Domestic and Global Banking: A Look Ahead – 2013

by Gene Kirsch, Senior Banking Analyst | December 19, 2012

Since hindsight is 20/20, it makes a lot of sense to look back at historical stock returns and bank financials before we consider where the industry is headed in 2013 (Bank Stocks among the Best Performers-2012 in Review). Then we’ll review key factors that are expected to influence the banking sector in the New Year: domestic and global macro economics (i.e., unemployment rate, Gross Domestic Product), geo-political climate (i.e., fiscal cliff, European financial crises, bank regulation) and the performance of individual bank management. This 2013 look ahead will focus on the three major areas that form the overall banking industry: Domestic banks, global banks and U.S. credit unions.

Domestic Banks

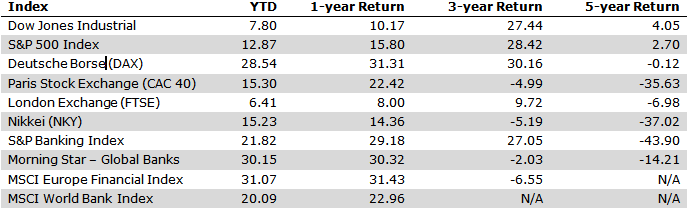

In our November annual review, it was clear that 2012 was a breakout year for bank-stock performance and earnings. In fact, the Morningstar Industry analysis we cited showed U.S. Banks as 2nd best in year-to-date performance at 30.61 percent (through 12/14/2012), behind only Australia at 41.90. And the year’s stellar performance was further highlighted by sharp contrast to the industry’s much lower three and five-year returns at 5.19 and negative 6.45 percent, respectively.

However, major concerns remain for the U.S. banking industry in 2013 and beyond. Although earnings generally beat forecasts in 2012, revenues were weak in quarter-over-quarter and prior-year comparisons. For the most part, U.S. banks met or exceeded earnings estimates by cutting costs and reducing loan loss reserves as a result of their efforts to shrink nonperforming loan portfolios. Demand for new loans was moderate with most banks showing only modest portfolio increases. And, the continuation of the Federal Reserve policy keeping record low interest rates, compressed net interest margin spreads in the second half of 2012, leading to lighter revenues than previous quarters.

We anticipate little change for the first half, and possibly most of 2013. With Gross Domestic Product (GDP) at or under 2 percent and unemployment rates above 7 percent, the Federal Reserve said it will continue to keep interest rates low until the tepid economy improves. And when will that be? The Fed recently set some expectations—tying the potential for a change in its easing policy and the federal funds rate (a key measure that sets interest rates) to a reduced jobless rate of 6.5 percent. The Fed also made it clear that monetary policy is not likely to change as long as inflation remains within a half percent of its arbitrary 2-percent target.

Additionally, the election mandate for a Democratic agenda means higher taxes and implementation of Dodd-Frank banking regulation will most likely go into full effect, albeit tempered with the Republican agenda of tighter fiscal spending. This new dawn of potential American austerity with higher taxes and lower spending will eventually be a necessity to resolve the fiscal cliff issues. But, the uncertainty of the fiscal cliff and the tough medicine needed to resolve those issues are both likely to be a continuing drag on the economy and overall business spending.

So here is what we expect for next year on the domestic banking front:

- Continued cost cutting through job consolidation and trimming unprofitable business divisions. This will help offset regulatory implementation expenses and the challenging revenue environment.

- Weak revenue growth for the first half of 2013. Unresolved fiscal cliff issues and the continued weak economy means dampened loan demand. Expect modest revenue growth in the second half of the year as economic and political policies become more defined.

- Compressed net interest rate margin spreads for most of 2013 and beyond as an effect of Fed policy.

- Increased net earnings achieved through consolidation, operating efficiencies and lower loan loss reserves.

- A decrease in nonperforming loan portfolios as banks continue to find ways to resolve or shed bad loans.

- Larger banks will continue to add shareholder value by increasing dividends and stock buyback programs. Upon successful passing of this year’s round of bank stress tests, look for Bank of America (BAC) and Citigroup (C) to be among the first and the largest banks to implement such measures.

- Modest stock price appreciation compared to last year’s 30 percent industry increase. But, a look at pre-crisis stock prices of 2007 and 2008 shows investing value can still be obtained. See the Weiss Undervalued U.S. Stock Portfolio II for potential 2013 investment ideas.

Global Banking

For the most part, 2012 was a very lucrative year for the global banking industry including the United States, with notable exceptions in certain regions. But remember that stock price and performance do not necessarily indicate the financial strength and safety of a particular bank or region. The ongoing European financial crisis, the Libor Scandal and the general performance of world economies including the U.S. remain threats to the future of global banking.

To assess possibilities for the coming year, let’s take a look at historical returns and performance rankings by region, financial strength by country and the individual performance of some of the largest U.S. and global banks.

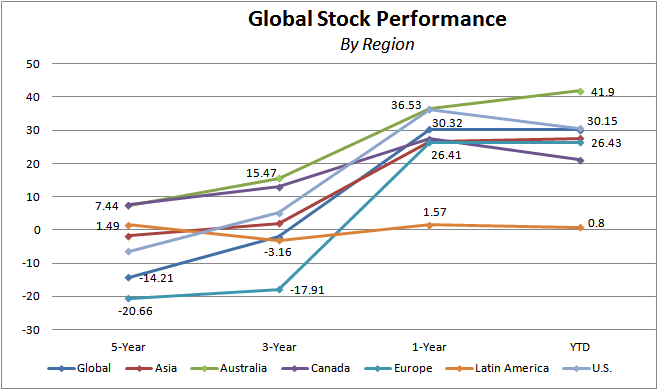

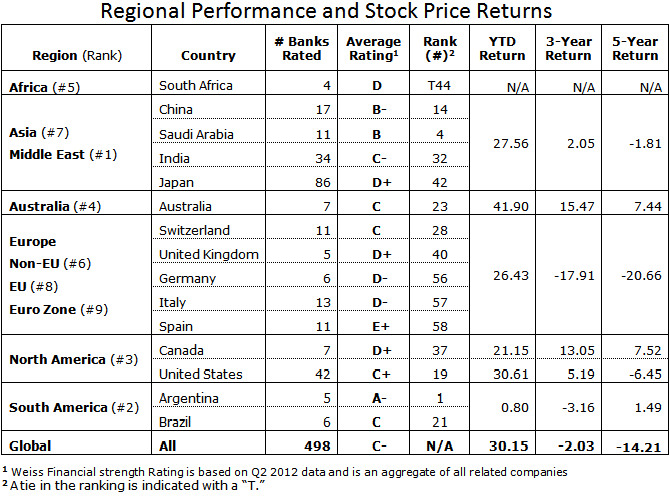

In the above chart you can see that with the exception of Latin America (South America), the banking industry enjoyed robust year-to-date and 1-year returns of 20 to 40 percent (through December 12). On a short term basis (less than or equal to one year), Australia, the United States, Asia and Europe have the highest stock returns. On a long term basis (over 3-years), Australia and Canada have enjoyed the best returns of 7 to 15 percent. And international banks have generally underperformed the U.S. in all time periods with the exception of 1-year returns, which were basically even.

Now look at Weiss Global Bank Ratings to see the financial strength of Canadian banks (top half of the country rankings) and Latin American banks (Venezuela – ranked 11th; Peru – ranked 12th and Mexico – ranked 5th). While relatively strong financially, they were among the weaker stock market performers for the year. The worst performing bank-stock sectors were Latin America with a 0.80 percent return and Canada, up only 21 percent year-to-date.

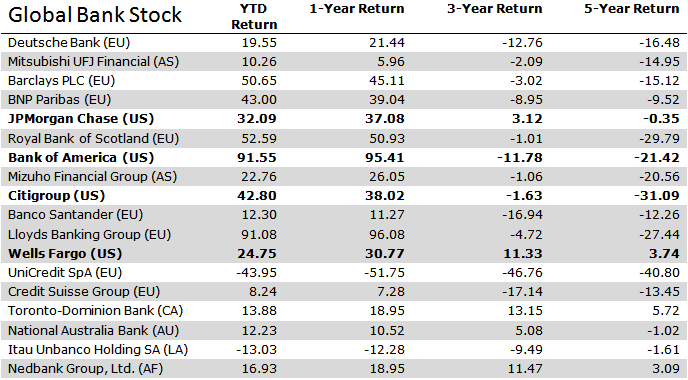

Now look at the top 18 global banks which include four of the biggest U.S. banks (in bold). And take note of their associated regions (adjacent to the bank name).

Here you can see global banks enjoyed robust returns for 2012 compared to the broader markets.

Taking all of these aspects into consideration, here is what we expect next year in global banking:

- Continued pressure in the European banking sector as they face their own fiscal crisis and challenging economic conditions.

- Global banks operating outside of Europe are likely to benefit the most from improving economies in the second half of 2013.

- Even banks within the European banking region that are diversified outside the area will benefit provided they are well capitalized. An example of this is Banco Santander (SAN) with primary operations in a weaker Spanish market offset by world operations in much more lucrative areas such as South America and Mexico (see table above). Additionally, this bank has one of the highest capital reserves as noted from this summer’s stress tests on the largest Spanish banks (Spanish Banks’ Stress Tests Reveal Capital Shortfall of $76.3 Billion).

- Banks that operate within strong established economies, void of major financial crises (i.e., South America, Australia, Canada) should continue to be financially strong, but will enjoy more modest returns compared to emerging market banks.

- Banks that have strong management, have kept their banks clear of major crises such as the LIBOR and money laundering scandals that have engulfed banks like Barclays (BARC), UBS AG (UBS) or HSBC Holdings (HSBC), should enjoy a higher financial safety rating and above average stock returns. Many of the large U.S. banks will probably benefit from this as will some of the banks in stronger rated regions like Canada and South America. See the Weiss Undervalued Global Bank Stocks for potential 2013 investment ideas.

U.S. Credit Unions

Credit unions are non-profit and not publicly traded, so our

evaluation is concentrated on financial strength. Although the

U.S. Credit Union industry accounts for only $1 trillion in assets

or about a 7 percent share compared to the $14 trillion U.S. banking

industry, larger credit unions are generally considered to be safer

and a less costly alternative for the average consumer looking to

just to deposit or borrow money. Banks may typically have a

wider range of financial products with more access to those

products, but they are also engaged in higher risk activities and

have a larger cost basis than does the average credit union.

Ultimately, financial strength will depend on size and how well

managed the institution is.

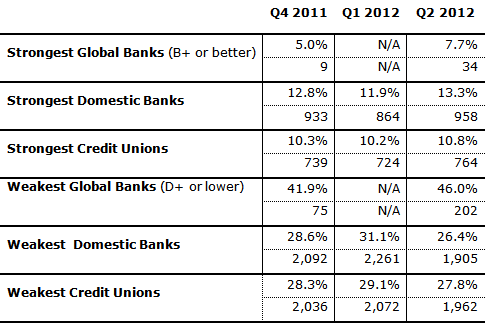

To bring the credit union landscape into focus, the table

below compares the Weiss Financial Strength Ratings of the

strongest (rated B+ or better) and weakest (rated D+ or lower)

institutions within each banking category (global, domestic, credit

union) through Q2 2012.

Across bank types, there were increases in the number of institutions considered strong, primarily a result of improved profitability and asset quality (fewer delinquent loans). And there were fewer weak domestic banks and credit unions, while the number of weak global banks grew.

So here is what we expect for the U.S. credit union industry in 2013:

- Lingering difficulties within the banking industry will continue to benefit credit union market share as risk adverse consumers seek perceived safety and better interest rates.

- As banks continue to improve in 2013, credit unions will have to offer more attractive rates and a larger array of products to compete.

- As costs continue to rise and the weak economy lingers, the credit union industry will have to consolidate to remain competitive in the financial industry dominated by large banks. The average credit union currently has $144.7 thousand in assets and only 193 credit unions have over $1 billion in assets, while an average bank has $1.89 billion in assets and 663 banks have over $1 billion in assets. Could be time for credit unions to achieve similar economies of scale.

- Expect reduced profitability as rates for both deposits and loans continue to be low for 2013 further compressing already thin net interest margin spreads.

Of course, as we all know, there really is no way to accurately foretell the future. But now you know our perspective on the major influences and potential results likely to affect the banking industry in 2013. The only thing we can tell you for certain is there will be change—you can depend on it—political and economic change as each world economy addresses its fiscal risks. We have high hopes for an improved economy in 2013 as do many market experts. So, hang on for the ride, and stay connected to Weiss Ratings for information on industry changes and to review the most recent bank performance.

See Weiss Ratings’ complete lists of the strongest and weakest banks. Or, purchase a Weiss Ratings’ domestic or global bank report to see all the details. Also, follow the Weiss domestic and global undervalued stock portfolios for potential investment value.

Gene Kirsch, senior banking analyst at Weiss Ratings, has more than 20 years of financial industry experience in credit-risk management, commercial lending and loan review analysis within various sized credit unions, finance companies and banks at both the retail and commercial level. He leads the firm's bank and thrift ratings division and developed the methodology for Weiss' credit union ratings and global bank ratings.

Copyright © Weiss Ratings. All rights reserved. http://weissratings.com