FSA: - ... on 5 February 2008, Trader B (a US dollar Derivatives Trader) stated in a telephone conversation with Manager B that Barclays’ Submitter was submitting “the highest LIBOR of anybody […] He’s like, I think this is where it should be. I’m like, dude, you’re killing us”. Manager B instructed Trader B to: “just tell him to keep it, to put it low”. Trader B said that he had “begged” the Submitter to put in a low LIBOR submission and the Submitter had said he would “see what I can do”;

...

[another conversation] “I really need a very very low 3m fixing on Monday – preferably we get kicked out. We have about 80 yards [billion] fixing for the desk and each 0.1 [one basis point] lower in the fix is a huge help for us. So 4.90 or lower would be fantastic”.

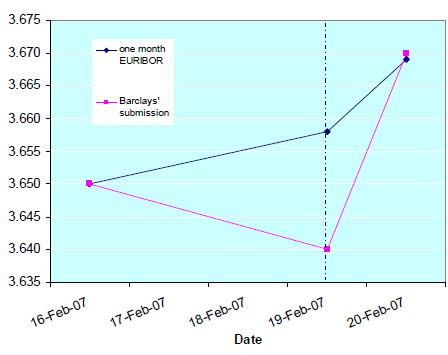

Here is an example of Barclays manipulation of EURIBOR in 2007. Hard to argue against this type of evidence.

|

| Source: FSA |

And much much more in the document.

Barclays LIBOR maniputation

© 2000-2012 by the Plone Foundation http://riskcenter.com