|

||

|

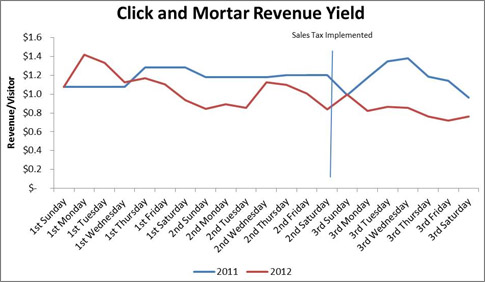

California's implementation of mandatory sales tax collection for online sellers keyed an up and down ecommerce sales cycle as the days of tax-free internet buying reached an end in September 2012. Software giant Adobe studied the effect of the California online sales tax law and how it impacted the "Pure Play" online sellers and their Click and Mortar online/offline selling counterparts. Its analysis of nearly 2 million visitors to 100 retailers from September 2011 to September 2012, evenly divided between Pure Play and Click and Mortar firms, showed a couple of trends coinciding with the California law.

Revenue per visitor for the Pure Play ecommerce businesses increased and spiked before California's sales tax law took effect. After the sales tax came into effect, that revenue per visitor fell below 2011 levels. On the Click and Mortar side, the new sales tax had no significant effect. Orders per visitor around the period of the online sales tax taking hold were close to paralleling the same figures as last year. In its analysis, Adobe speculated that California hoped revenue lost by purely online sellers would find its way into the cash registers of local businesses. The thought process seems to be that if a buyer has to pay sales tax, they may consider just going ahead and buying locally (where they would pay the tax anyway) rather than waiting for a shipment to arrive. Of course if the reason someone shops online is to find a product that isn't available locally, the customer probably opts to buy the desired item from the online retailer and absorb the added sales tax cost. The sales tax law solves the concern of taxpayers failing to properly account for and pay lawful taxes due on their online purchases. It's difficult seeing this as a driver for local small businesses, and Adobe's findings appear to confirm this. About the Author Copyright 1999-2012. Steiner Associates LLC. All rights reserved. http://www.ecommercebytes.com/cab/abn/y12/m10/i19/s05 |