The Nation's Nuclear Plants Are Nuked

Published: December 18, 2012

While the

nation has been focused on

new sources of natural gas and shale oil, few noticed the slow

decline of an older energy source, nuclear power. Today,

commercial nuclear power is struggling to stay in the game.

The power markets are hammering the nation's nukes. Over a decade ago,

several regions decided to create Regional Transmission Organizations

(or Independent System Operators) and use the market to set power

prices. Today, North America has ten independent RTOs/ISOs, where

wholesale power is auctioned every few minutes.

Power auctions are about energy, not power plants. Auctions don't care

how power plants produce energy; they only care about the bid. The

primary focus is on the last bid that clears the auction; it sets the

price for all participants. That's why the last bid is called the

market-clearing price.

The difference between the market-clearing price and the generator's

production cost is the gross margin. The last bid is technically on the

margin and it earns little to no gross margin. But every dollar above

production costs contributes towards the generator's fixed costs.

Most nuclear units are "must run plants" and they will produce power

even if market-clearing prices fall below production costs. Recently,

some nuclear plants have been booking negative gross margins. They hope

they can make up losses with subsequent gains and average a gross

margin.

A gross margin is not always enough. Nuclear units must pay all their

bills and leave something for shareholders. Recently, some nuclear units

are achieving modest gross margins, but not enough left to pay all the

bills or achieve any earnings.

Just ask

Dominion

Resources. They recently announced the retirement of their Wisconsin

nuclear plant 20 years early. Dominion claims they sought buyers for

their Kewaunee Power Station. None could be found. It appears that not

only did Dominion conclude their nuclear plant would remain

unprofitable; Dominion's competitors concurred.

It turns out that Kewaunee is located near

NextEra Energy's

Point Beach Nuclear Plant. Point Beach operates in the same market and

shares a similar design. It would seem that Point Beach must be as

economically challenged as Kewaunee.

It's likely because the nation's largest fleet of nuclear power plants

is operating nearby and they are financially challenged.

Exelon owns 10

generating stations and 17 reactors, which are located in Illinois,

Pennsylvania and New Jersey. Altogether, these power plants are

struggling to provide their owners with earnings to the point where

Exelon's management warned shareholders they might be forced to cut

dividends.

A Different Picture in Regulated States, but Challenges Remain

Nuclear plants operating in regulated states are faring better. While

consumers' demand for electric power is down, nuclear power plants are

safely embedded in states' rate bases. Owners of regulated nuclear

assets are protected, up to a point.

Two nuclear power stations are finding their state regulators are losing

patience. One is Duke Energy's Crystal River Nuclear Generating Plant

operating near Tampa, Florida. The other is Edison International's San

Onofre Nuclear Generating Station operating in Southern California.

Both stations are experiencing unusual and costly maintenance expenses.

Crystal River's containment repairs could exceed $2 billion, a price

that state regulators may find excessive.

San Onofre also incurred unexpected and costly maintenance challenges.

But San Onofre's 2,350 megawatts is a critical resource for Southern

California and without that resources California could see rolling

blackouts. Nevertheless, San Onofre's headaches provide new

opportunities for opposition groups to pressure regulators and political

leaders. San Onofre could survive, but it is at risk of early

retirement.

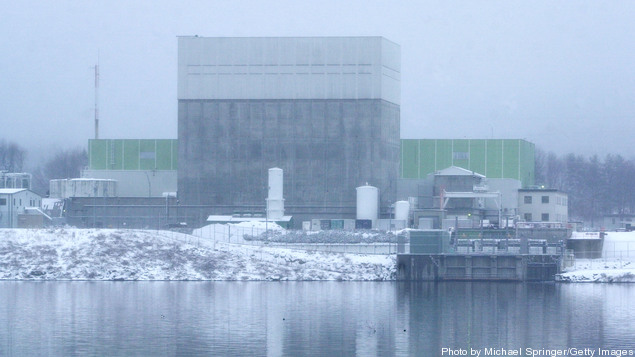

Entergy is at war with

two states at the same time. Vermont wants Vermont Yankee Nuclear Power

Station to retire 20 years early. Politicians and regulators are

fighting with everything they have to prevent Entergy from continuing

nuclear operations.

The State of New York wants Entergy's

Indian Point to retire 20 years early and they are vowing a fight to

prevent further operations. Governor Cuomo believes the state can import

enough power from Canada to provide them with enough power to assure

regional reliability. But in the case of New York City, existing

transmission lines are inadequate and they are constrained. New lines

will be needed to deliver Canadian power to the energy hungry city.

New Jersey regulators already negotiated the early retirement of

Exelon's Oyster Creek Nuclear Generating Station. Oyster Creek is

630-megawatt facility and it will go on the scrap heap ten years early

in 2019.

A pattern is developing. It may take a few years, but it appears small

nuclear plants will face increasing pressure to retire early. They

cannot compete, particularly in soft markets. Some plants will find

their costs consistently exceed any benefits they earn and their owners

will be forced to retire and dismember plants.

Natural gas may replace retiring nuclear plants.

New turbine technologies and low fuel costs allow some gas turbines

to outperform nuclear power plants. But it is

unlikely fuel prices will remain low for the next 60 years, the

design life of a new nuclear unit.

Glenn Williams worked in the nuclear power industry for over 20

years. At the time of publication, he had no position in any of the

stocks mentioned.

© Copyright 2012 AOL Inc. All Rights Reserved.

http://energy.aol.com/2012/12/18/the-nation-s-nuclear-plants-are-nuked