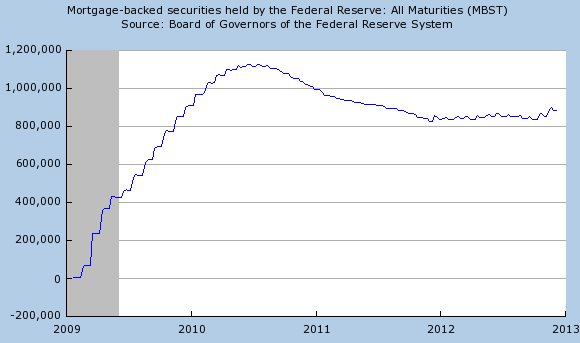

|

| $bn, source: St Louis Fed |

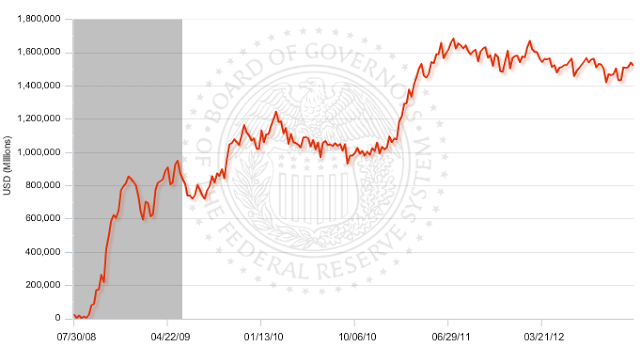

More importantly, bank reserves are basically holding flat...

|

| Reserve balances with Federal Reserve Banks (source FRB) |

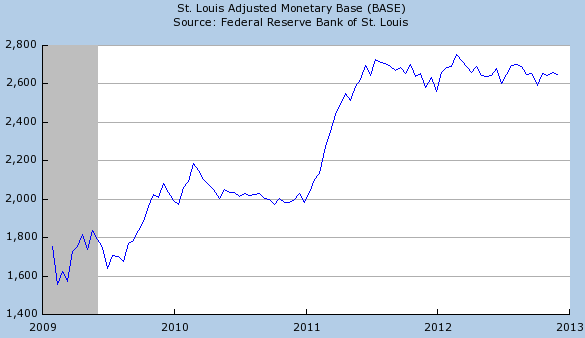

... and so is the overall monetary base (effectively no new base money has been created since the start of the QE3 program).

|

| $bn, source: St Louis Fed |

Just the "threat" of open-ended MBS purchases by the Fed has created demand for agency MBS, pushing MBS yields to new lows. That in return has sent mortgage rates to record lows as well.

|

| Source: Bankrate |

In fact today even as the 30y fixed rate hovers above absolute lows, the 15y fixed and the 30y jumbo both hit records.

.png) |

| Source: MortgageNewsDaily.com |

If lowering mortgage rates was what the Fed intended to accomplish with the latest monetary expansion, the central bank has succeeded. And so far they have done it without a significant change in bank reserves. Whether this will translate into improved economic activity and job growth remains to be seen.

![]()

To subscribe or visit go to: http://www.riskcenter.com