As

analysts look deeper under the hood of Spain's public finances, they

are finding an increasingly unstable engine. It's not just the

growth in the debt to GDP ratio that worries people but also the

"contingent" liabilities and other debt not yet included in this

ratio. In many cases the central government will be stepping in to

bail out regional governments,some of which are in trouble

(sometimes unable to pay vendors such as garbage collectors, etc.).

FROB (Fund For Orderly Bank Restructuring) that gets consolidated

into government's balance sheet has contingent liabilities to the

banking system. And the government continues to guarantee

bank-issued unsecured bonds that banks use as collateral at the ECB

to borrow funds. That allows them to buy more Spanish government

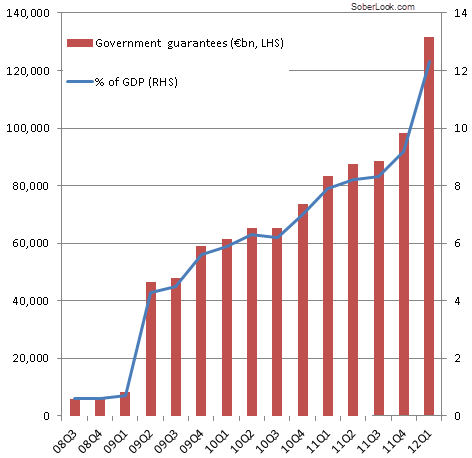

paper to support Spain's bond auctions. The chart below shows how

government guarantees have grown in the past few years - both on an

absolute basis as well as the percentage of the GDP.

|

| Spain's government guarantees |

Italy is also facing some of the same issues. But at this point

market participants' view is that even though

Italy

has more debt to roll, Spain's issues are more extreme -

particularly the banking sector. The market views the

recent

announcement of Eurozone's support for Spanish banks as lacking

in detail and insufficient in size. Many view Spain's

property market bubble as dwarfing that of Italy.

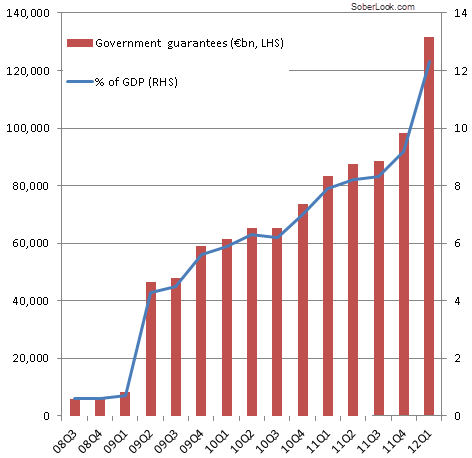

Italy to Spain 10-year spread has hit a record (as did the

Spanish yields, spreads, and CDS levels this morning). In fact

some in the market are now putting on Italy to Spain spread

trades (long Italy short Spain).

|

| Italy 10y yield minus Spain 10y

yield. |

With the Greek elections out of the way, Spain will now be the

primary focus.

To subscribe or visit go to:

http://www.riskcenter.com

![]()