Collapsing German Yields Impacting Currency Markets

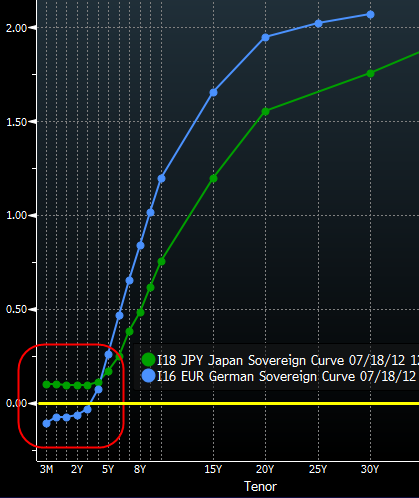

With German government yields collapsing, the two-year rate just

touched a new low yesterday - negative 6bp. The 3-year yield is

negative as well.

|

| German 2yr yield |

This is now impacting the currency markets. As an example the

Germany-Japan rate differential at the short end of the curve is

widening - the 2-year differential (Japan rate minus Germany rate)

is at a record.

In fact some are looking at this as the new carry trade, long the

yen short the euro - the reverse of the original carry trade. And

that is pushing up the value of the yen, particularly against the

euro. Euro-yen has touched a new multi-year low today.

|

| Euro-yen (number of yen per one euro) |

This currency move will help support German manufacturers at the

expense of those in Japan. In that sense the ECB has accomplished

something - making Germany more competitive using currency

devaluation (though it's not clear that this was their intent).

Welcome to the world of negative rates and currency wars.

Source: SoberLook