|

|

|

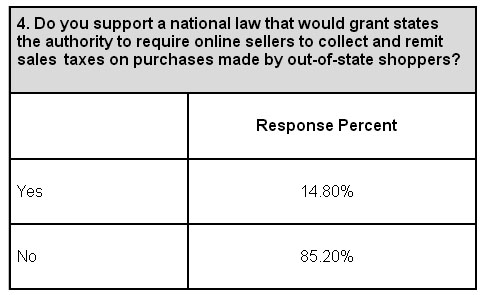

In the survey of 324 sellers, nearly 99 percent of whom have an online store, 85 percent of respondents expressed opposition to a national sales-tax law. At 83 percent, a nearly equal number said that sales-tax legislation "would have a negative impact on my business."

"I would not be able to hire the staff to keep up with the taxes. I would not be able to grow my business since I would be calculating taxes all the time," one seller said. Another respondent argued that the precedent established in a 1992 U.S. Supreme Court ruling should remain intact. In that case, the court held that states could only compel retailers to remit sales taxes if they have a store, office, warehouse or some other physical presence within the state. "The rule has always been if you don't have a physical storefront in the state, you are not required to collect that state's sales tax," the seller said. "The burden should remain on the buyer to report and pay the tax if required by their state. This law would place a horrific burden on the sellers, and would cause many to abandon their business." As that respondent noted, shoppers who live in states that tax sales are required to report the purchases that they make online if they weren't taxed at the time of purchase on their annual return. But as a practical matter, most people are either unaware of that obligation or ignore it, leaving states with billions of dollars in uncollected revenue. Supporters of legislation that would grant states the authority to force out-of-state retailers to remit taxes on online purchases made by residents argue that such a measure would level the playing field, that brick-and-mortar retailers are unfairly disadvantaged under the current sales-tax framework. Perhaps unsurprisingly, online sellers tend to disagree. Seventy-one percent of respondents in the EcommerceBytes survey said that online sellers don't enjoy any competitive edge over their offline counterparts thanks to sales taxes. Sixty-eight percent of respondents said that they collect sales taxes only in their state, while 30 percent said that they don't collect any sales taxes. The slim remainder said that they collect taxes on out-of-state purchases. Proposals to grant states new taxing authority over online purchases are expected to return in the next Congress. One measure to enact the Marketplace Fairness Act in the Senate was filed as an amendment to a recent defense authorization bill, though it was not brought to the floor for debate. A spokeswoman for the author of that amendment, Dick Durbin (D-Ill.), said that the senator "will continue to look for opportunities like this" to advance online sales-tax legislation. Last week, one of the staunchest opponents of online sales tax proposals, Sen. Jim DeMint (R-S.C.), made the surprise announcement that he will resign from the Senate early next year to head up operations at the Heritage Foundation, a conservative think tank. Earlier this year, DeMint penned an op-ed likening the Marketplace Fairness Act to taxation without representation. "If states want more taxes, they can raise taxes on their residents, but it's antithetical to our federalist system to let states raise taxes on out-of-state residents," DeMint wrote. "Call this legislation what it is: A nationally-mandated Internet tax on small business. It's anything but fair." In addition to the question of fairness, critics of online sales tax legislation point to the thicket of state and local tax codes across the country that they say would create a heavy accounting burden for small online sellers. The Marketplace Fairness Act addresses that issue in two ways. First, it stipulates that before any state can compel out-of-state retailers to remit sales taxes, it must take steps to simplify its tax code. Second, the bill would exempt the smallest sellers from the collection requirement, setting a threshold of $500,000 in annual remote sales. Opponents of the law, eBay among the most prominent, have argued that that exemption level is far too low, and that many small-scale operations would be saddled with an unmanageable burden. Sellers in the Ecommerce Bytes survey disagree. Asked whether the $500,000 exemption was sufficient to protect small sellers, 64 percent said yes. "If I made $500K in sales, I could afford to hire an accountant to do the tax disbursements," one seller said. About the Author |

Online

sellers are strongly opposed to any proposal that would provide

for a nationwide sales-tax collection requirement, with an

overwhelming majority saying that such a mandate would hurt

their business, according to a new survey conducted by

EcommerceBytes.

Online

sellers are strongly opposed to any proposal that would provide

for a nationwide sales-tax collection requirement, with an

overwhelming majority saying that such a mandate would hurt

their business, according to a new survey conducted by

EcommerceBytes.