Major Headwinds Confronting Banking Industry

U.S. National Elections

by Gene Kirsch, Senior Banking Analyst | September 27, 2012

While the S&P and KBW Banking Indices are up 27 percent and 28 percent, respectively, through September 24, outperforming the broader markets by nearly two times, major headwinds still face banks and the economy in general. Although the LIBOR scandal has not spread to banks beyond Barclays PLC, and the ongoing European financial crisis has temporarily subsided, other challenges closer to home still remain.

The November 6 presidential and congressional elections may dramatically influence stock prices as the markets anticipate the ramifications to public policy. While uncertainty surrounding a national election is not a new phenomenon, the impact of this particular election could be long lasting for the banking industry and the economy in general.

What is at stake for either the Republicans or Democrats in the White House and Congress? Whomever wins, will be faced with the so-called fiscal cliff involving the expiration of the Bush tax cuts at year end, the automatic spending cuts and the expiration of Operation Twist (the Federal Reserve’s buying/selling of short-term bonds to influence short-term interest rates). The debt ceiling of $16.4 trillion is expected to be reached some time after the elections or early in 2013, depending on the strength of revenues collected between now and the end of the year. We are currently about $800 billion below the limit. (This will be addressed at length in Part IV of this series.) Other contentious issues are U.S. tax policy, foreign policy and healthcare reform—all of which could undergo radical changes if the presidency or control of Congress changes hands.

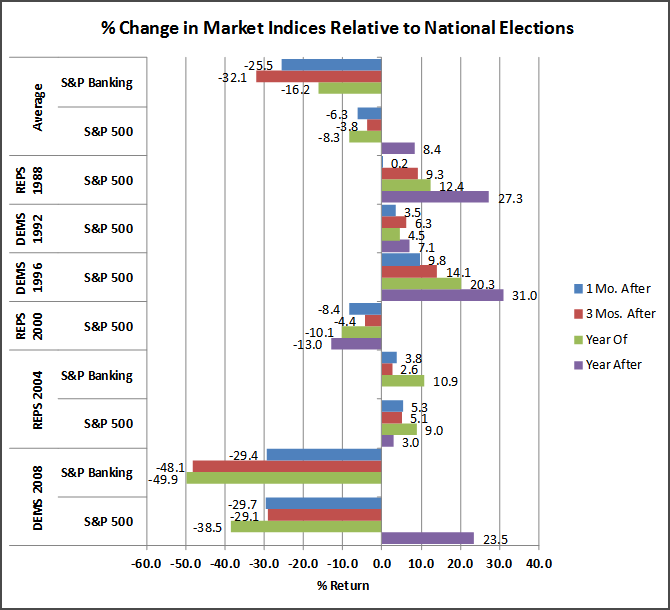

The chart below demonstrates the effect on stock prices of the last six national elections comparing the S&P 500 one month prior to the election to one month after the election and three months after the election plus the return in the calendar year of the election and the calendar year after the election:

Data Source: Yahoo Finance

Note: S&P Banking Index not in existence for

elections prior to 2004

It is widely anticipated that a national election with favorable results for the Republican Party—whether it is for the presidency or Congress—would benefit Wall Street and the banking industry. Conversely, a Democratic win for both is expected to be a drag on the industry. The Republican Party is pro business and favors less regulation and lower corporate taxes, while the Democratic Party, whose members authored the Dodd-Frank banking legislation, favors more regulation and higher taxes. The implementation, enforcement and overall robustness of the Dodd-Frank legislation is what is at stake for the banking industry in the long term.

Stock market data, however, provide a mixed picture and may reflect other circumstances in play simultaneously, such as the recessions in 2008 and 1991-92. It is clear that when President Obama was elected in 2008, the market did not respond favorably and declined 29.7 percent from one month before the election to one month after and 29.1 percent by three months after the election. Again, the ongoing turmoil with the financial, housing and economic crises certainly contributed to the rapid decline, but the change in political power and uncertainty surrounding the Democratic strategy to address the crises did not help in the short term. The S&P Banking Index did not fare much better with a drop of 29.4 percent in the month following the election and 48.1 percent in the three months after.

Other elections show that both the Democrats under President Clinton and Republicans under President Bush, Sr. had mostly a favorable effect on stock market returns in the broader-based indices.

On average, the response of the S&P 500 Index for one month and three months after a national election has been negative 6.3 percent and 3.8 percent, respectively, regardless of who gained power (including three Democratic Presidents and three Republican Presidents). The S&P Banking Index fared no better with average losses of 25.5 percent after one month further declining to 32.1 percent three months after the elections. If broken down further, the broader S&P 500 Index was down 2.1 percent and up 0.7 percent one and three months post-elections, respectively, for the Republicans and down 11.6 percent and 9.5 percent, respectively, for the Democrats.

So what conclusions can we draw from all of the numbers? Although the S&P Banking Index and other newly created banking indices are too new to be good industry benchmarks, the broader market indices indicate that no matter which party is viewed as the overall winner, the market tends to go down on average in the months immediately following the election. The short-term uncertainty also bears out for the entire 12 months of the election year with an average -8.3 percent return in the S&P 500 for all six national elections.

However, we should bear in mind that these averages may be skewed because of the severe recession and financial crisis in the 2008 election year. In fact, four of the six election-year results were positive for the one-month, three-month and one-year returns. So, there is probably a good chance of positive returns for this election year. In addition, if you eliminate the high return in 1996 and the low return in 2008, the average three-month return in the S&P 500 Index for the remaining elections is a positive 1.4 percent. Therefore, absent unforeseen dramatic events affecting the market, it is logical to conclude that the S&P 500 will go up after the election; and thus the banking sector, which closely tracks the broader market, has a good chance of increasing. In fact, historically, the average return for the market in the calendar year after the election is 8.4 percent with five of the six election periods showing market gains.

The bottom line is that, in the short term, while banking stocks may be up year-to-date, further appreciation is unlikely until the uncertainty of the election is over. In the long term, who wins the election, could dramatically affect the regulatory environment in the industry.

To review bank performance, see Weiss Ratings’ complete lists of the strongest and weakest banks at www.weissratings.com/banklists. Or to purchase a domestic or global banking report with Weiss recommendations and ratings see www.weissratings.com. Also see the domestic and global undervalued portfolios on our website for potential value bank stocks.

First article in the series: Libor Scandal Threatens Major U.S. and Global Banks

Second article in the series: European Financial Crisis Looms Larger than Ever

Gene Kirsch, senior banking analyst at Weiss Ratings, has more than 20 years of financial industry experience in credit-risk management, commercial lending and loan review analysis within various sized credit unions, finance companies and banks at both the retail and commercial level. He leads the firm's bank and thrift ratings division and developed the methodology for Weiss' credit union ratings and global bank ratings.

Copyright © Weiss Ratings. All rights reserved. http://weissratings.com