It is no secret that the U.S. is facing a debt crisis today. The national debt has risen to $14 trillion this year and is expected to go up to $16 trillion in 2012. High interest rates and budget deficit problems are among the main reasons why the national debt has ballooned to this amount. And as long as the U.S. government can’t find a way to lower down the country’s debt, the country and its citizens will suffer from its repercussions.

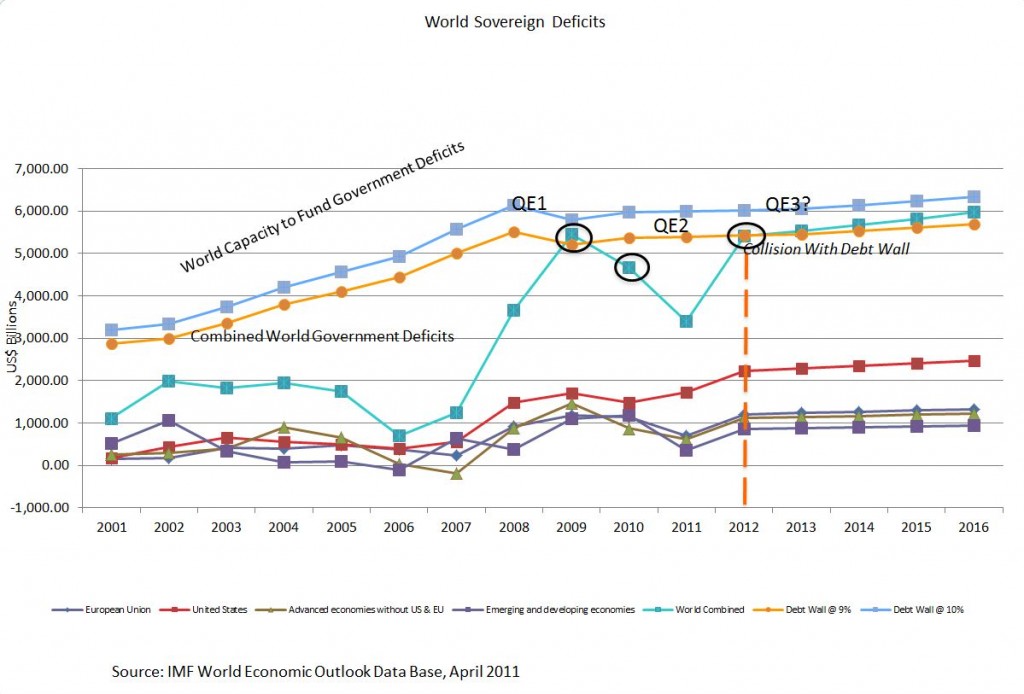

Marc Nuttle, a global economic policy expert has recently applied the debt wall concept in the current economic situation of the U.S. This debt wall happens when a country relies on foreign debt to subsidize the country’s deficits and there is not much foreign capital flow entering the country. And since the U.S. is in a very crucial situation right now, they are expected to hit the debt wall very soon. According to Nuttle, the U.S. has less than 18 months before they hit this wall.

With the overwhelming debt problem of the U.S., there is no doubt that the debt wall will be reached. And having America’s back against the wall will bring bad repercussions to the nation’s economy and its citizens. Some of the results will include extremely high interest rates, unemployment, hyperinflation, bankruptcies and even sovereign instability.

The U.S. budget deficit problem has been around for 40 years. Obviously, the U.S. is spending more than they are earning which resulted to countless debts. And since the country isn’t making enough money, they tend to rely on foreign debt to supply them the money for government expenditures. The reduced foreign capital flow or investments in the country is detrimental to the U.S. currency. The lack of foreign capital flow entails a lower demand for the currency and the U.S. will end up with high supply of useless currencies. Because of this, currency devaluation will occur. Hence, what used to be one of the most powerful currencies in the world is just a few months away from getting devalued and pretty much close to becoming worthless.

Another repercussion that every American citizen should be concerned of is the possibility of the U.S. going bankrupt. Hitting the debt wall is a symbol of dire financial situation and this is something that every nation’s economy should avoid. Once the wall is reached and there is no money going in to the economy, liquid capital runs dry. Without liquid capital, the country will no longer be able to fund their deficits. To put it simply, without money, the U.S. economy will go bankrupt.

And if you think that the U.S. will be the only one suffering from this problem, you better think again. The whole world’s financial situation is affected. For economists, the world capacity for sustainable debt is $42 trillion and that is 70% of GDP. But right now, the world’s debt is already at $58 trillion and that is 97% of GDP. They predict that by 2013, the world debt will be $70 trillion, 116% of GDP which leaves the world’s economy with nothing but debts to their name.

http://www.americanobjective.com/debtwall/the-united-states-debt-wall