The Price of Oil and the Value of the Dollar Declining Value of the U.S. Dollar Adds to the Price of Oil and Gasoline

May 16, 2011

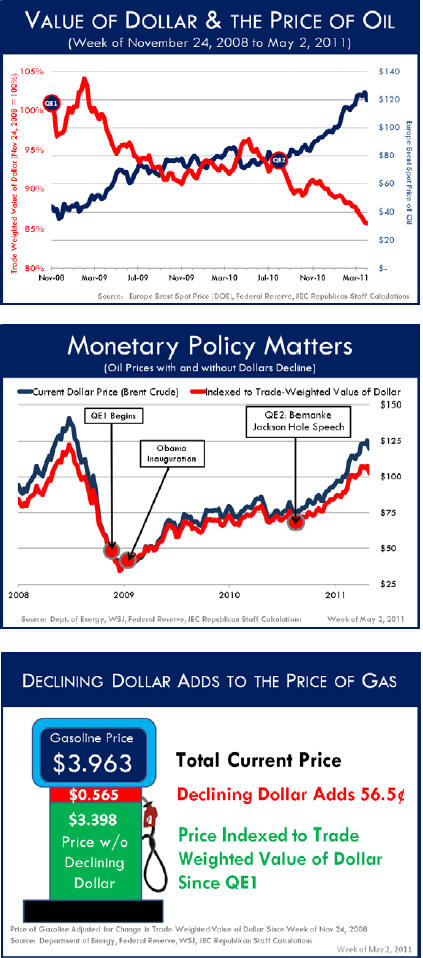

Rapidly rising energy prices are imposing a significant burden on American families and businesses. Since the end of 2008, the price of oil (West Texas intermediate, Cushing) has increased by 150 percent from $42.40 to $115.84 per barrel. Consumers have also experienced a commensurate increase in the price paid at the pump for regular gasoline. The average retail price of gasoline has increased from $1.613 to $3.963 – an increase of 146 percent.

Analysts and pundits often cite, correctly or incorrectly, the turmoil in the Middle East, a strengthening global economy, or speculation as the causes for the run up in crude oil prices. What is rarely discussed as an important factor in the rise of the dollar price of oil is the role played by the dollar itself. Oil is an international commodity that trades in dollars. The value of the unit of exchange, in this case the dollar, plays an important role in determining the “headline” price for the underlying commodity.

There are a number of ways to examine the impact of the dollar’s “value” in the changing price of oil. The chart to the right illustrates this point by comparing the relative price of oil in U.S. dollars and Canadian dollars. As the chart illustrates, expressed in U.S dollars the price of oil has increase 150 percent since the end of 2008, while the increase in Canadian dollars equates to an increase of 96 percent.

Quantitative Easing and the International Value of the U.S. Dollar

In addition to comparisons to individual currencies, the “international” value of the dollar can be measured versus a group or basket of currencies. The Federal Reserve publishes a data series that tracks the trade weighted value of the U.S. dollar compared to a broad basket of currencies. In late November 2008, the Federal Reserve adopted what has become known as QE1 to increase liquidity in the financial system. To accomplish its objective, the Federal Reserve purchased $100 billion in direct GSE obligations (Fannie Mae, Freddie Mac, and the Federal Home Loan Banks) and $500 billion in Mortgage Backed Securities (backed by Fannie Mae, Freddie Mac and Ginnie Mae). In late August 2010, during a speech in Jackson Hole, Wyoming, Federal Reserve Chairman Ben Bernanke laid out the Federal Reserve’s further quantitative easing, known as QE2. The Federal Reserve subsequently announced it would accomplish this plan through the direct purchase of some $600 billion in U.S. Treasury Securities. The Federal Reserve’s objective was to put downward pressure on long-term interest rates.

Joint Economic Committee | Republican Staff Commentary

jec.senate.gov/republicans Page 2

A consequence of the Federal Reserve’s policy of easing was to put downward pressure on the value of the dollar. The chart to the right shows the trade weighted value of the dollar since the announcement of QE1 in November 2008 as well as the price for Brent Crude Oil. Since that announcement the trade weighted value of the dollar has declined approximately 14 percent.

How has the U.S. Dollar’s Decline Affected the Price of Oil?

In much the same way that one can use the Consumer Price Index (CPI) to measure the cost of living, one can index the price of oil, an international commodity, to the value of the dollar measure the impact of the dollar’s declining value on the price of oil.

The chart to the above right tracks the dollar price of oil and shows the price based on indexing the dollar to its trade weighted value when QE1 was announced by the Federal Reserve.

The next chart plots the dollar price of oil versus the price when indexed to the trade weighted value of the dollar. The chart shows that if the dollar’s value had remained unchanged since the announcement of QE1, the price of oil (Brent Crude) would be $17.04 per barrel less.

Estimating the Effect of the U.S. Dollar’s Decline on Gasoline Prices

Arguably, there are other factors affecting the price of gasoline than just the price of oil. However, the retail price of gasoline in the United States moves in tandem with the price of oil. In fact, the correlation between the two is greater than 98%. Given that oil is the primary input to gasoline and the close correlation we can perform a similar analysis to determine how much of the current price of gasoline is attributable to the declining value of the dollar.

The final chart shows what the price of gasoline would be if the value of the dollar had not declined. In other words, the dollar’s decline accounts for 56.5 cents of the $3.963 current price of gasoline.

jec.senate.gov/republicans