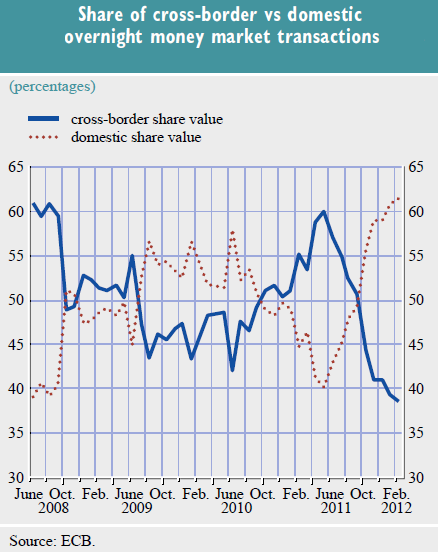

The latest ECB data is showing for example that cross-border overnight money market transactions are rapidly declining (both secured and unsecured). That is Spanish banks transact with each other but not with Italian or German banks. Fragmentation is on the rise.

The fragmentation is showing up in banks' mistrust of other Eurozone nations, severely limiting credit to non-domestic institutions.

ECB: - The growing significance of perceived country risk in the money market is also illustrated by the findings of an informal survey conducted among the major euro area banks represented in the ECB Money Market Contact Group in March 2012. It showed that country risk is the most significant consideration when assigning counterparty credit lines. 75% of the respondents said that they apply different haircuts to the assets in repo operations depending on the geographic origin of the counterparty. In addition, more than 60% of the respondents have operational restrictions on the euro area countries that are most affected by the sovereign debt crisis.

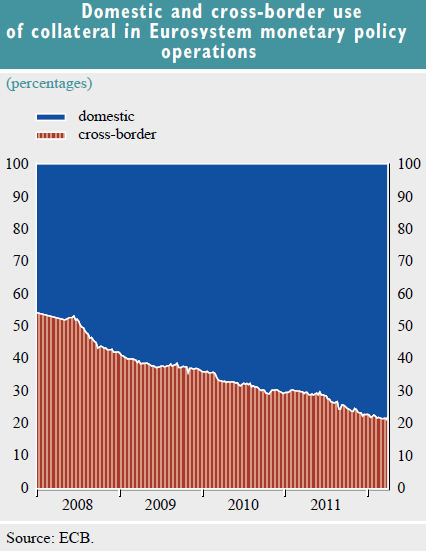

Even the collateral posted at the ECB is increasingly

domestic. Banks use primarily bonds from the country of

domicile as collateral to borrow from the ECB.

Of course cuts in exposure to the periphery banks are particularly extreme.

ECB: - As a further indicator of market segmentation, the Bank for International Settlements (BIS) first quarter data showed that cross-border claims of European banks on EU/IMF programme countries and on Spain and Italy have decreased significantly since 2008. Meanwhile, cross-border claims on Germany rose sharply, reflecting safe haven flows.