Abundance of Methane Hydrates will Destroy the Oil Market

U.S. Department of Energy (DOE)

Secretary Steven Chu contributed a statement to an

announced breakthrough in

research into tapping the vast fuel resource of methane hydrates

that could eventually bolster already massive U.S. natural gas

reserves.

As Al Fin

pointed out yesterday natural

gas is priced to a barrel of oil equivalent at

about $10-$11 per the estimable Geoffrey Styles view,

something less than 10% of the cost of oil. For North

Americans adding a viable and hopefully low cost means to make use

of gas hydrates could be giant boost to low cost fuel sources and a

massive kick to the economy.

For experts the methane hydrates

resource is the largest reserve of hydrocarbons in the planetary

crust. So far humanity has not devised a process to economically

harvest this immense energy wealth. Today’s DOE announcement may

point the way to a new era in abundant energy to build out a bigger

and better world economy.

By

injecting a mixture of carbon

dioxide and nitrogen into a methane hydrate formation (pdf link) on

Alaska’s North Slope, the DOE partnering with

ConocoPhillips and

Japan Oil, Gas and Metals National Corp

was able to produce a steady flow of natural gas in the first field

test of the new method. The test was done from mid-February to about

mid-April this year.

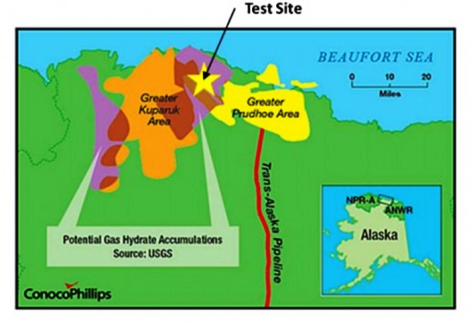

Methane Hydrate Test Site Map of

US DOE, CononcoPhillips and JOGMNC Process Test.

The department said it would likely

be years before production of methane hydrates becomes economically

viable. Secretary Chu said in his statement, “While this is just the

beginning, this research could potentially yield significant new

supplies of natural gas.”

Methane hydrates are cold ice

crystal-like structures that contain methane the chemical of natural

gas. The hydrates are located under the Arctic permafrost and in

ocean sediments along the continental shelf and widely spread

worldwide.

Methane Hydrate Resources per

Der Spiegel.

Gerald Holder, dean of the

engineering program at University of Pittsburgh, who has worked with

the DOE’s National Energy Technology Laboratory on the hydrate

issue, said before the announcement he had been sceptical about what

researchers would be able to accomplish.

He said the main problem until now

was finding a way to extract natural gas from solid hydrates without

adding a whole lot of steps that made the process too expensive,

which makes the success of this new test significant.

“It makes the possibility of

recovering methane from hydrates much more likely. It’s a long way

off, but this could have huge impact on availability of natural

gas,” said Holder.

While everyone is suggesting that

methane hydrate production is some time in the future, we might note

that a partner is from Japan, a country that has been buying via

imports virtually all its energy and fuel inputs. A glance at

the map of potential reserves shows that Japan may well pour on the

intellectual and financial power to get results much quicker than

many expect.

On the other hand, for North

Americans natural gas is ratcheting down to dirt cheap, with more

resources with the new horizontal drilling and reserve fracturing

available on land and significant amounts of natural gas at sea in

already developed areas.

For everyone the matter of coming up

with the CO2 for the injection is going to be a significant issue.

First just gathering it remains a significant problem. Making

it from – natural gas – is the preferred method today. That

raises the question if the CO2 injected is lost to sequestration or

is it recycled for reuse, or what proportion is being lost or

recycled? CO2 is very useful and it may become a valuable

resource in its own right very soon.

Abundance makes a lot of things that

weren’t viable at a price possible at lower costs. Abundant

fission or cold fusion could make electrolysis viable freeing

hydrogen for adding to coal for both liquid fuels and CO2 sources.

Scaling could make such concepts usual and common thinking very

quickly.

For now though the DOE and partner’s

news is very gratifying. It must be giving the futurists at

OPEC an OMG moment, again. Things are going to be changing.

Let’s hope the DOE and the partners

spill some more info soon so we can have a better look.

This article was first published in OilPrice.com on May 9th, 2012.