q1 2012. Even the top two economies—the United States and China—have slower or declining growth rates for Q2 2012. Looking at the European Union as a whole, the figures show that weakness is widespread and the entire region looks like it is headed for recession.

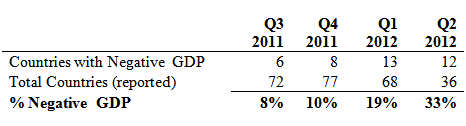

Furthermore, by expanding the above list to the GDP growth rates of the top 70 economies, a declining trend emerges. To date, 12 of 36 countries, or 33%, have reported negative GDP. New data is expected to show additional GDP contraction, as the effects of the recession continue expanding well beyond the Eurozone.

This table shows the number of countries currently reporting a declining annual GDP:

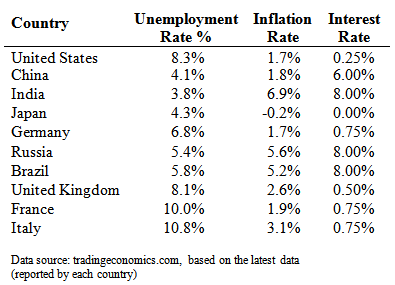

Another indicator pointing to weaker economies is the unemployment rate. As of July 2012, the U.S. reported an unemployment rate of 8.3 percent, the 41 months that the rate has been above 8%. More alarming, unemployment rates have climbed even higher in the European Union, with 25 percent reported in Spain and 10 percent in Italy and France. While inflation rates are generally tame in most of the largest economies, ranging from 0.5 percent to 3 percent, there is early evidence that prices are on the upswing. Brazil, Russia and India are reporting inflation rates of 5.2 percent, 5.6 percent and 6.9 percent, respectively. It will only be a matter of time before inflation becomes a more imminent threat to global markets as the full effect of world governments pumping cheap money into the economy with artificially low interest rates materializes.

Globally, several diverging economies have been identified based on the key metrics of unemployment, inflation and interest rates. The table below shows these metrics for the 10 largest world economies1:

Gene

Kirsch, senior banking analyst at Weiss Ratings, has more than 20 years

of financial industry experience in credit-risk management, commercial

lending and loan review analysis within various sized credit unions,

finance companies and banks at both the retail and commercial level. He

leads the firm's bank and thrift ratings division and developed the

methodology for Weiss' credit union and global bank ratings.

Gene

Kirsch, senior banking analyst at Weiss Ratings, has more than 20 years

of financial industry experience in credit-risk management, commercial

lending and loan review analysis within various sized credit unions,

finance companies and banks at both the retail and commercial level. He

leads the firm's bank and thrift ratings division and developed the

methodology for Weiss' credit union and global bank ratings.