SoberLook - Denmark to Eurozone: Keep Your Darn Euros Out

As Eurozone depositors look for safer places to put their money,

Denmark has become one of the "destinations". It's not as popular as

Switzerland but good enough to attract some sizable flows from euros

into Danish Krone (DKK). With DKK pegged to the euro, the central

bank has to buy euros to maintain the peg. And that's exactly what

they have been forced to do for some time, as seen from growth of

the foreign reserve account balances.

|

| Denmark Foreign Exchange Reserves (DKK billion) |

Defending the peg is forcing the central bank to flood the market

with DKK (which they try to sterilize), all while building a large

euro position. Allowing DKK to appreciate on the other hand will

hurt the economy. Not a great outcome. Instead Denmark wants

Eurozone's citizens to keep their euros out.

A few days ago the

ECB set the deposit rate to zero, squeezing cash holders in the

Eurozone to look for other places to keep cash. Denmark's central

bank, Nationalbank, had to do one better to keep these people out.

Nationalbank set the deposit rate to negative 0.2. Denmark's banks

will be losing money on deposits they take in (unless they charge

rather than pay interest), which should keep these banks from taking

large amounts of DKK (converted from euros) from Eurozone

depositors.

The Copenhagen Post: - Banks will now have to pay to have their money in the central bank, Nationalbanken, after interest rates last week dropped into the negative for the first time ever.

Interest on deposits in the Nationalbank now lies at -0.2 percent while lending rates were cut to 0.2 percent.

...

The krone has been under increasingly intense pressure from investors that started to purchase the currency that is seen as a safe haven compared to the euro.

As a result the kroner risked strengthening too much against the euro, which placed pressure on the tight peg that Nationalbanken tries to keep with the common currency.

Speaking to finanical daily Børsen, Sydbank’s chief economist Jacob Graven said that the decision to reduce the interest rates was made to defend the Danish economy.

“Nationalbanken is reducing the interest in order to make it a little less attractive to investors to invest in Danish kroner compared to the euro,” Graven said.

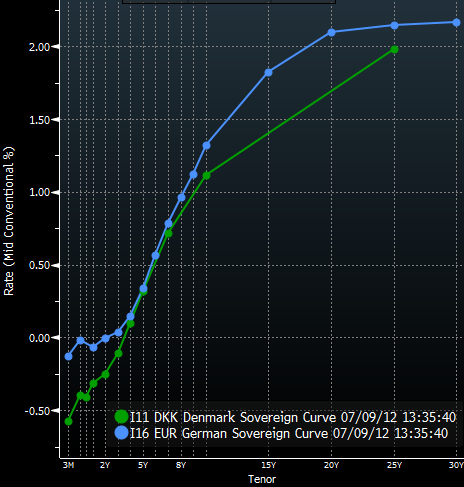

But if banks won't take euro-citizens' money, what about buying Denmark's

short term government paper. It can't be worse than Germany's

negative rates, can it? Actually Denmark's government rates are much

worse. Maturities below 5 years now all have negative yields.

Denmark is making is increasingly expensive for those who want

to convert euros into DKK. But obviously some are willing to pay

just to avoid holding euros. In some situations it may already be

cheaper to hold physical DKK notes in a safe deposit box than in a

bank account, which is apparently what many Europeans are already

doing.

![]()

To subscribe or visit go to: http://www.riskcenter.com